- Spain

- /

- Personal Products

- /

- BME:PUIG

Will Steady Full-Year Guidance Shape Confidence in Puig Brands' (BME:PUIG) Growth Story?

Reviewed by Sasha Jovanovic

- On October 30, 2025, Puig Brands reaffirmed its earnings guidance for the full year, maintaining like-for-like revenue growth expectations in the 6% to 8% range.

- This steady outlook, confirmed just after its Q3 2025 earnings call, reflects management’s confidence in the underlying momentum of Puig Brands’ business performance.

- We’ll explore how management’s reaffirmation of growth guidance shapes Puig Brands’ investment narrative and outlook moving into year-end.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Puig Brands' Investment Narrative?

To be a shareholder in Puig Brands, you need to believe in the appeal and resilience of long-term brand portfolios even as growth moderates. The company’s reiterated full-year guidance for 2025, delivered just after Q3 results, signals solid faith from management in steady demand for their products and operational execution, especially in a sector where volatility has been commonplace. Recent guidance confirmation keeps short-term catalysts, like stable revenue growth and margin improvement, at the forefront, without introducing new upside or downside scenarios. Risks remain unchanged for now: share price volatility continues, and board inexperience paired with a heavy influx of new directors may amplify governance uncertainty moving forward. Overall, while the guidance lends reassurance, it does not fundamentally alter the business’s near-term risks or growth levers, based on all recent data and analysis. On the other hand, fresh board turnover could have a bigger impact than many realise.

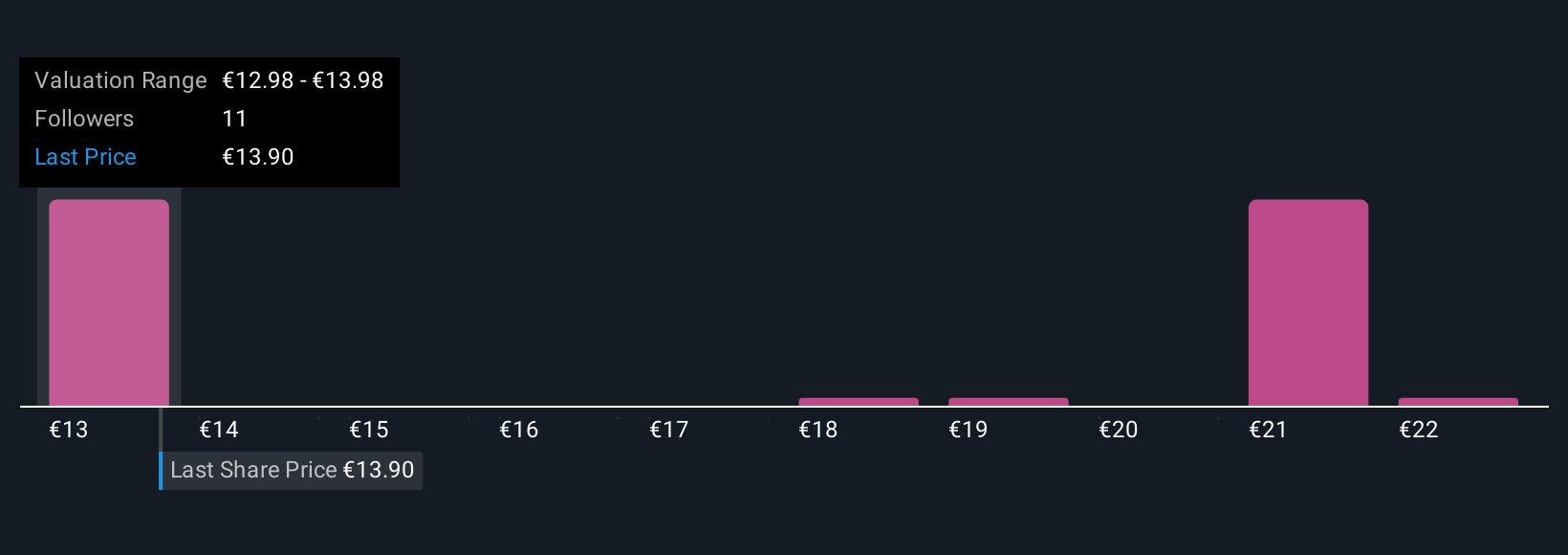

Puig Brands' shares have been on the rise but are still potentially undervalued by 11%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Puig Brands - why the stock might be worth 13% less than the current price!

Build Your Own Puig Brands Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Puig Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Puig Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Puig Brands' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PUIG

Puig Brands

Operates in the beauty and fashion industry in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives