Why Is Hiab Oyj (HLSE:HIAB) Raising Margin Guidance After Lower Q3 Sales and Profits?

Reviewed by Sasha Jovanovic

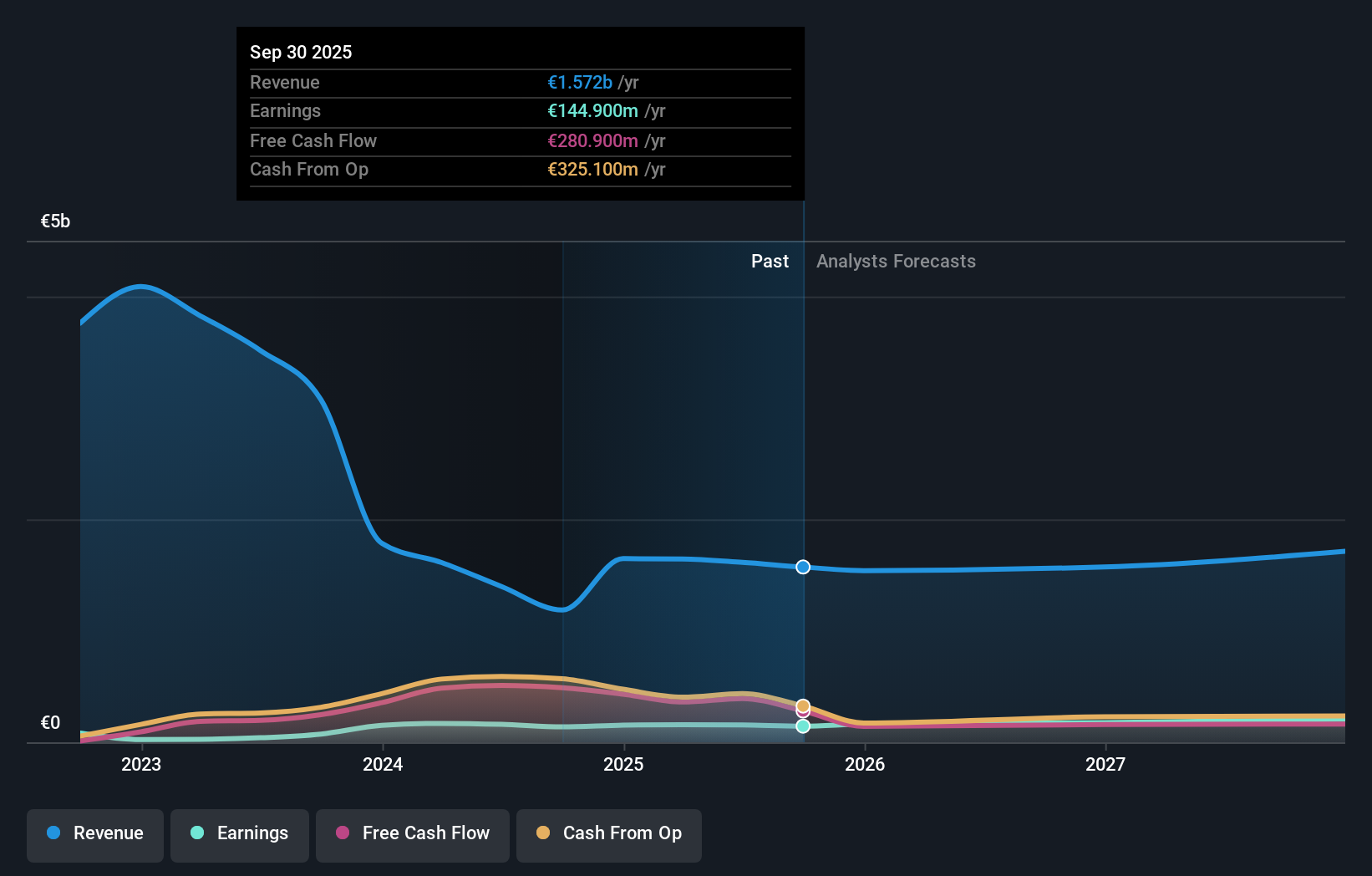

- Hiab Oyj recently announced its third quarter 2025 results, reporting sales of €346.4 million and net income of €31.6 million, both lower than the previous year, alongside updated guidance forecasting its 2025 comparable operating profit margin to exceed 13.5%.

- The company shared these disclosures shortly before its 2025 Virtual Roadshow, providing important insights into its current performance and forward-looking expectations for profitability.

- We'll explore how Hiab's updated profit margin outlook influences the company's investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Hiab Oyj Investment Narrative Recap

To be a Hiab Oyj shareholder today, you need to believe in the company’s ability to expand its high-margin Eco portfolio, connected services, and cost efficiencies, even as short-term pressures from softening US demand and order book declines challenge near-term revenue growth. While the latest quarterly results were down year-over-year, the company’s revised profit margin target, now set above 13.5%, suggests management feels confident in operational resilience, and this guidance may be the most important near-term catalyst for sentiment. However, the sales softness and order intake trends in the Americas remain the biggest risk, and the new guidance does not materially change the urgency of addressing these pressures.

Among the recent news, Hiab’s updated 2025 earnings guidance stands out: forecasting a comparable operating profit margin above 13.5%. This is directly relevant, as it reinforces the company’s focus on cost efficiencies and higher-value offerings, themes that are central to Hiab’s ability to counteract margin pressures and offset weaker volumes in key regional markets. Investors can use this forward-looking margin outlook as a reference point to evaluate whether Hiab’s restructuring and innovation efforts are translating into improved profitability.

But while the margin target is encouraging, investors should also be aware of order book declines and the growing risks if US demand continues to weaken...

Read the full narrative on Hiab Oyj (it's free!)

Hiab Oyj's outlook anticipates €1.8 billion in revenue and €225.8 million in earnings by 2028. This scenario assumes a 4.1% annual revenue growth rate and a €70.3 million increase in earnings from the current €155.5 million.

Uncover how Hiab Oyj's forecasts yield a €56.33 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Two retail investors in the Simply Wall St Community placed Hiab’s fair value anywhere from €35.05 to €56.33 per share. With opinion divided and order intake in important regions under pressure, it’s important to explore how different assumptions might affect the company’s outlook and your expectations.

Explore 2 other fair value estimates on Hiab Oyj - why the stock might be worth 25% less than the current price!

Build Your Own Hiab Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hiab Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hiab Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hiab Oyj's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hiab Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HIAB

Hiab Oyj

Provides smart and on road load-handling solutions and services in Finland.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives