Undiscovered Gems in Europe with Promising Potential This November 2025

Reviewed by Simply Wall St

As the European market navigates a mixed landscape with the pan-European STOXX Europe 600 Index recently pulling back after reaching new highs, investors are keenly observing how economic indicators like inflation and GDP growth might influence future monetary policy decisions by the European Central Bank. In this context of cautious optimism, identifying stocks that demonstrate resilience and potential for growth amidst these broader economic trends can be particularly rewarding for those looking to uncover hidden opportunities in Europe's diverse markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 6.00% | 71.62% | 80.06% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Aplicaciones y Tratamiento de Sistemas (BME:ATSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aplicaciones y Tratamiento de Sistemas, S.A. operates in the computer services industry and has a market capitalization of €218.52 million.

Operations: ATSI generates revenue primarily from its computer services segment, amounting to €185.63 million. The company's market capitalization is €218.52 million.

ATSI, a nimble player in the IT sector, showcases promising attributes with its high-quality earnings and satisfactory net debt to equity ratio of 14.3%. Earnings growth at 2.1% outpaced the industry average of 1.3%, highlighting its competitive edge. The company’s interest payments are comfortably covered by EBIT at a robust 13.9x, indicating strong financial health. Recent reports reveal sales surged to €47.19 million for the half-year ending June 2025, up from €24.85 million year-over-year, while net income increased to €6.49 million from €4.48 million, suggesting positive momentum in revenue generation and profitability.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a Belgian company that produces and markets natural mineral water, with a market capitalization of €954.58 million.

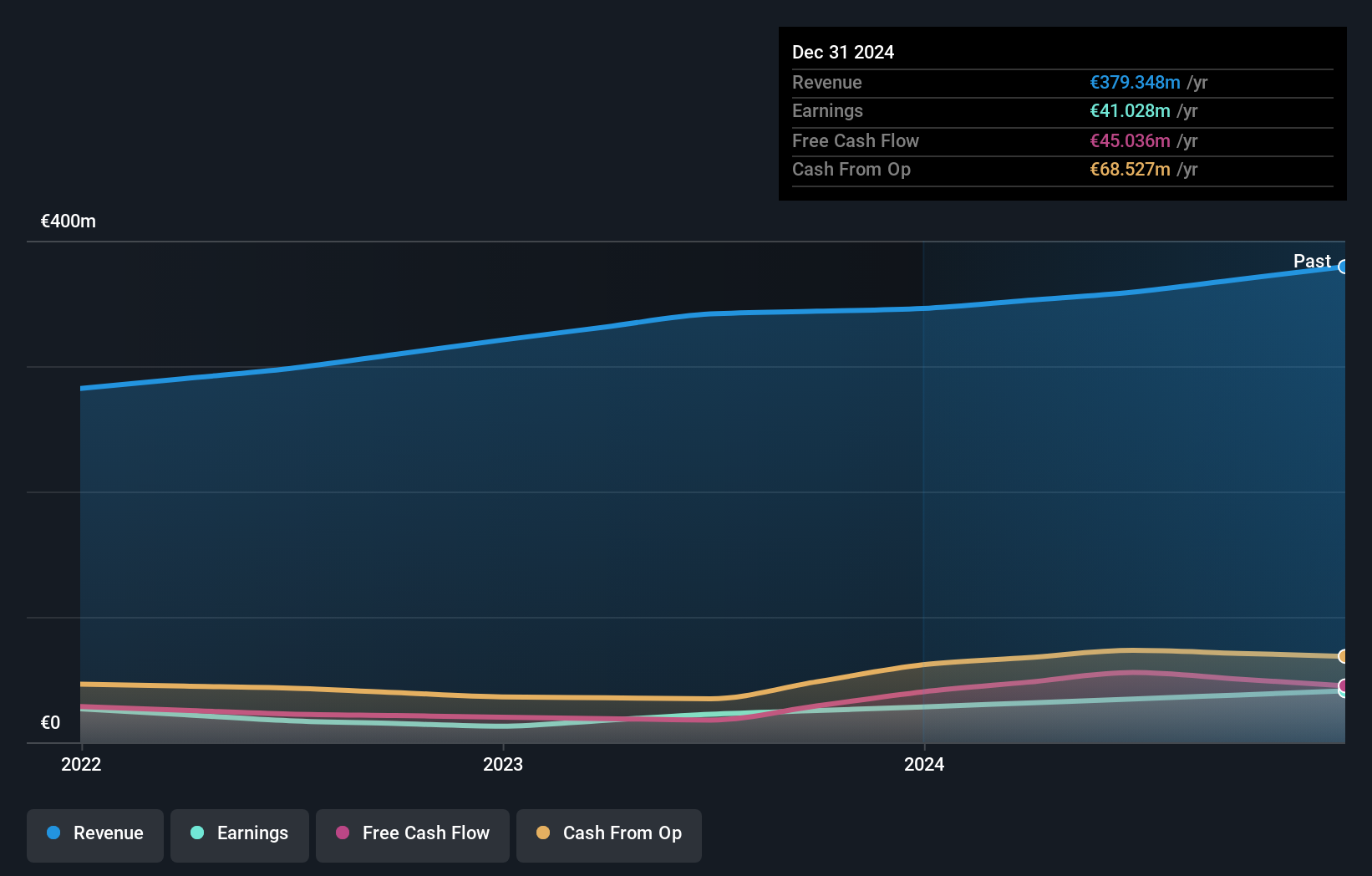

Operations: Spadel's primary revenue stream comes from its non-alcoholic beverages segment, generating €399.96 million.

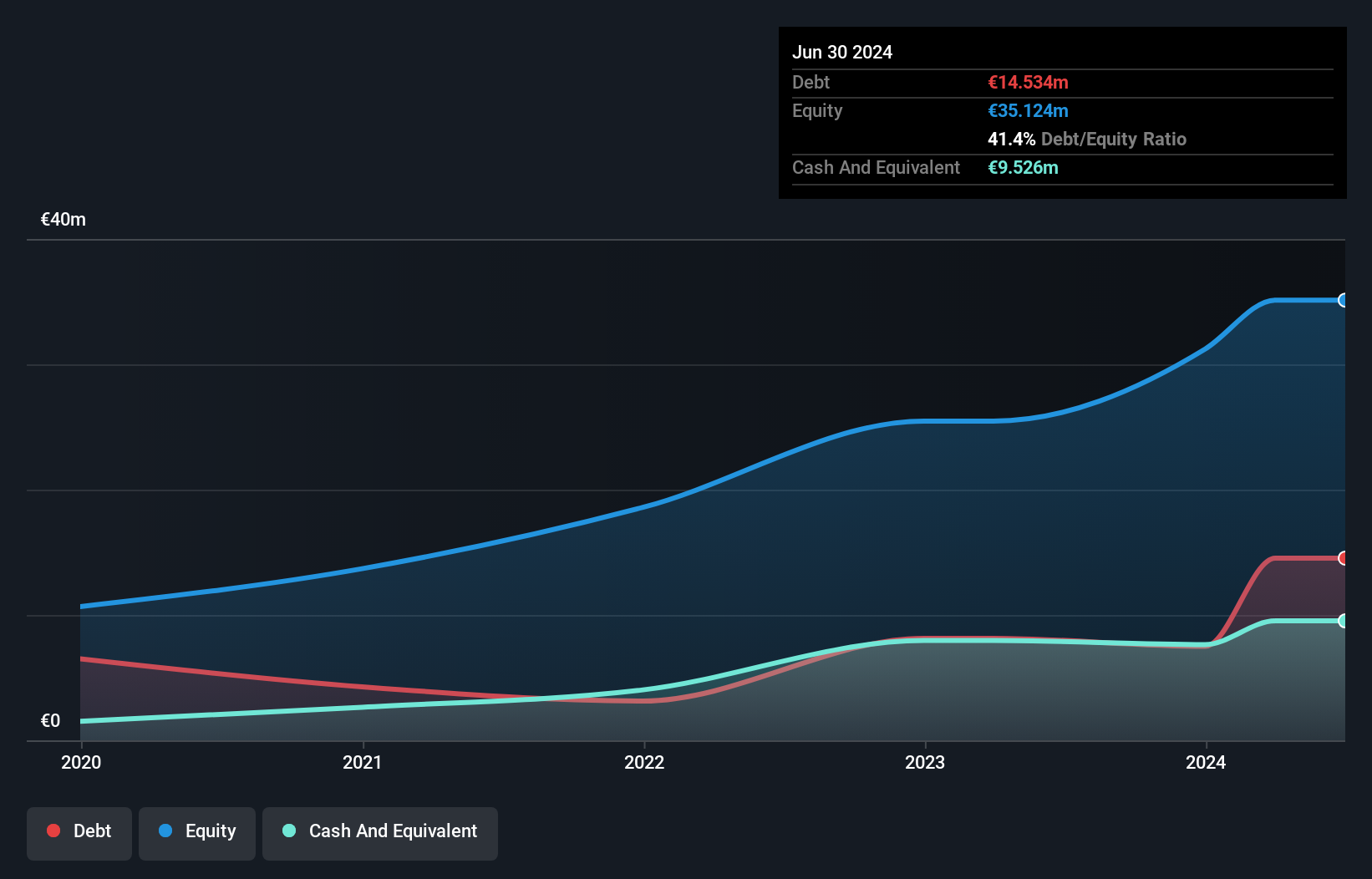

Spadel, a nimble player in the beverage industry, showcases impressive financial health with no debt and a 26.6% earnings growth over the past year, outpacing the industry's -6.6%. The company's high-quality earnings are complemented by positive free cash flow, which hit €50.34 million recently. Despite a volatile share price in recent months, Spadel's net income rose to €26.78 million for the half-year ending June 2025 from €24.19 million last year, with basic earnings per share climbing to €6.45 from €5.83. This growth trajectory suggests resilience and potential for continued success in its market segment.

- Click here to discover the nuances of Spadel with our detailed analytical health report.

Gain insights into Spadel's past trends and performance with our Past report.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various customer segments in France, with a market cap of €1.62 billion.

Operations: Brie Picardie generates revenue primarily through its retail banking segment, which accounted for €662.31 million.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with total assets of €41.6 billion and equity of €5.7 billion, presents a solid profile in the banking sector. The company reported net income of €165.58 million for the half year ended June 2025, up from €146.24 million the previous year, highlighting its earnings growth of 6.7%, which outpaced the industry average by a significant margin. It has an appropriate bad loans ratio at 1.6% and maintains a sufficient allowance for these at 106%. Trading at 11% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in Europe’s financial landscape.

Taking Advantage

- Gain an insight into the universe of 328 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRBP2

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative

Provides a range of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives