- Finland

- /

- Consumer Durables

- /

- HLSE:HONBS

Honkarakenne Oyj's (HEL:HONBS) Shares Leap 36% Yet They're Still Not Telling The Full Story

Honkarakenne Oyj (HEL:HONBS) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

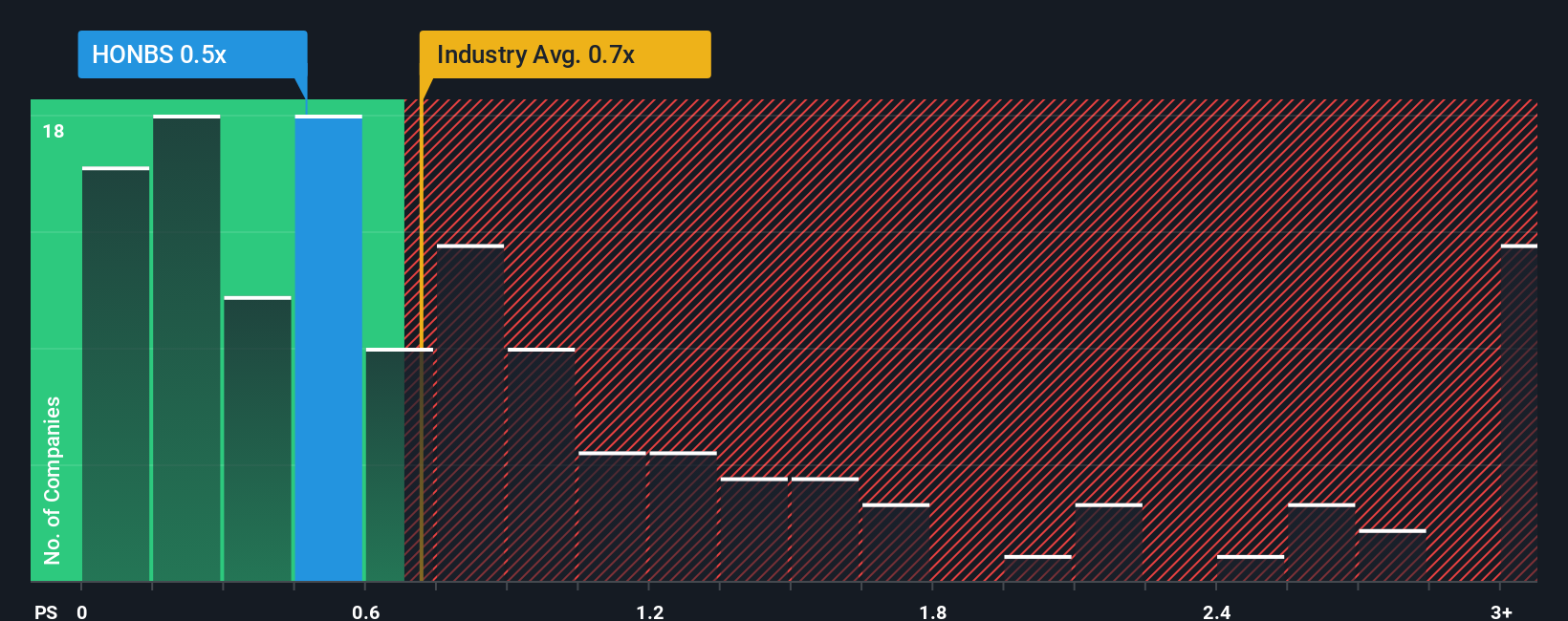

In spite of the firm bounce in price, it's still not a stretch to say that Honkarakenne Oyj's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Consumer Durables industry in Finland, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Honkarakenne Oyj

What Does Honkarakenne Oyj's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Honkarakenne Oyj has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Honkarakenne Oyj's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Honkarakenne Oyj's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 2.9% gain to the company's revenues. Still, lamentably revenue has fallen 49% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.4% each year, which is noticeably less attractive.

In light of this, it's curious that Honkarakenne Oyj's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Honkarakenne Oyj's P/S Mean For Investors?

Honkarakenne Oyj's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Honkarakenne Oyj's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Honkarakenne Oyj (2 don't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Honkarakenne Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Honkarakenne Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:HONBS

Honkarakenne Oyj

Designs, manufactures, and sells log and solid-wood house packages in Finland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives