Is Lundbeck Still Attractive After 12.6% Monthly Surge and Positive Neurology Pipeline Updates?

Reviewed by Simply Wall St

If you are eyeing H. Lundbeck stock and trying to decide whether now is the right time to move, you are not alone. Investors have noticed the recent uptick, with shares climbing 5.6% in the past week and 12.6% over the last month. Year to date, the return is a solid 6.9%. What really stands out is the 91.1% gain over the past three years. Clearly, the market has warmed up to Lundbeck, giving some the sense that the momentum could continue, or perhaps that all the easy gains are already gone.

While part of this upward movement can be linked to broader market optimism and sector shifts, investors are also factoring in a reassessment of risk and potential upside in pharmaceuticals. There has not been a single headline-grabbing event driving the price. Instead, a collection of tailwinds is at play, including positive sentiment around innovative neurological treatments and changing market dynamics in healthcare that have encouraged buyers.

With all this happening, how does the company stack up on valuation? According to our data, H. Lundbeck scores a 5 on our value checklist, meaning it appears undervalued in five out of six major valuation checks. This may indicate that there could be more room to run from here, even after recent gains.

Let us break down how that value score is calculated and take a look at what each valuation approach reveals about Lundbeck. At the end, we will discuss what we believe is the single most useful way to gauge whether this stock is truly undervalued right now.

H. Lundbeck delivered 2.1% returns over the last year. See how this stacks up to the rest of the Pharmaceuticals industry.Approach 1: H. Lundbeck Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting them back to today's value. This method helps investors answer the fundamental question: what is Lundbeck truly worth based on the cash the business is expected to generate?

For H. Lundbeck, the latest reported Free Cash Flow is DKK 2.68 billion. Analyst forecasts anticipate this number rising sharply, with projections reaching DKK 5.94 billion in 2029. These forward-looking estimates combine both analyst consensus for the next five years and further extrapolations by Simply Wall St up to ten years ahead.

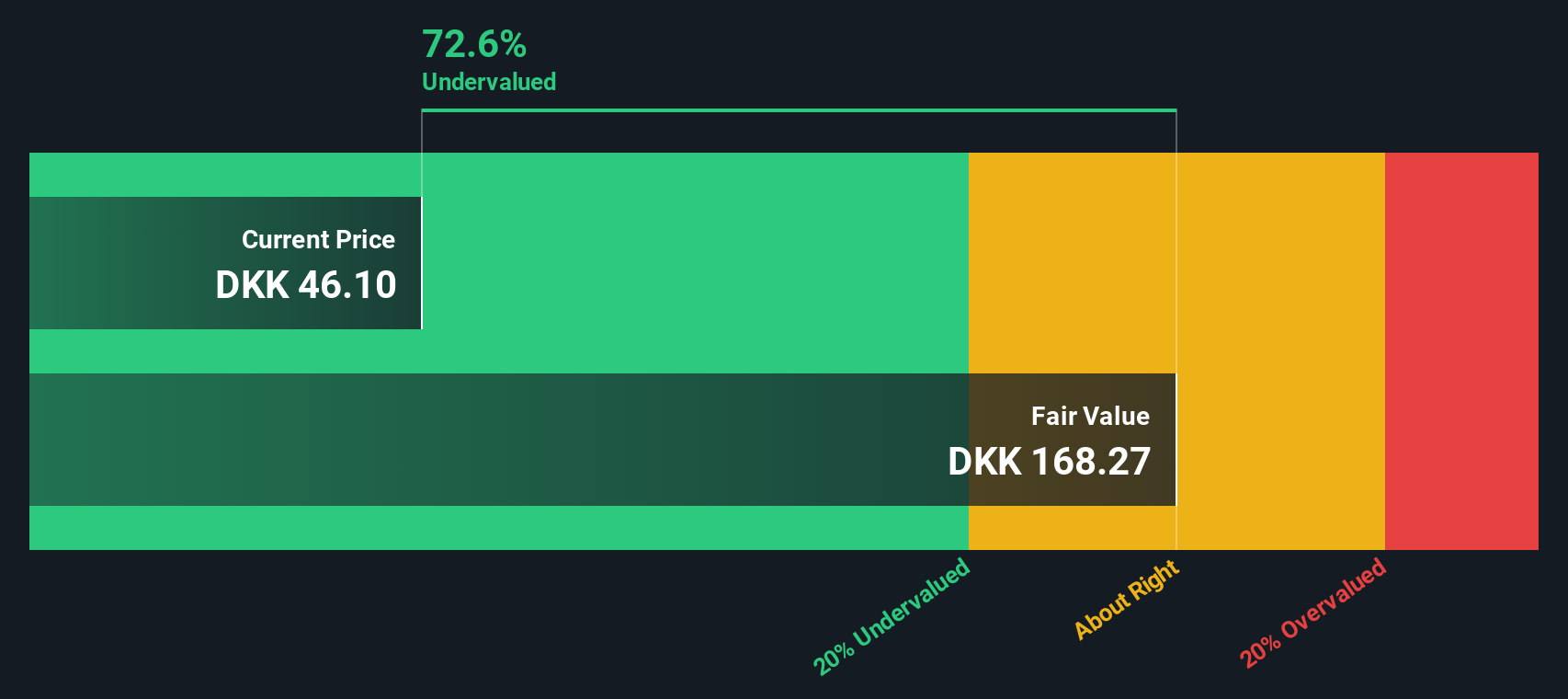

When these figures are run through the DCF process, using the 2 Stage Free Cash Flow to Equity model, the intrinsic value per share comes out to DKK 166.80. Based on current market pricing, this calculates to the stock trading at a 73.1% discount to its estimated fair value. Such a high margin suggests the market is significantly undervaluing Lundbeck at the moment, at least on a purely cash flow basis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for H. Lundbeck.

Approach 2: H. Lundbeck Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like H. Lundbeck. It tells investors how much they are paying for each Danish krone of earnings. For established companies with a steady record of profitability, the PE ratio is especially suitable, as it directly links the share price to the business’s bottom line.

A company’s “normal” or “fair” PE ratio depends on a few factors, primarily its growth outlook and risk profile. Companies expected to grow faster or with lower business risk typically justify higher PE multiples, while those with slower expected growth or additional risks trade at a lower ratio.

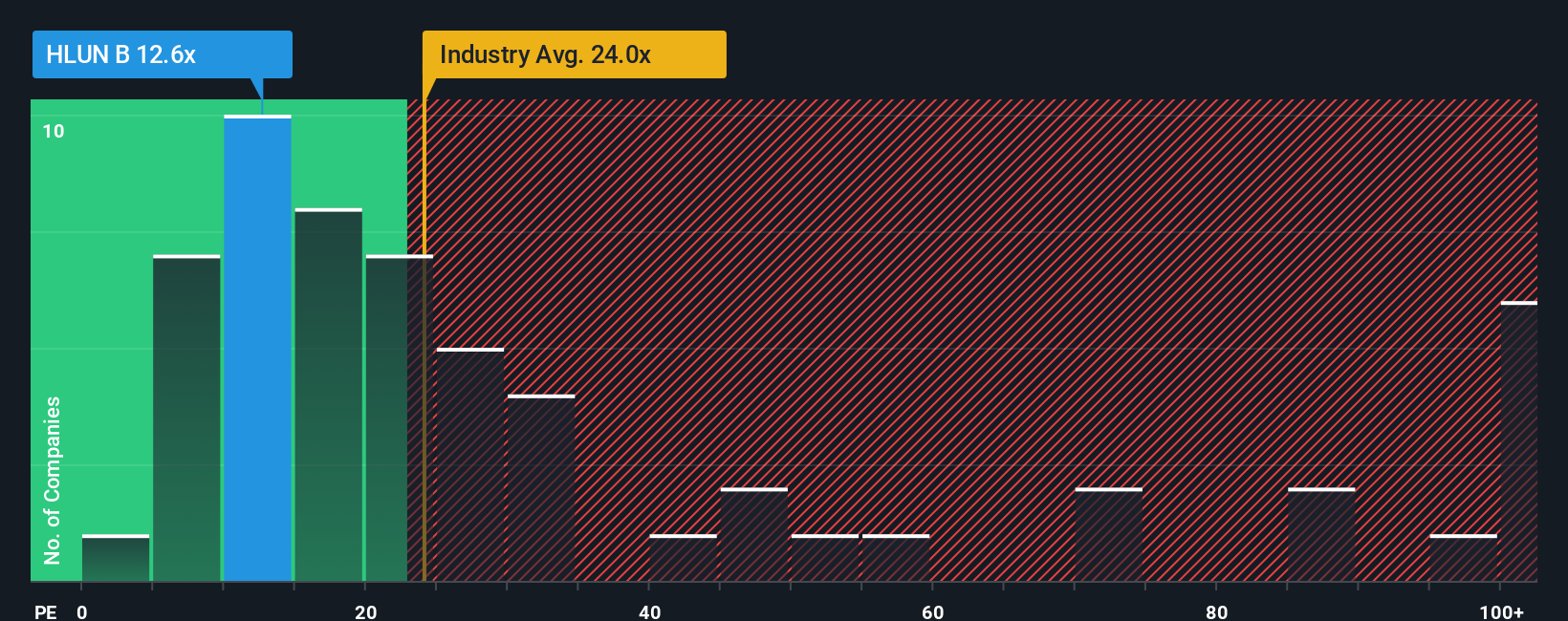

H. Lundbeck’s current PE stands at 12.8x. This is well below the average for the pharmaceuticals industry, which sits at 25x, and also lower than the average of its peer group at 21.8x. At first glance, this suggests the market is valuing Lundbeck’s earnings more conservatively than its peers.

However, Simply Wall St's proprietary “Fair Ratio” provides another lens for comparison. This custom benchmark, set at 14.6x for Lundbeck, takes into account not just industry peers but also the company’s own earnings growth potential, profit margin, risks, and market capitalization. This broader context makes it more informative than simply comparing with industry or peer averages.

Since Lundbeck’s actual PE ratio of 12.8x is modestly below its Fair Ratio of 14.6x, the numbers suggest that Lundbeck is currently undervalued on an earnings multiple basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your H. Lundbeck Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

A Narrative is your story about a stock. It combines your perspective on the future of a company with numbers, such as your fair value, revenue, earnings, and margin assumptions, providing meaning behind the data.

With Narratives, you connect the company’s business outlook, key catalysts, and risks to your own financial forecast, and from there, to a personal fair value estimate. This approach clarifies how your unique view ties into what you think the stock is worth.

This makes Narratives a simple yet powerful tool, accessible to everyone through the Community page on Simply Wall St, where millions of investors weigh in and update their stories as new information emerges.

Your Narrative helps guide action, as you can easily see if your fair value is above or below the current share price. This empowers you to decide whether it is the right time to buy, hold, or sell based on your beliefs. Your fair value and forecast will update instantly when there is new news or results.

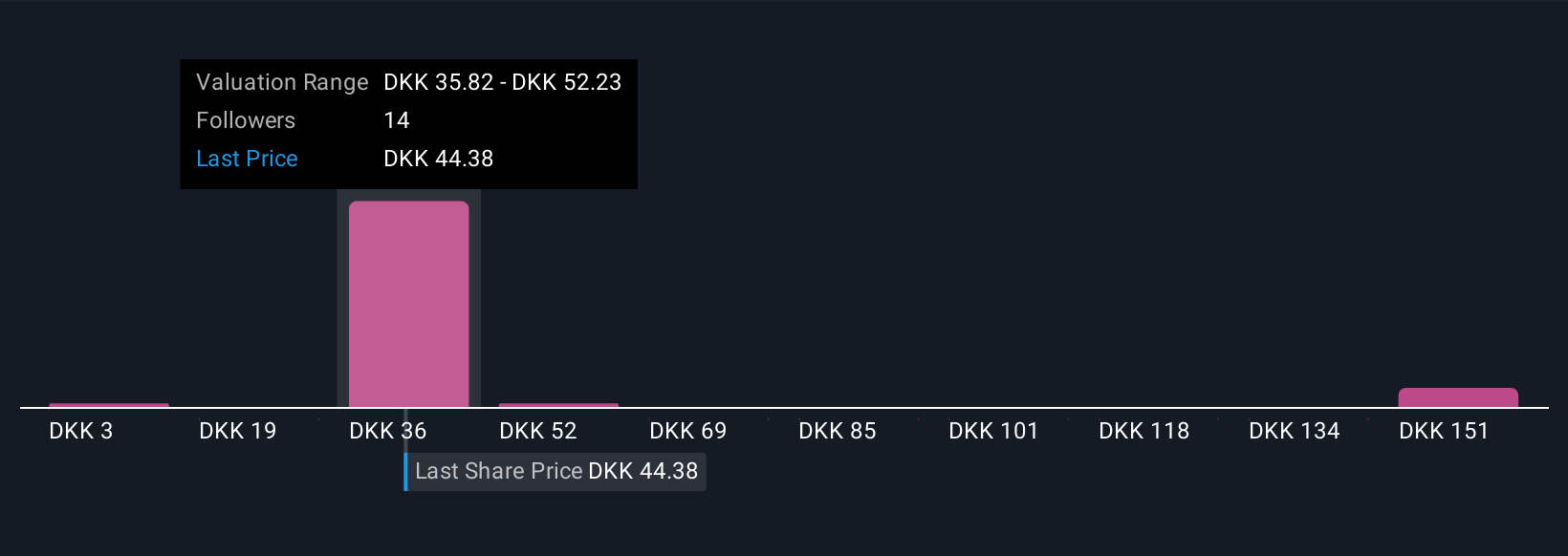

For example, some investors believe H. Lundbeck can achieve robust growth through its global expansion and innovative CNS pipeline, supporting a high valuation target of DKK71.0. Others see risk from patent cliffs and competition, justifying a much lower target of DKK39.5. This clearly shows how different stories result in different investment decisions.

Do you think there's more to the story for H. Lundbeck? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H. Lundbeck might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:HLUN B

H. Lundbeck

Engages in the research, development, manufacturing, and commercializing pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives