The European market has shown cautious optimism recently, with the pan-European STOXX Europe 600 Index ending slightly higher as investors weigh ongoing U.S. trade policy developments and geopolitical efforts. Despite these broader market dynamics, penny stocks remain an intriguing investment area due to their potential for growth at lower price points. Often representing smaller or newer companies, these stocks can offer significant upside when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.92 | SEK293.94M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.958 | €32.08M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.50 | SEK244.2M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.68 | SEK223.89M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.74 | €53.82M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.47 | €25.46M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.195 | €96.26M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.345 | €324.54M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.79 | PLN128.46M | ★★★★☆☆ |

Click here to see the full list of 425 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Altia Consultores (BME:ALC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Altia Consultores, S.A. operates in the information and communication technologies (ICT) sector both in Spain and internationally, with a market cap of €329.46 million.

Operations: The company's revenue is primarily derived from its business lines, with Altia contributing €122.39 million, Noesis €72.98 million, Bilbomatics €57.48 million, Exis €8.98 million, and operations in Chile generating €1.43 million.

Market Cap: €329.46M

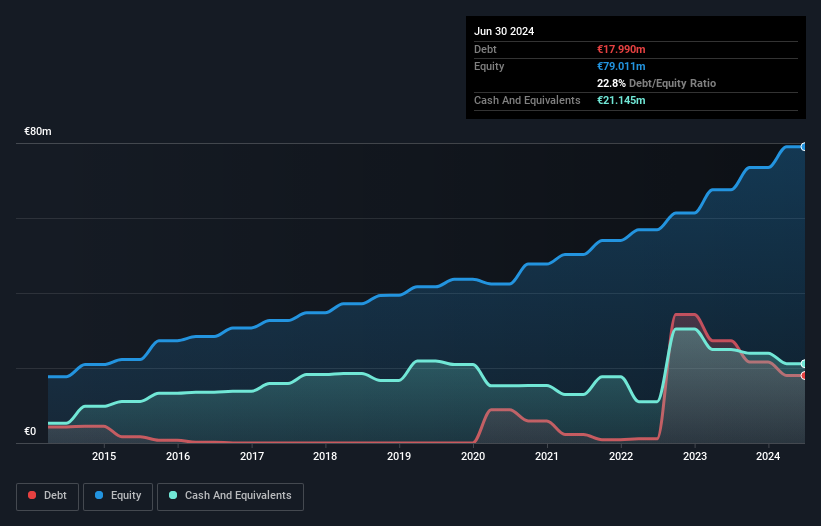

Altia Consultores, S.A., with a market cap of €329.46 million, operates in the ICT sector and has demonstrated robust financial health with short-term assets (€93.5M) exceeding both short-term (€62.4M) and long-term liabilities (€11.8M). The company’s earnings have grown significantly by 22.6% annually over the past five years, though recent growth (9.9%) lags behind this average and matches industry performance. Altia's debt is well-covered by cash flow (81%), while interest payments are comfortably managed with EBIT covering them 17.9 times over, indicating strong operational efficiency despite its low return on equity of 19.1%.

- Unlock comprehensive insights into our analysis of Altia Consultores stock in this financial health report.

- Evaluate Altia Consultores' historical performance by accessing our past performance report.

AGF (CPSE:AGF B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AGF A/S operates in the sports and facilities sector in Denmark with a market capitalization of DKK362 million.

Operations: The company generates revenue primarily from its Sport segment, contributing DKK168.67 million, and its Facilities segment, adding DKK22.43 million.

Market Cap: DKK362M

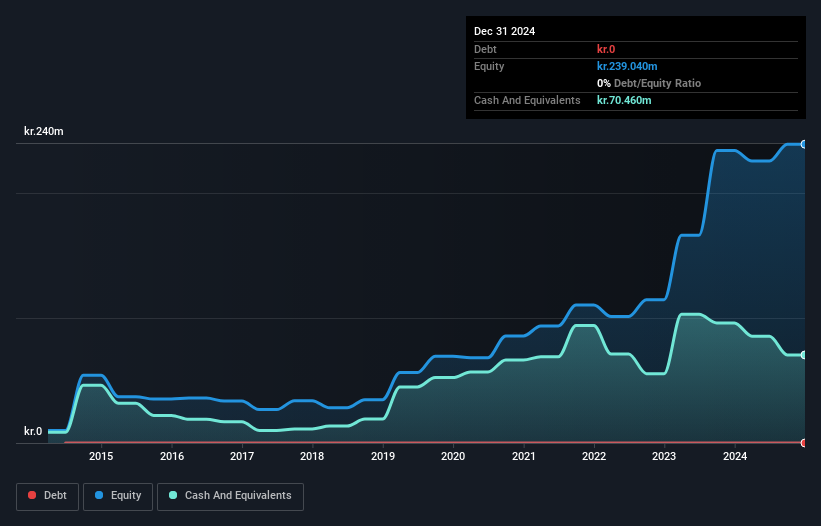

AGF A/S, with a market cap of DKK362 million, operates debt-free and maintains strong financial health as its short-term assets (DKK140.5M) surpass both short-term (DKK72.4M) and long-term liabilities (DKK32.2M). Despite a seasoned management team averaging 9.6 years in tenure, the company faces challenges with declining net profit margins from 41.3% to 3.1% over the past year and negative earnings growth of -92.3%. Recent half-year results show sales increased to DKK101.4 million from DKK95.94 million, though net income dropped significantly to DKK13.69 million from DKK68.17 million year-over-year.

- Click here to discover the nuances of AGF with our detailed analytical financial health report.

- Understand AGF's track record by examining our performance history report.

Vincit Oyj (HLSE:VINCIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vincit Oyj offers service design and software development services across Finland, Poland, Portugal, Sweden, and the United States with a market cap of €33.14 million.

Operations: The company generates €84.65 million in revenue from its computer services segment.

Market Cap: €33.14M

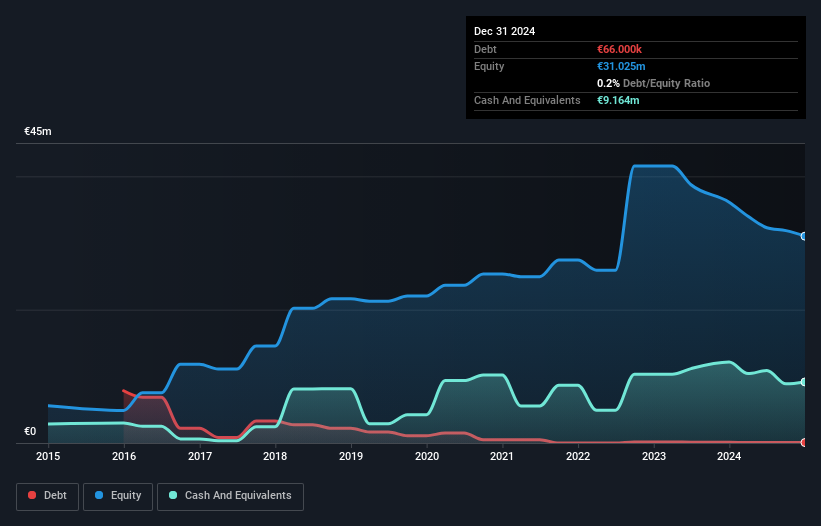

Vincit Oyj, with a market cap of €33.14 million, faces challenges as it remains unprofitable and has seen losses increase annually by 60.5% over the past five years. Despite trading at a significant discount to its estimated fair value and having short-term assets (€27.5M) that cover both short-term (€16.1M) and long-term liabilities (€683K), its operating cash flow is negative, indicating poor debt coverage. The company's recent earnings report shows declining annual sales from €98.09 million to €84.65 million while reducing its net loss from €2.67 million to €0.942 million in the fourth quarter year-over-year.

- Jump into the full analysis health report here for a deeper understanding of Vincit Oyj.

- Evaluate Vincit Oyj's prospects by accessing our earnings growth report.

Where To Now?

- Get an in-depth perspective on all 425 European Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALC

Altia Consultores

Operates in the information and communication technologies (ICT) sector in Spain and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives