Discovering Europe's Hidden Gems With 3 Promising Small Caps

Reviewed by Simply Wall St

Amidst a backdrop of rising European stock indices and subdued inflation, the pan-European STOXX Europe 600 Index closed 2.35% higher, signaling a positive sentiment across major markets like Germany and France. In this environment, small-cap stocks often present unique opportunities for investors seeking growth potential in less explored areas of the market. Identifying promising small caps involves looking for companies with strong fundamentals and innovative business models that can thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, and Venezuela with a market capitalization of approximately €966.60 million.

Operations: The company's primary revenue stream is from production, generating $554.05 million, while drilling contributes $22.23 million.

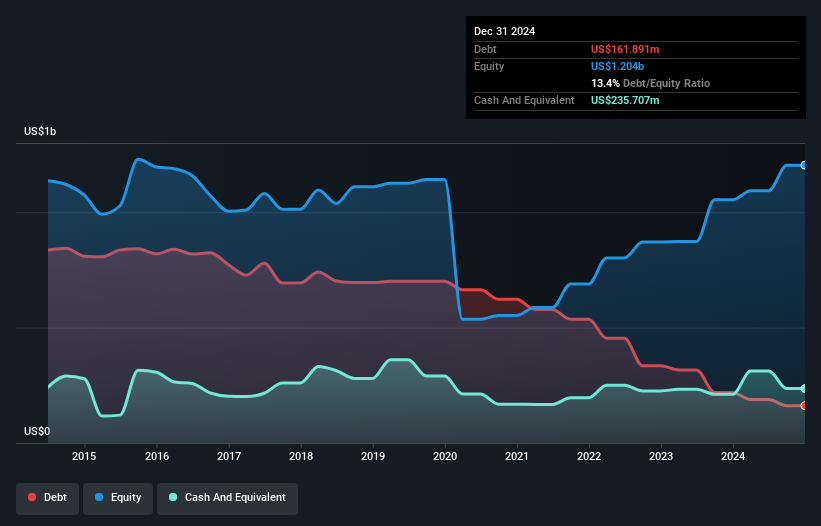

Etablissements Maurel & Prom, a small-cap player in the oil and gas sector, offers intriguing prospects despite some challenges. The company has significantly reduced its debt to equity ratio from 123.8% to 11% over five years, indicating improved financial health. While earnings growth was negative at -8.6%, production increased to 37,749 boepd for the first nine months of 2025 from 36,288 boepd a year earlier. Trading at an estimated 81.8% below fair value suggests potential upside for investors seeking undervalued opportunities in this industry segment. Recent leadership changes with Wisnu Santoso as Chairman could steer strategic growth initiatives forward effectively.

GRK Infra Oyj (HLSE:GRK)

Simply Wall St Value Rating: ★★★★★★

Overview: GRK Infra Oyj is a company that offers infrastructure construction services across Finland, Sweden, and Estonia with a market capitalization of €547.02 million.

Operations: GRK Infra Oyj generates revenue primarily from its heavy construction segment, amounting to €877.32 million. The company's market capitalization stands at €547.02 million, reflecting its position in the infrastructure sector across Finland, Sweden, and Estonia.

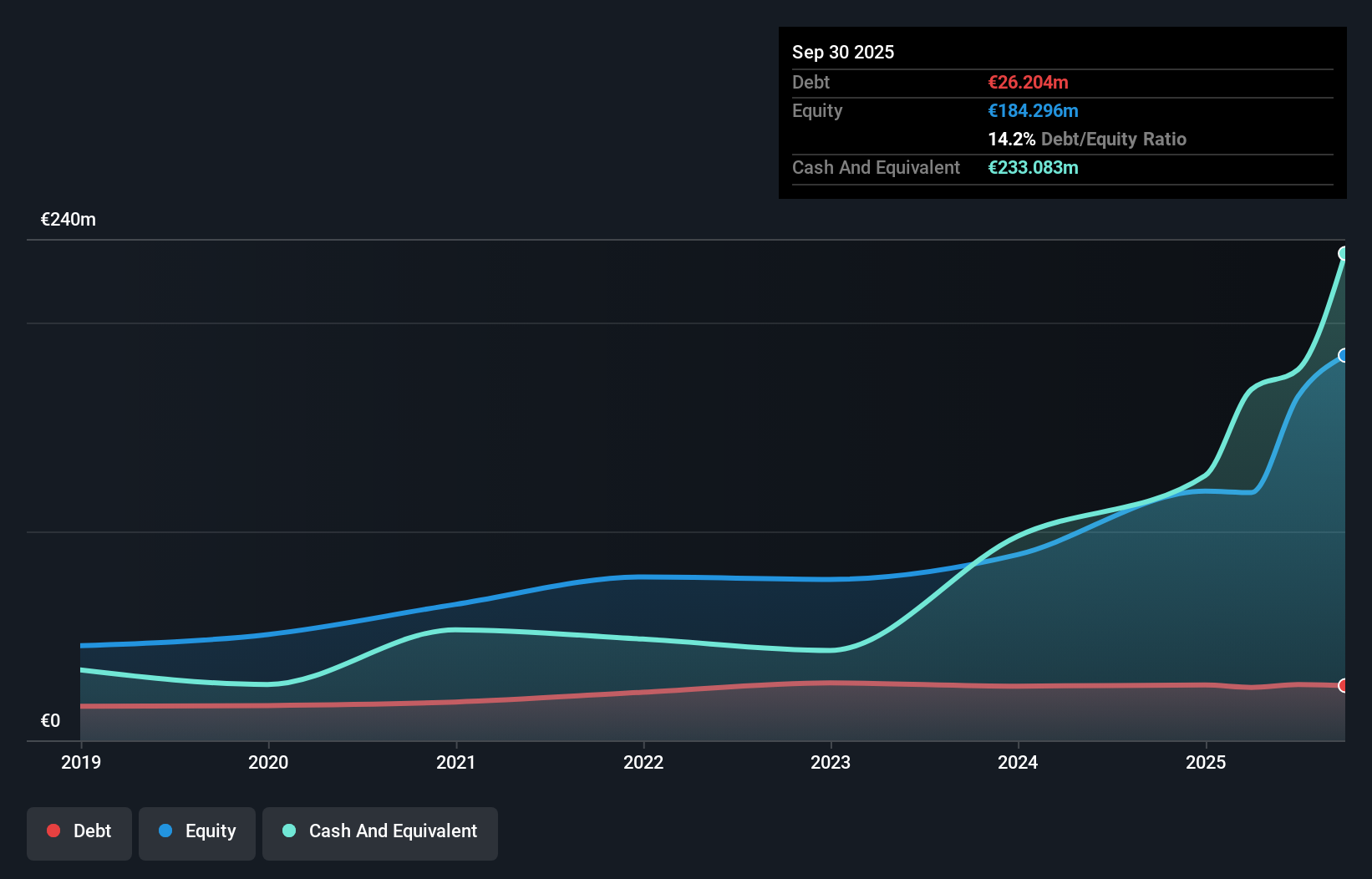

GRK Infra Oyj, a nimble player in the European construction scene, has been making waves with its impressive 58% earnings growth over the past year, outpacing the industry average of 9%. The company’s debt-to-equity ratio has improved significantly from 29.1% to 14.2% over five years, reflecting sound financial management. Recent projects like the Vantaa tramway and Port of Umea expansion add substantial value to its order book. With a price-to-earnings ratio of 10.6x, GRK is trading below the Finnish market average of 18.8x, suggesting it offers good relative value within its sector.

- Click to explore a detailed breakdown of our findings in GRK Infra Oyj's health report.

Examine GRK Infra Oyj's past performance report to understand how it has performed in the past.

Saniona (OM:SANION)

Simply Wall St Value Rating: ★★★★★★

Overview: Saniona AB (publ) is a clinical-stage biopharmaceutical company focused on the research, development, and commercialization of treatments for rare diseases across Sweden, the United States, Germany, Denmark, and the United Kingdom with a market cap of approximately SEK2.49 billion.

Operations: Saniona generates revenue primarily from its biotechnology segment, amounting to SEK743.21 million.

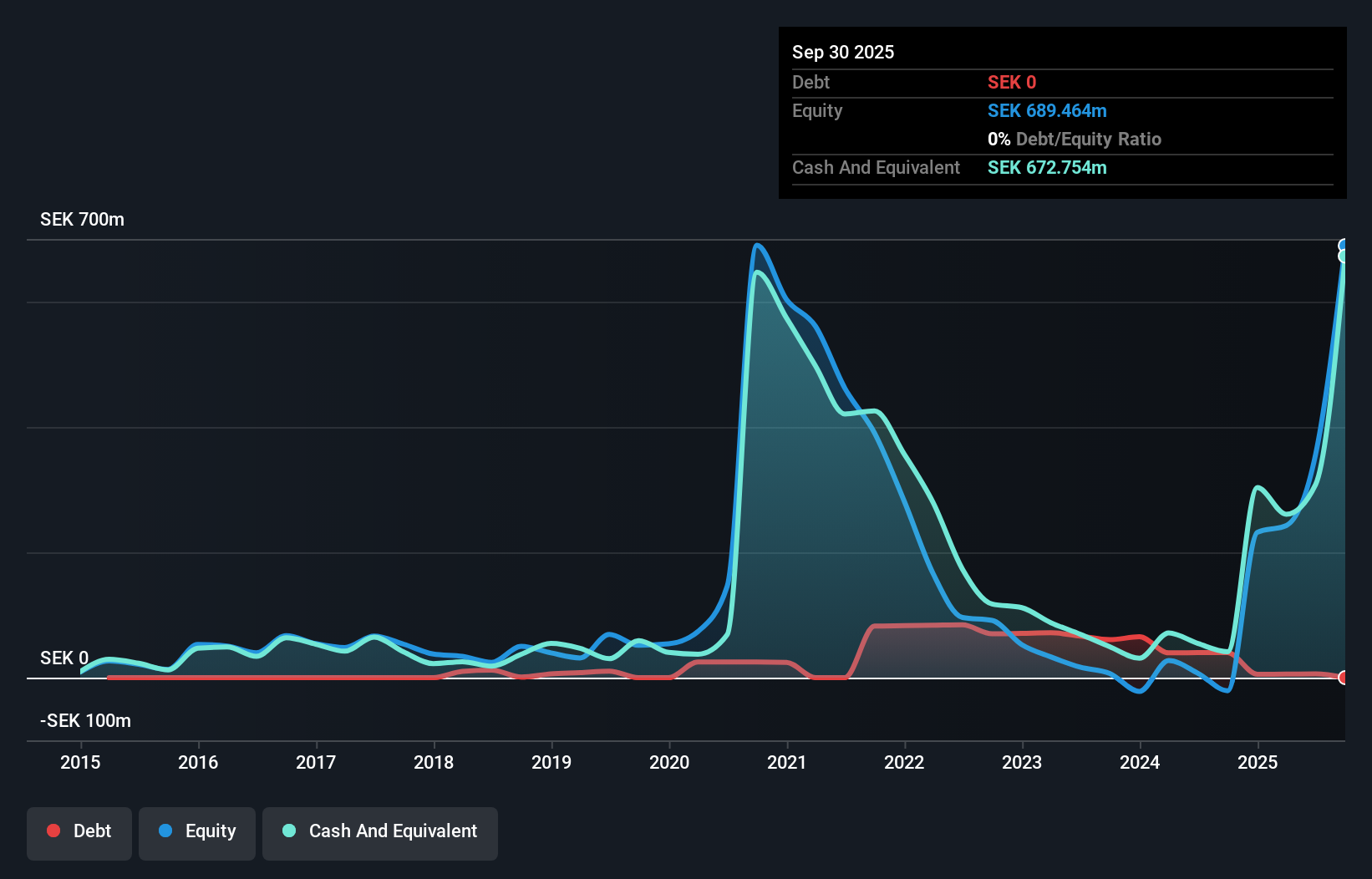

Saniona, a biotech company, is making waves with its recent profitability and debt-free status. With earnings reaching SEK 329.62 million in Q3 2025, compared to a net loss of SEK 29.45 million the previous year, it highlights significant growth. The company's stock trades at an estimated 98.6% below fair value, suggesting potential undervaluation. Despite shareholder dilution over the past year and volatile share prices recently, Saniona's robust free cash flow and high-quality earnings offer promising prospects. Notably, their candidate SAN2668 shows promise in epilepsy treatment with strong preclinical results supporting its unique efficacy profile.

- Unlock comprehensive insights into our analysis of Saniona stock in this health report.

Gain insights into Saniona's historical performance by reviewing our past performance report.

Summing It All Up

- Click here to access our complete index of 313 European Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SANION

Saniona

A clinical-stage biopharmaceutical company, engages in the research, development, and commercialization of treatments for rare disease patients in Sweden, the United States, Germany, Denmark, and the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026