Is Novo Nordisk a Hidden Opportunity After Its 9.6% Weekly Gain?

Reviewed by Bailey Pemberton

- Ever wondered if Novo Nordisk is a hidden gem or an overhyped story? If you want the real scoop on what the stock is worth, you’re in the right place.

- The stock has been anything but dull lately. It is up 9.6% in the last week, barely changed over the past month, but still down over 50% year-to-date and in the last 12 months, despite gaining more than 60% over five years.

- Recent news has seen Novo Nordisk in the headlines, from major regulatory developments to ongoing buzz around its diabetes and weight management drugs. Each of these updates adds important context to what’s happening with the stock price and what might happen next.

- On our in-depth valuation checks, Novo Nordisk scores a solid 5 out of 6 for undervaluation, but before you jump to conclusions, let’s break down the approaches analysts use and hint at a fresh perspective we’ll share at the end.

Find out why Novo Nordisk's -58.3% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to what they are worth today. This approach relies on forecasts for Free Cash Flow (FCF), along with expectations of how those future profits might change over time.

For Novo Nordisk, the latest reported Free Cash Flow stands at approximately DKK 67.6 billion. Based on analyst estimates and extrapolations, this figure is projected to grow significantly, reaching about DKK 127.2 billion by 2029. These projections indicate a robust outlook, with cash flows consistently increasing year over year.

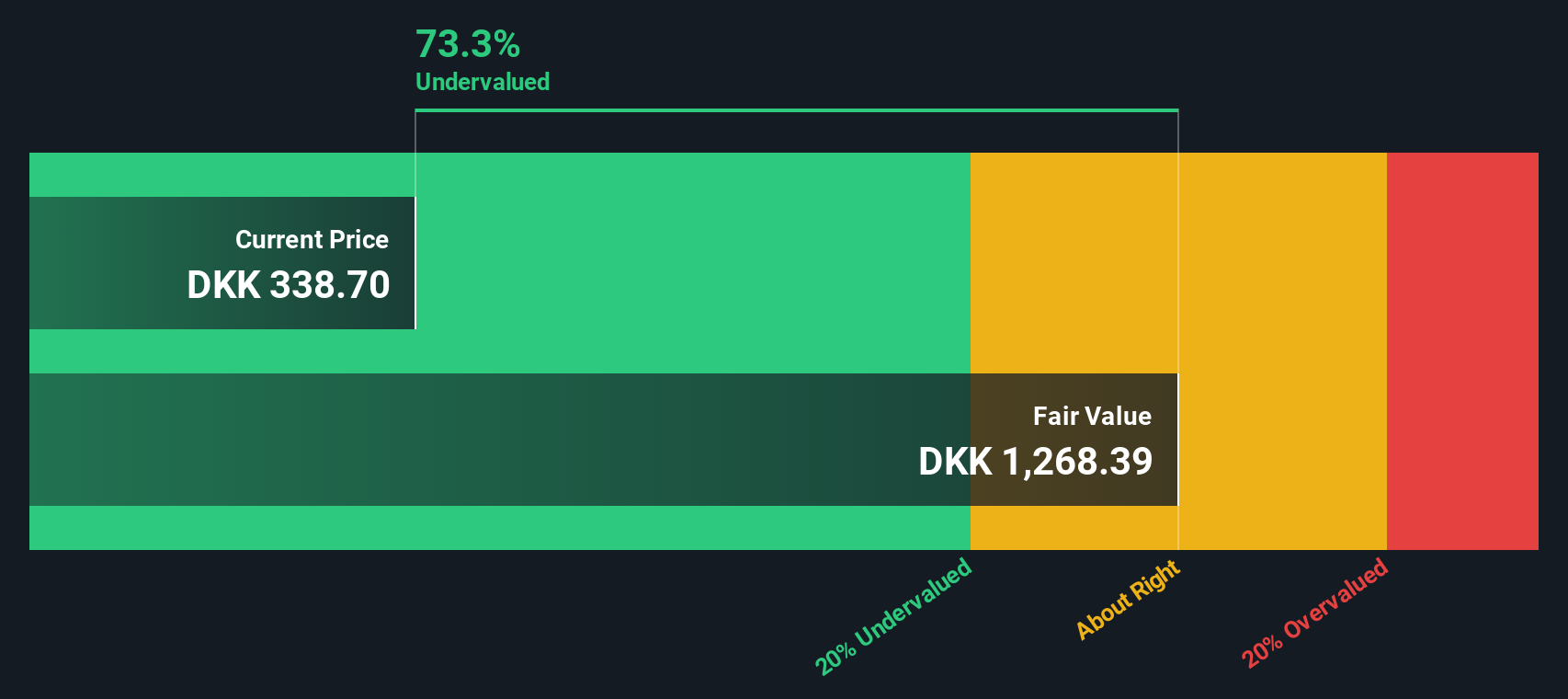

Using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Novo Nordisk is DKK 1,060.10 per share. Compared to the current share price, this reflects a sizable discount of 70.3%, which may suggest that the market is underpricing the stock relative to its future earnings potential.

Overall, the DCF analysis presents Novo Nordisk as undervalued based on the cash it is expected to generate in the coming years.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 70.3%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Novo Nordisk Price vs Earnings

When evaluating profitable companies like Novo Nordisk, the Price-to-Earnings (PE) ratio is a widely used and insightful metric. It helps investors understand how much they are paying for each unit of the company’s earnings. This is especially useful when the business has reliable, growing profits.

Growth expectations and risks play a major role in setting what is considered a “normal” or “fair” PE ratio. Companies with stronger growth prospects or lower risks typically command higher PE ratios, while those facing headwinds tend to trade at lower multiples.

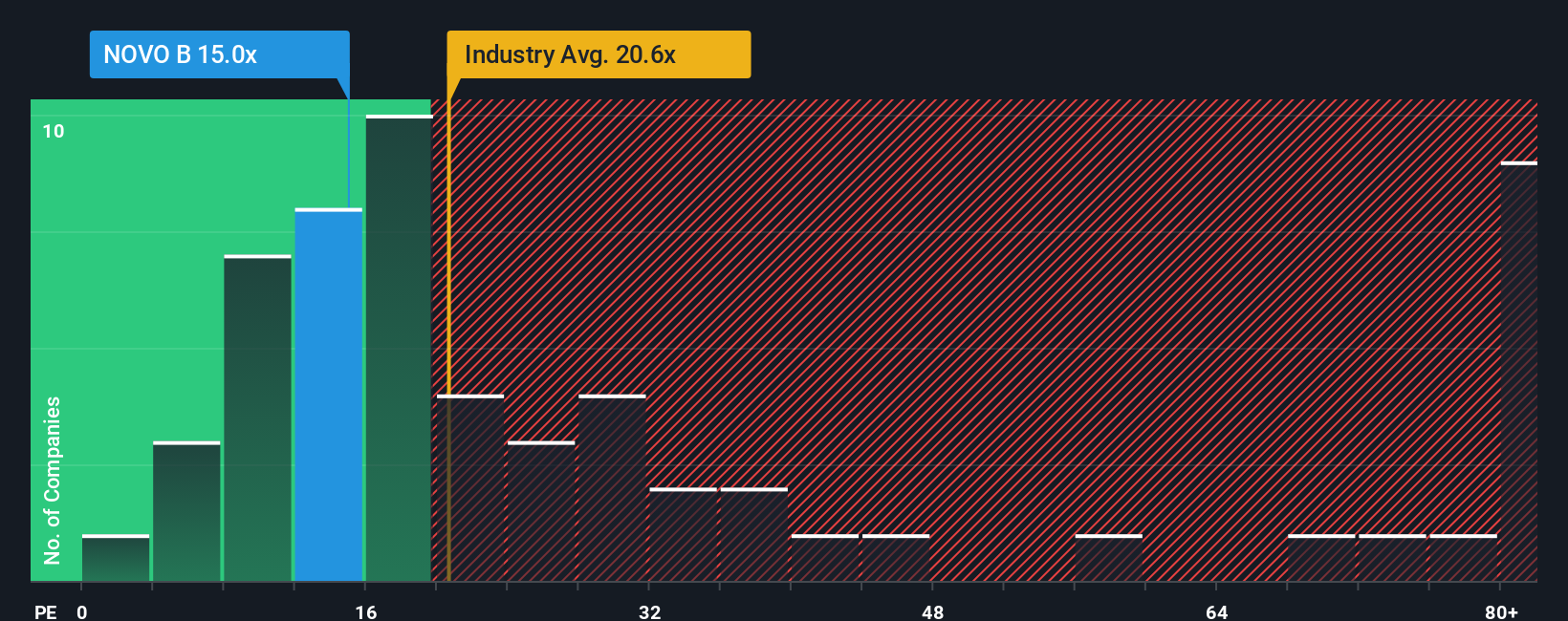

Novo Nordisk currently trades at a PE ratio of 13.5x. For context, this is well below the Pharmaceuticals industry average of 22.8x and its peer group average of 26.5x. On the surface, this seems to signal an attractive opportunity, with Novo Nordisk priced much more conservatively than many of its competitors.

Simply Wall St introduces the “Fair Ratio,” a tailored PE that adjusts for factors such as Novo Nordisk’s earnings growth, profit margins, industry dynamics, market cap, and unique risk profile. Unlike a simple comparison to industry or peer averages, the Fair Ratio provides a more nuanced benchmark.

Novo Nordisk’s Fair Ratio stands at 26.3x, nearly doubling its current PE. This suggests the stock is significantly undervalued relative to the level of profitability and growth the company offers today.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that allows you to attach your own story and expectations to a company, linking what you believe about its future—such as upcoming revenue, profit margins, or market opportunities—to a financial forecast and a resulting fair value.

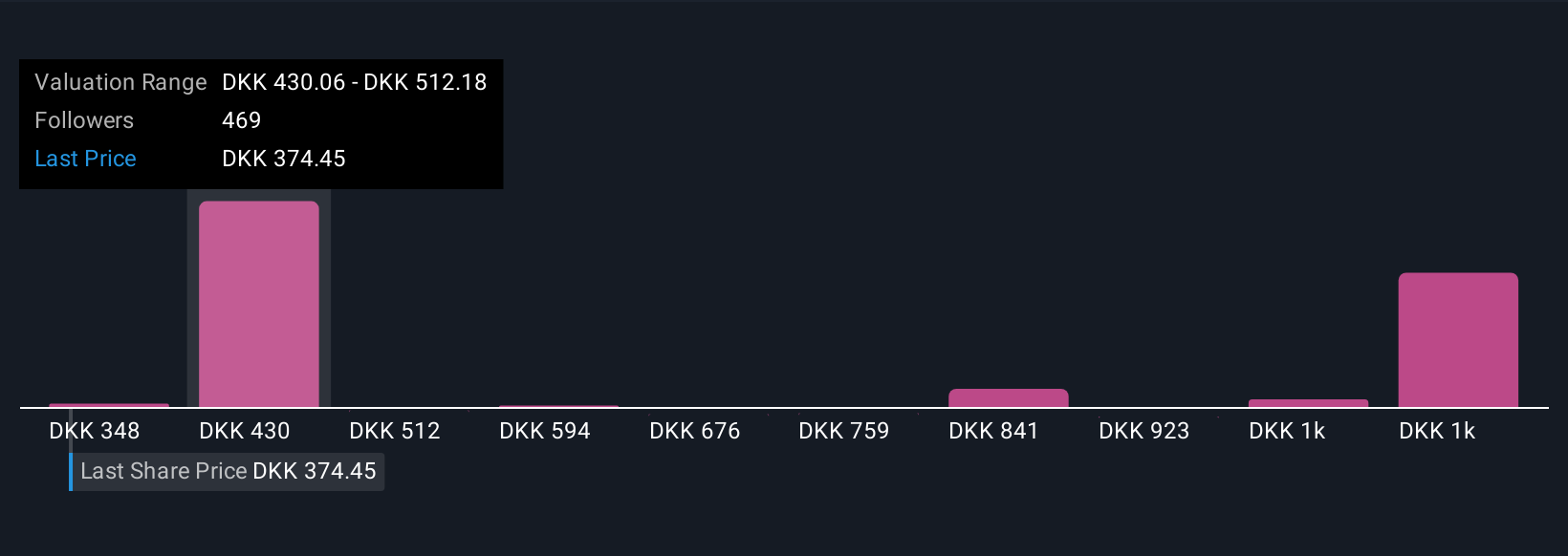

Narratives bridge the gap between numbers and real-world outlooks, helping investors frame decision making in terms of both facts and perspective. On Simply Wall St, millions of investors collaborate by building and sharing Narratives on the Community page, making it easy and accessible for anyone to compare their view with others or test new scenarios as news and results develop.

When you craft or follow a Narrative, the platform dynamically updates fair value and buy/sell signals every time new information becomes available. This ensures you are always working with the latest insights. For example, one Novo Nordisk investor’s Narrative might predict significant growth and assign a fair value of DKK 1,036 per share, while another, expecting only modest gains, sees fair value closer to DKK 400. These differences reveal the real drivers behind buy, hold, or sell decisions.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026