Fluidra (BME:FDR): Assessing Valuation Following Guidance Reaffirmation and Strong Nine-Month Results

Reviewed by Simply Wall St

Fluidra (BME:FDR) just announced two key updates that caught investor attention, including stronger nine-month sales and net income figures, as well as a confirmation of its full-year 2025 sales guidance. These signals are fueling market discussions about the company's ongoing performance and outlook.

See our latest analysis for Fluidra.

After a steady start to the year, Fluidra’s recent sales and earnings update has given its share price new momentum, with a current price of $23.74. While the year-to-date share price return is still slightly negative, the stock’s 1-year total shareholder return of 0.61% marks a modest gain, and the 3-year total return of nearly 71% highlights how much long-term holders have benefited from the company's progress. Investor optimism appears to be building around Fluidra’s growth story as management delivers on guidance and operational goals.

If you’re looking for more opportunities beyond this sector, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With recent results beating last year and management reaffirming guidance, the stock’s upward push begs the question: is Fluidra trading below its true value, or has the market already factored future growth prospects in?

Most Popular Narrative: 8.7% Undervalued

With Fluidra’s most followed narrative fair value set at €25.99, the figure sits above the last close price of €23.74. This brings renewed debate over upside potential. This evaluation weighs Fluidra’s operational strategies and future expectations against current market pricing.

Operational efficiencies and exposure to global commercial pool projects are fortifying long-term profitability, revenue resilience, and future growth opportunities. Weaker currency, cost inflation, and dependence on pricing and acquisitions threaten margins and growth, with limited organic expansion and vulnerability to shifts in customer or market conditions.

What ambitious financial targets are woven into this popular valuation? One key lever is the expectation for sharply rising earnings margins and top-line growth powered by new markets and innovation. Want to see exactly which projections and assumptions are at the heart of this forecast? Dive in to reveal the underlying thrum behind Fluidra’s fair value.

Result: Fair Value of €25.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency weakness and reliance on price increases could derail the growth outlook if cost pressures mount or if consumer demand softens.

Find out about the key risks to this Fluidra narrative.

Another Perspective: Looking Beyond Analyst Estimates

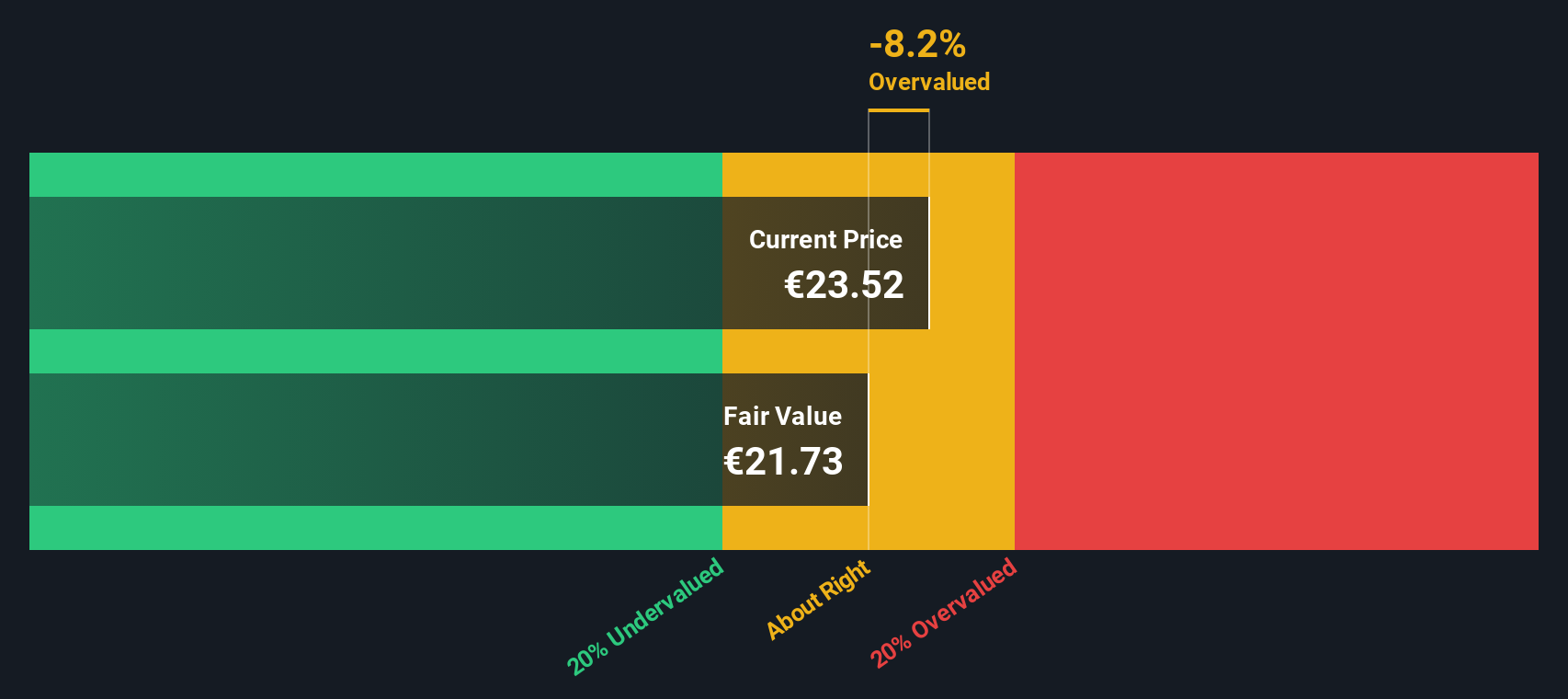

While analysts suggest Fluidra is undervalued based on future growth, the SWS DCF model tells a different story. According to this cash flow approach, the current share price of €23.74 is actually above our calculated fair value of €19.52, which signals possible overvaluation by the market. Which method reflects reality, and where does the real opportunity lie?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fluidra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fluidra Narrative

If you want to draw your own conclusions or dig deeper into the numbers behind Fluidra, you can shape your own perspective in just a few minutes using the following resources: Do it your way

A great starting point for your Fluidra research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity. The market is full of potential gems. Let the Simply Wall Street Screener help you pinpoint your next smart move before others catch on.

- Capitalize on automation trends by tapping into these 26 AI penny stocks. These are making waves across industries with advanced machine learning tools and disruptive platforms.

- Boost your passive income by reviewing these 15 dividend stocks with yields > 3%. These offer reliable yields and proven financial stability.

- Stay on the leading edge of finance by checking out these 82 cryptocurrency and blockchain stocks. These are shaping tomorrow’s digital economy right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:FDR

Fluidra

Designs, manufactures, distributes, and markets accessories and machinery for swimming-pools, irrigation and water treatment, and residential and commercial pool purification market worldwide.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives