- Spain

- /

- Oil and Gas

- /

- BME:REP

Repsol (BME:REP) Valuation in Focus After Recent 5% Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Repsol.

After a steady climb through most of the year, Repsol's 5% share price gain over the past month points to growing momentum, reflecting renewed optimism around the energy sector. The company now boasts a 35% year-to-date share price return and an impressive 45% total shareholder return over the past year. These are clear signs that sentiment has shifted in its favor for both the short and longer term.

If this upward trend has you rethinking the energy space, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Now, with Repsol delivering strong returns, the key question facing investors is whether the recent rally still leaves shares undervalued or if the market has already priced in all the company’s growth potential.

Most Popular Narrative: Fairly Valued

Repsol closed at €16.04, just above the narrative's fair value estimate of €15.27 per share, signaling alignment between market price and consensus expectations. This close gap reflects a market that appears to have already accounted for both current strengths and upcoming opportunities in its valuation.

Expansion in renewables and strategic green hydrogen and biofuel investments are set to diversify revenue, stabilize earnings, and enable higher-margin growth in low-carbon markets. Portfolio optimization and technological upgrades should improve operational resilience, drive efficiency, and support stable earnings from both hydrocarbon and customer-focused divisions.

Curious what underpins Repsol’s current valuation? The narrative rests on ambitious growth in new energy streams and bold future profit projections. Want to know what financial leaps analysts believe are possible? Find out how much lasting value these strategic bets could unlock and what it would take for the price to break higher.

Result: Fair Value of €15.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and slower progress in renewables could challenge Repsol’s upbeat outlook if these risks begin to weigh on margins or overall growth.

Find out about the key risks to this Repsol narrative.

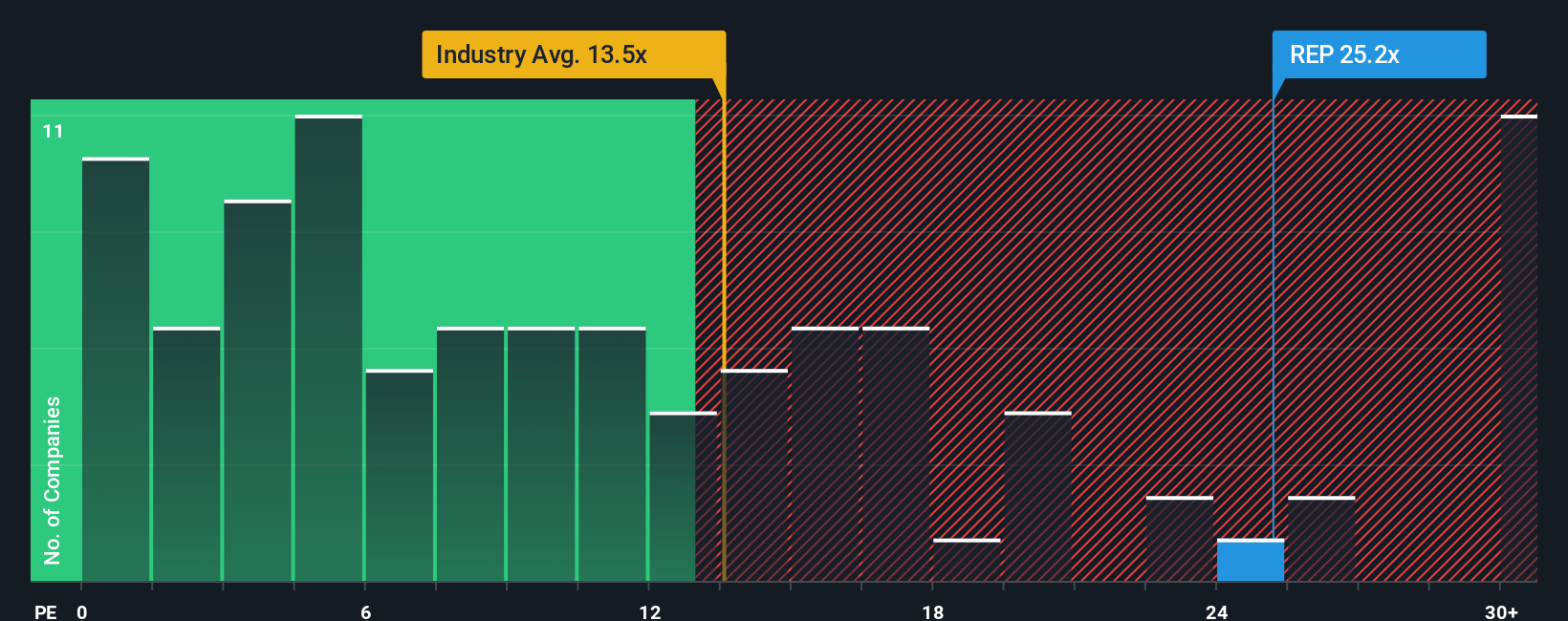

Another View: Market Ratios Suggest Good Value, but Compare Broadly

Looking at market ratios, Repsol trades at a price-to-earnings of 16.7x, which is above the average for its European oil and gas peers (13.6x), yet well below its fair ratio of 28.9x. This suggests shares are attractively valued by some measures. However, is the current price more risk or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Repsol Narrative

If you see the numbers differently or want to dive deeper into your own analysis, building a personalized Repsol story only takes a few minutes. Do it your way

A great starting point for your Repsol research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay a step ahead and give your watchlist new energy by checking out these unique opportunities you might regret missing out on.

- Seize the chance to boost your returns by tracking these 20 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

- Catch the wave of artificial intelligence advancements by following these 26 AI penny stocks positioned to lead in the next era of tech innovation.

- Uncover tomorrow’s growth stories before the crowd by researching these 842 undervalued stocks based on cash flows already showing strong fundamentals and exciting upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:REP

Repsol

Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives