As the European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index recently pulling back after hitting a fresh high, investors are keenly observing opportunities that may arise amidst shifting economic conditions. Penny stocks, despite their somewhat outdated moniker, continue to capture interest for their potential to offer surprising value and growth. In this article, we explore three European penny stocks that stand out for their financial strength and potential long-term promise in today's ever-evolving market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.60 | €1.25B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.40 | SEK206.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.937 | €75.61M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €3.95 | €77.27M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.46 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 280 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Libertas 7 (BME:LIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Libertas 7, S.A. operates in the real estate and investment sectors in Spain, with a market cap of €70.85 million.

Operations: The company generates revenue through three primary segments: Investments (€2.82 million), Touristic Area (€1.93 million), and Real Estate Area (€7.22 million).

Market Cap: €70.85M

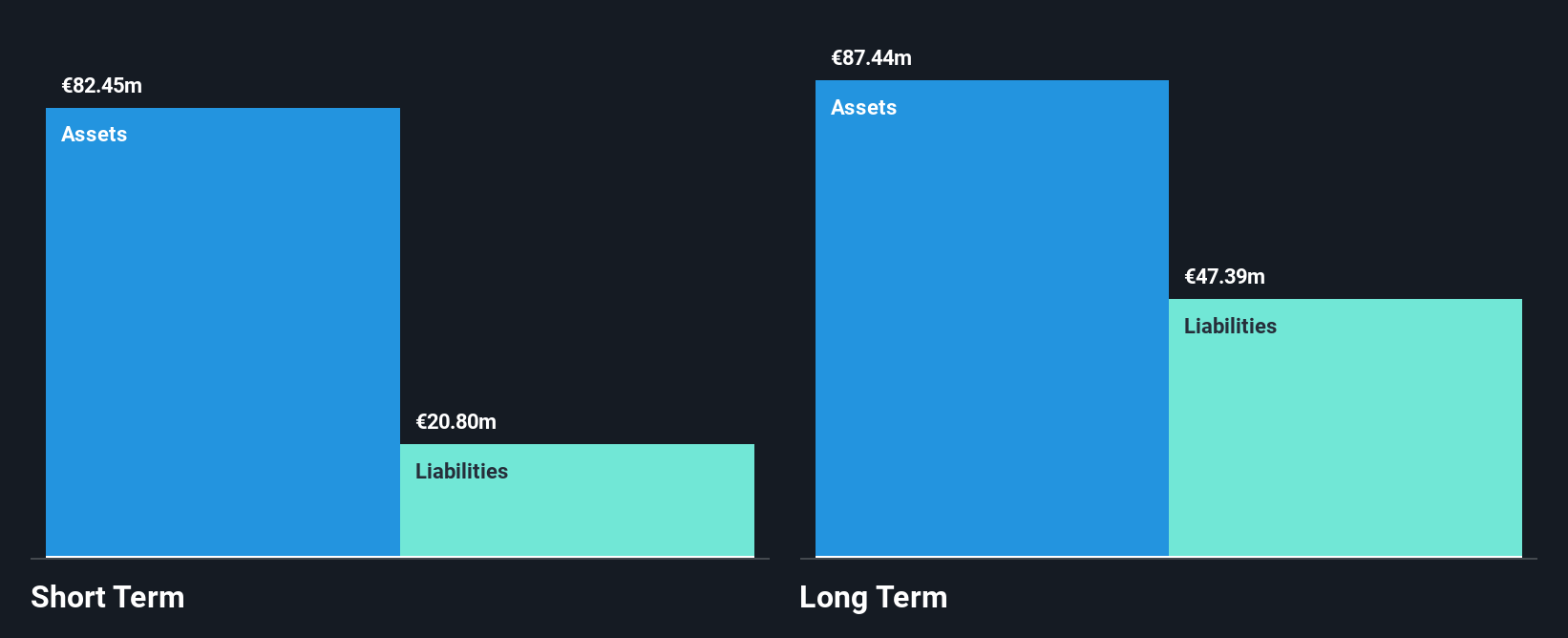

Libertas 7, with a market cap of €70.85 million, operates in Spain's real estate and investment sectors. The company has become profitable recently, showing significant earnings growth over the past five years. However, its operating cash flow covers only 11% of its debt, indicating potential liquidity concerns despite having more cash than total debt. Short-term assets exceed both short-term and long-term liabilities comfortably. Although the stock trades below estimated fair value and interest payments are well covered by EBIT, high volatility remains a concern for investors seeking stability in penny stocks.

- Get an in-depth perspective on Libertas 7's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Libertas 7's future.

Deceuninck (ENXTBR:DECB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deceuninck NV is involved in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions across Europe, North America, Turkey, and internationally with a market cap of €285.43 million.

Operations: The company's revenue is primarily derived from its Window and Door Systems segment (€724.41 million), followed by Home Protection (€38.30 million) and Outdoor Living (€26.26 million).

Market Cap: €285.43M

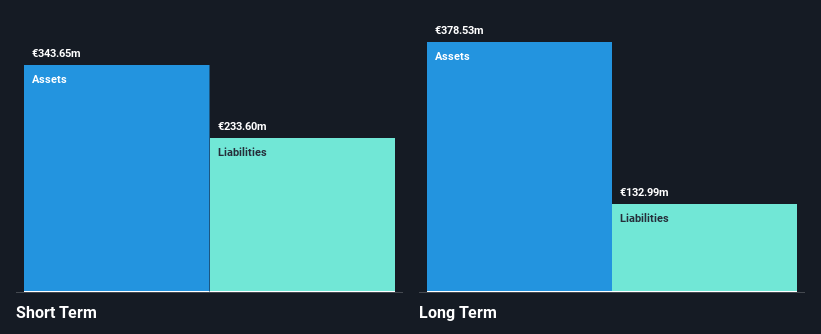

Deceuninck NV, with a market cap of €285.43 million, has shown impressive earnings growth of 811.3% over the past year, significantly outpacing the building industry. Despite a decline in sales to €383.55 million for the half year ended June 2025, net income increased to €11.15 million from €7.74 million previously, reflecting improved profit margins now at 2.2%. The company's debt is well-managed with interest payments covered 15 times by EBIT and operating cash flow covering 65.4% of its debt obligations. However, low return on equity at 5.7% and an inexperienced management team present challenges amidst its promising financial metrics.

- Click to explore a detailed breakdown of our findings in Deceuninck's financial health report.

- Explore Deceuninck's analyst forecasts in our growth report.

Onward Medical (ENXTBR:ONWD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Onward Medical N.V. is a medical technology company focused on developing and commercializing therapies for functional recovery in individuals with Spinal Cord Injury, with a market cap of €191.25 million.

Operations: Onward Medical generates its revenue primarily from its Biotechnology (Startups) segment, which amounts to €2.72 million.

Market Cap: €191.25M

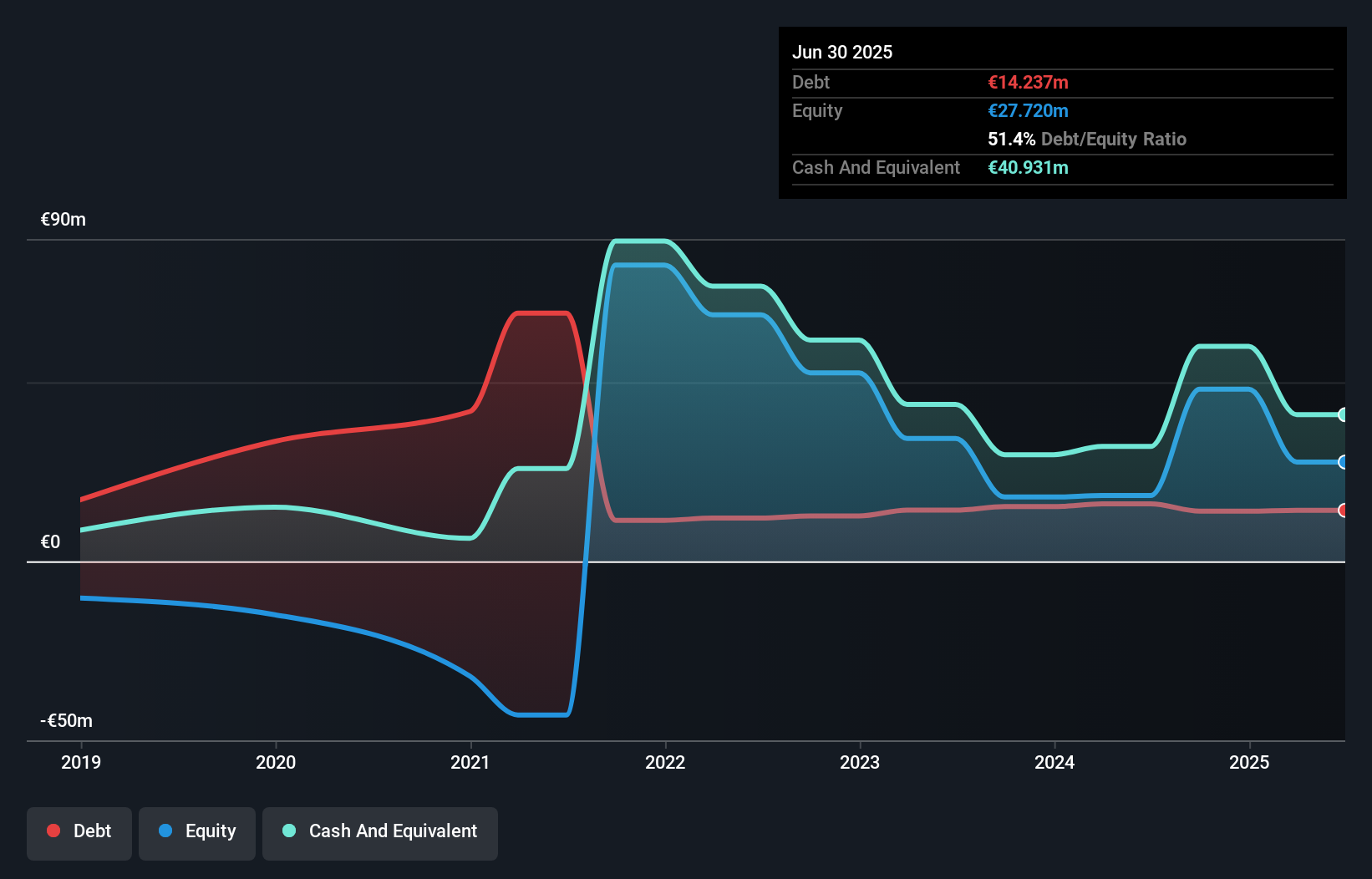

Onward Medical N.V., with a market cap of €191.25 million, remains pre-revenue in its biotechnology segment, generating only €2.72 million in revenue. Despite this, the company has made strides with its ARC-IM System receiving FDA approval for a pivotal study addressing blood pressure instability post-spinal cord injury. The company's recent follow-on equity offering raised €50.85 million, bolstering its cash runway beyond nine months despite ongoing losses and negative return on equity (-139.43%). While volatility is high compared to Belgian stocks, Onward's strategic developments and experienced board offer potential amidst financial challenges and unprofitability forecasts over the next three years.

- Click here to discover the nuances of Onward Medical with our detailed analytical financial health report.

- Gain insights into Onward Medical's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Get an in-depth perspective on all 280 European Penny Stocks by using our screener here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DECB

Deceuninck

Engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives