- Spain

- /

- Personal Products

- /

- BME:PUIG

Will Puig’s (BME:PUIG) Asia Pacific Retail Push Reveal Its Next Global Growth Play?

Reviewed by Sasha Jovanovic

- Earlier this year, Puig showcased its prestige fragrance brands Rabanne, Carolina Herrera, and Jean Paul Gaultier at Kuala Lumpur International Airport through a partnership with Eraman, marking its first multi-brand pop-up in Malaysia's main airport and debuting Rabanne in Asia Pacific travel retail.

- This activation signals Puig's focused approach to expanding its footprint in the fast-growing Asia Pacific market, underscoring its regional growth ambitions through targeted brand exposure.

- We'll explore how Puig's new airport retail presence and regional marketing may shape its overall investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Puig Brands' Investment Narrative?

For anyone considering Puig Brands as an investment, the big picture comes down to believing in the company’s ability to steadily grow earnings and expand its global reach in premium beauty. The Kuala Lumpur airport activation signals a clear effort to lift its brand profile in Asia Pacific, an initiative that directly touches on what many see as Puig’s most important short term growth catalyst: deeper regional market penetration. Even as management’s revenue guidance remains unchanged at 6 to 8 percent like-for-like growth for 2025, this new marketing push could support momentum in a region seen as increasingly crucial to future sales. That said, recent share price declines and the company’s underperformance relative to both peers and the broader Spanish market highlight ongoing risks: competitive pressure, slow broader revenue growth and a relatively inexperienced board following several new appointments. While the airport campaign alone may not be immediately material to earnings, its effect on brand awareness could begin shifting short term catalysts and risk balances as Puig seeks greater traction outside its core markets.

On the other hand, board inexperience is a key issue investors should not ignore.

Exploring Other Perspectives

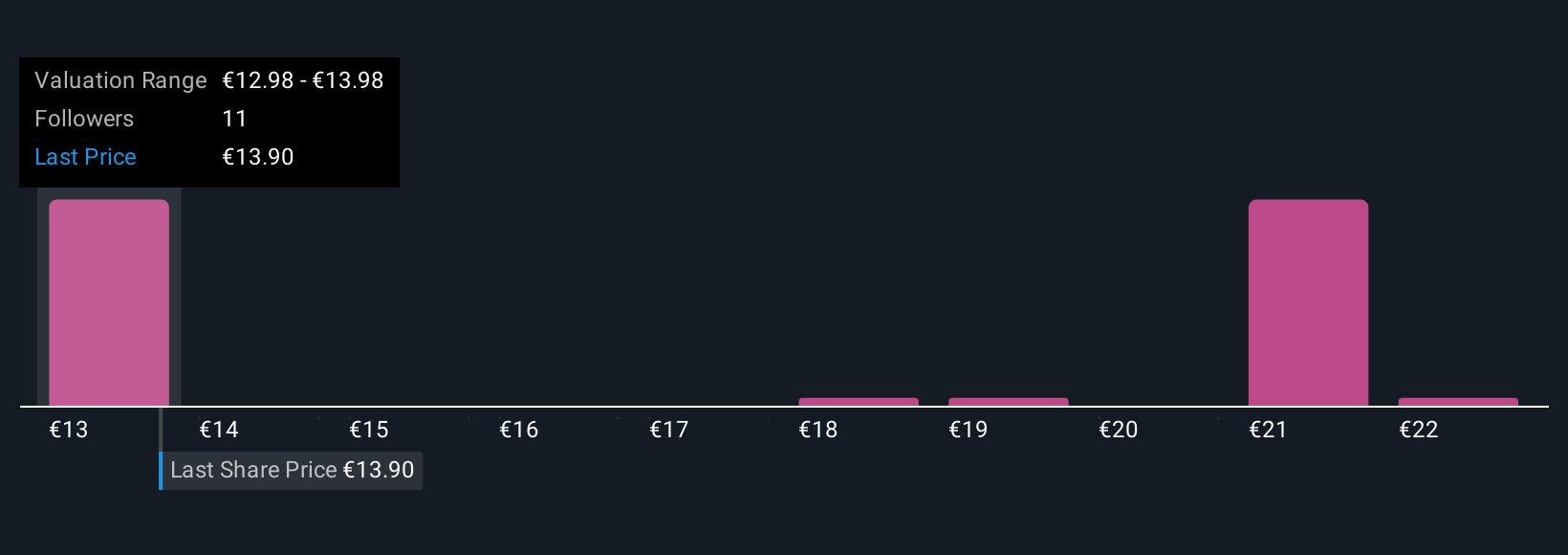

Explore 6 other fair value estimates on Puig Brands - why the stock might be worth as much as 72% more than the current price!

Build Your Own Puig Brands Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Puig Brands research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Puig Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Puig Brands' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PUIG

Puig Brands

Operates in the beauty and fashion industry in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives