Grupo Catalana Occidente (BME:GCO) Net Margin Jump Reinforces Value Narrative Despite Slower Growth Outlook

Reviewed by Simply Wall St

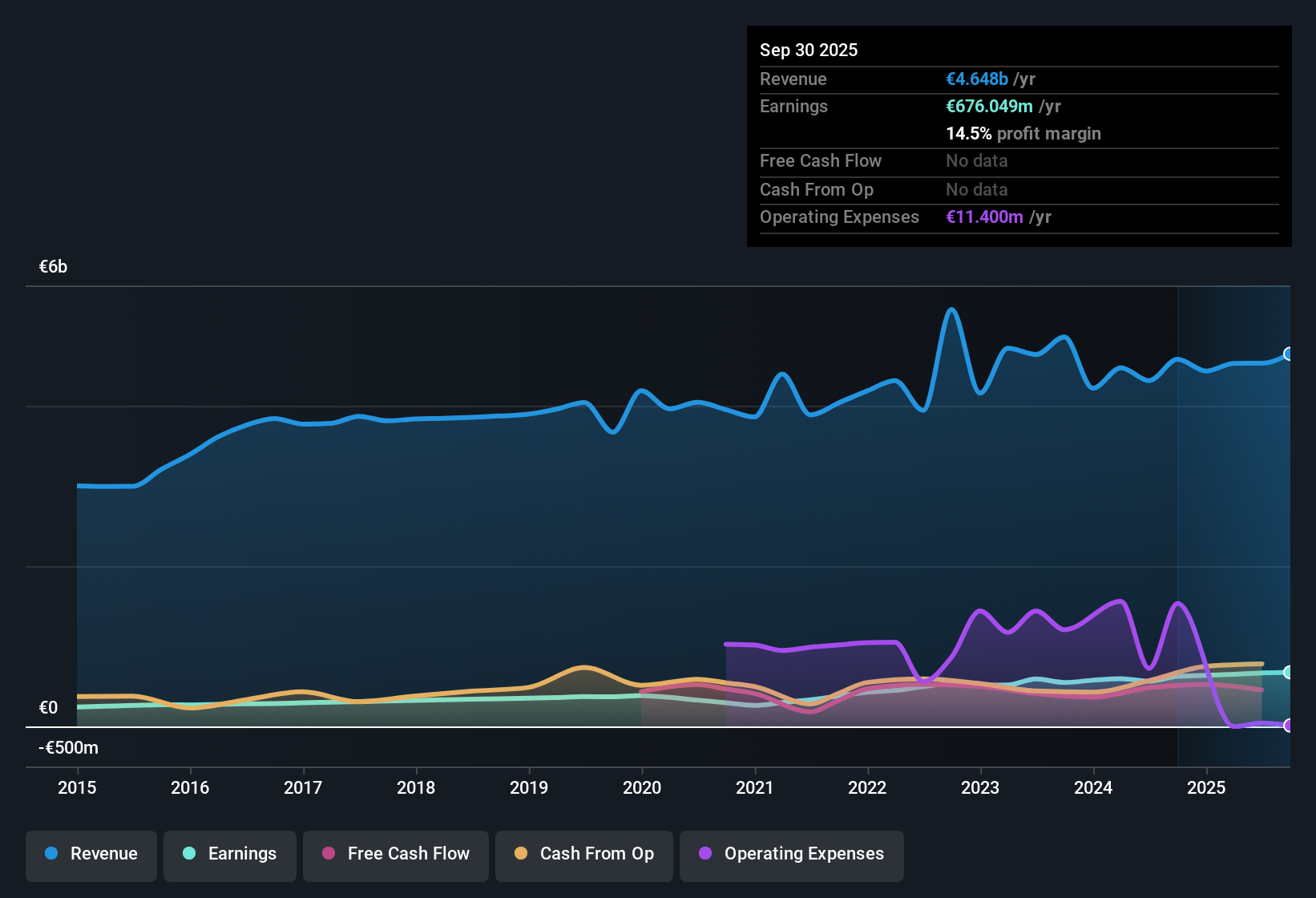

Grupo Catalana Occidente (BME:GCO) posted net profit margins of 14.8%, up from 13.1% previously, and delivered EPS growth of 18.5% over the past year, beating its 5-year average of 16.5% per year. Looking ahead, earnings are forecast to grow at 4.41% per year, with revenue set for 2.3% annual growth, both trailing the broader Spanish market. With a steady track record, accelerating profit growth, and no major risks highlighted, investors have several reward factors to weigh as they consider GCO’s latest results.

See our full analysis for Grupo Catalana Occidente.The next section dives into how these headline figures stack up against the core narratives that investors follow. This highlights where expectations match the facts and where the story looks different.

See what the community is saying about Grupo Catalana Occidente

Margins Supported by Declining Expense Ratio

- GCO’s most recent combined ratio targets remain below 90%, reflecting operational efficiency improvements that support sustained profitability beyond just headline net margin figures.

- Analysts' consensus view sees GCO’s ability to control expenses and maintain margins as a key driver for longer-term resilience. They caution, however, that current technical margins have benefited from an unusually benign claims environment.

- Analysts note that future profitability could normalize as claims trends revert, which may temper some of the optimism about the current cost structure.

- The consensus highlights outperformance in written premiums and operational efficiency, but questions whether the pace of recent margin gains is sustainable amid potential sector headwinds.

DCF Fair Value Shows Major Discount

- The company’s share price of €49.50 trades at a substantial discount compared to its DCF fair value estimate of €83.04, indicating the market currently values GCO well below its estimated intrinsic worth.

- According to the consensus narrative, this discount is seen by some analysts as a double-edged sword. It may offer opportunity for value-driven investors, but also reflects lingering concerns about revenue growth slowing relative to broader markets and mature segment concentration.

- Notably, despite the discount, analysts’ price target aligns almost perfectly with the current share price, underscoring a view that GCO could be fairly valued unless forecasts or sentiment change significantly.

- The consensus points to prudent balance sheet management and high quality of earnings as support for valuation, but these are offset by structural headwinds in mature markets.

PE Ratio Well Below Industry Peers

- GCO trades at a price-to-earnings ratio of 8.7x, which is noticeably lower than the European insurance industry average of 12.7x and the peer group average of 19.9x. This highlights its relative undervaluation on this measure.

- The consensus narrative questions whether investors are underappreciating the group’s strong business mix and geographic diversification or if the discount simply reflects competition from insurtechs and increasing market maturity in Spain and Western Europe.

- This gap in relative valuation could be attractive to patient investors if GCO sustains outperformance in premium growth and stability in combined ratios.

- Alternatively, it may simply reflect persistent market caution around top-line growth potential as insurance markets approach saturation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Grupo Catalana Occidente on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Turn your perspective into a narrative in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Grupo Catalana Occidente.

See What Else Is Out There

While Grupo Catalana Occidente trades at a notable discount to its fair value, concerns persist around its slowing revenue growth and maturing segments compared to market peers.

If you want to focus on companies showing more consistent momentum in both revenue and earnings, shift your search to stable growth stocks screener (2103 results) for investment ideas with proven track records of stability and expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GCO

Grupo Catalana Occidente

Provides insurance products and services in Spain, the European Union, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives