Do Genmab Shares Offer Value After Cancer Drug Pipeline Updates and Recent Price Swings?

Reviewed by Bailey Pemberton

- Wondering if Genmab shares are truly worth their current price? Here is what savvy investors should know about its value.

- The stock has gained 25.3% year-to-date and is up 21.6% over the past year. However, it did pull back by 6.1% in the last month, highlighting both growth potential and possible shifting risk perceptions.

- Genmab recently saw renewed investor interest after positive updates on its cancer drug pipeline and new partnership announcements. These factors have fueled both optimism and speculation about its future prospects. Such developments help explain some of the recent swings in the share price as the market digests each new milestone.

- According to our framework, Genmab has a valuation score of 5 out of 6, suggesting it is undervalued in most of our key checks. We will walk through different ways to look at Genmab’s value next, so stay tuned for a smarter approach that can put any stock’s price into sharper context.

Approach 1: Genmab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects Genmab's future cash flows and brings them back to today's value, providing a data-driven estimate of what the company is really worth. In simple terms, DCF calculates what all of Genmab’s expected future cash, generated by the business, would be worth if you had it in hand right now.

Looking at Genmab’s latest numbers, the company generated $1.3 Billion in Free Cash Flow over the last twelve months. Analyst consensus projects steady growth, estimating Free Cash Flow at around $1.8 Billion in 2029. While professional forecasts only go out five years, further projections are automatically extrapolated from those trends. This helps outline a long-term expectation of continued growth in cash generated by Genmab’s operations.

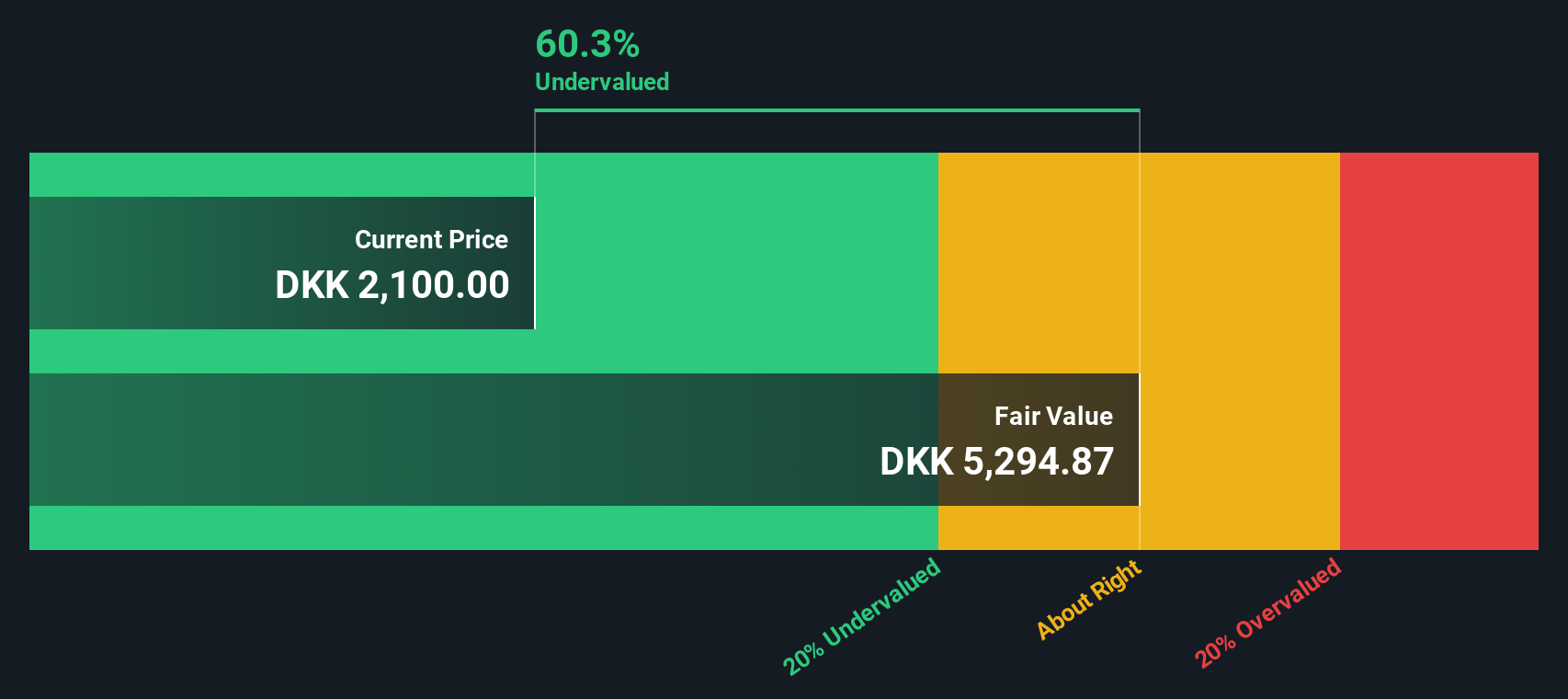

With the DCF approach, the estimated intrinsic value stands at $5,030 per share. Compared to the company’s recent trading price, this suggests Genmab is trading at a substantial 61.9% discount to its calculated worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Genmab is undervalued by 61.9%. Track this in your watchlist or portfolio, or discover 866 more undervalued stocks based on cash flows.

Approach 2: Genmab Price vs Earnings

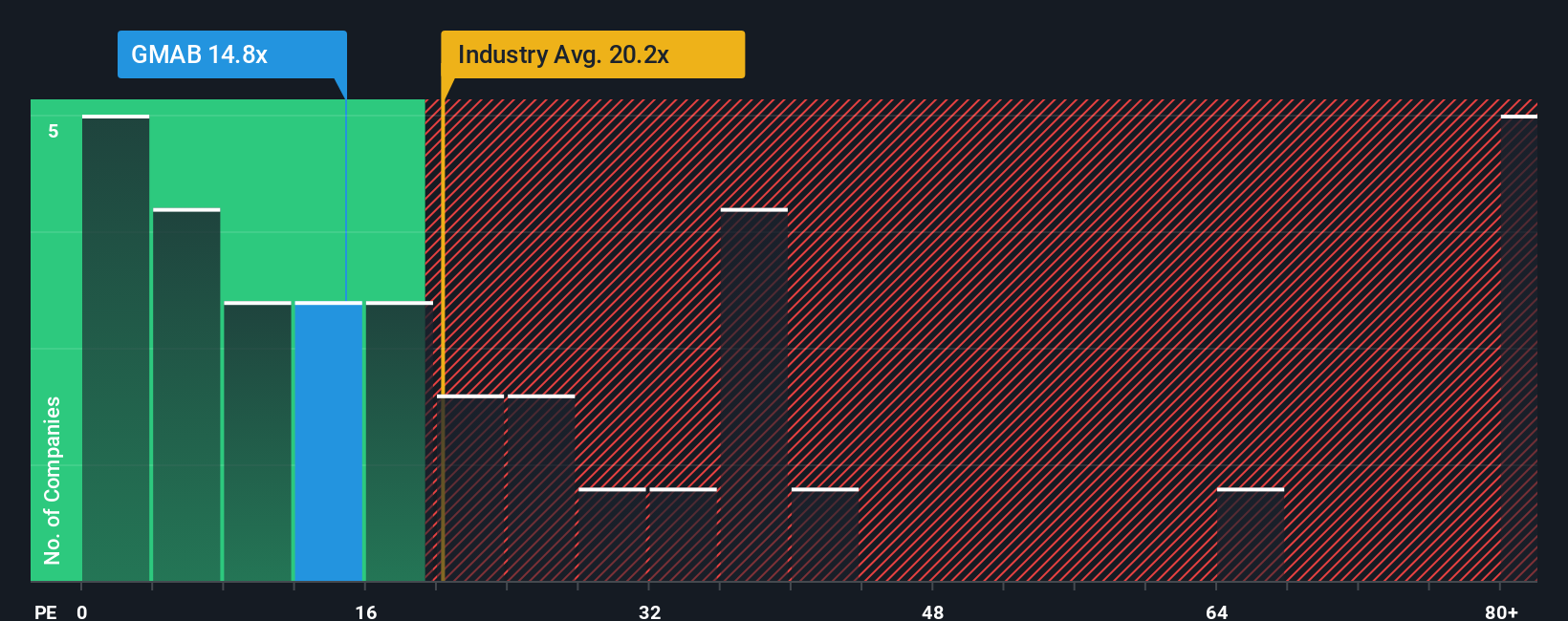

The Price-to-Earnings (PE) ratio is often considered the gold standard for valuing profitable companies like Genmab. It gives investors a direct comparison of what the market is willing to pay for each unit of current earnings. Since Genmab is generating robust profits, PE offers a simple yet effective way to benchmark its stock price against both its own performance and its peer group.

However, a company’s “normal” or “fair” PE ratio is influenced by several factors, mainly growth expectations and perceived business risk. Companies growing quickly or with lower risks typically trade at higher PE multiples, while slower-growing or riskier firms see lower numbers. Therefore, context is crucial when comparing PE ratios across companies and industries.

As of now, Genmab’s PE ratio sits at 11.59x, which is noticeably lower than the biotech industry average of 30.30x and the average among its peers, which is 18.31x. This lower figure may initially suggest that the stock is undervalued. To determine what Genmab’s PE “should” be, we look at the proprietary Fair Ratio from Simply Wall St, calculated at 18.54x. This metric stands out because it does not just benchmark against industry averages or peers. Instead, it factors in Genmab’s earnings growth, risk profile, profit margins, industry positioning, and market capitalization for a more individualized assessment.

Given Genmab’s current PE of 11.59x versus the Fair Ratio of 18.54x, the data points to a stock trading below what its unique outlook justifies.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1389 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Genmab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful concept where you create your own story for a company based on your perspective on its prospects and grounded in your forecasts for future revenue, margins, and what you believe the shares are really worth.

On Simply Wall St’s Community page, Narratives let you combine your take on Genmab’s business, the numbers driving your outlook, and the fair value you believe is justified. Each Narrative turns your story into a data-backed forecast with a clear fair value, making it much easier to decide if Genmab’s current share price offers a good opportunity, or if it is time to wait or sell.

Narratives are living tools. As new earnings reports or news hit the market, your assumptions and the resulting fair value update right away. This means your decision-making stays relevant and responsive to real-world changes without any manual spreadsheet work or guesswork.

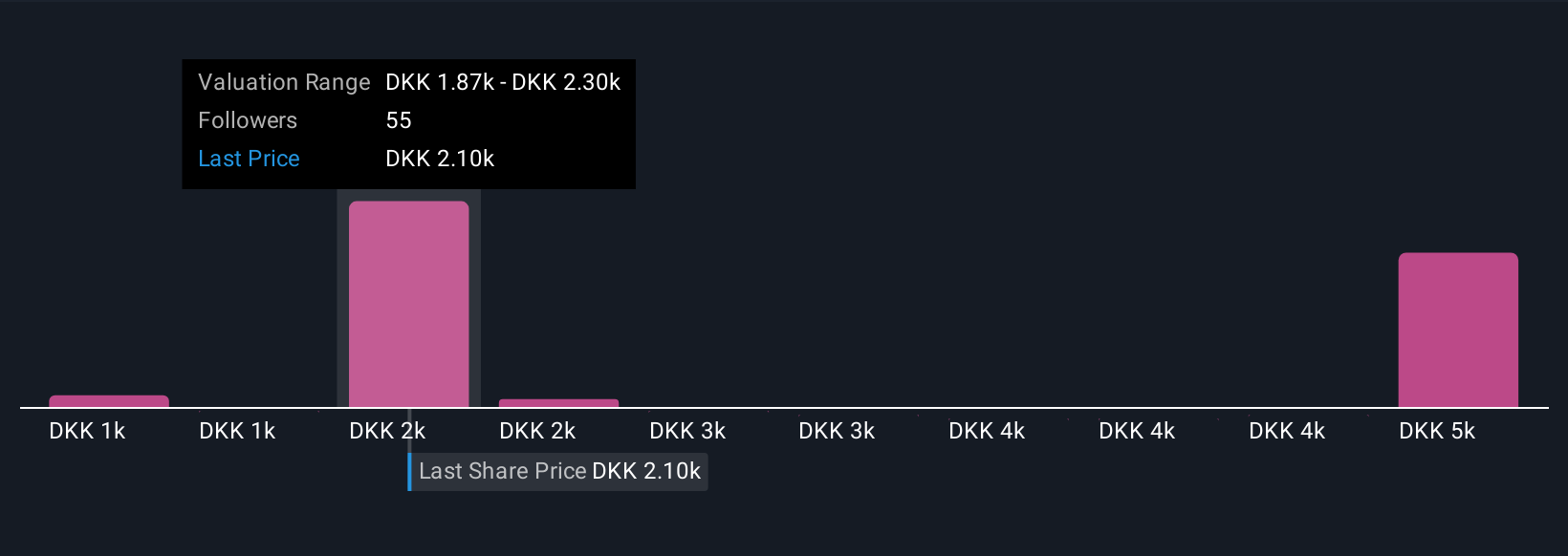

For example, one investor might craft a bullish Genmab Narrative, assuming earnings grow rapidly (DKK 2,650 price target), while a more cautious investor focuses on risks and sets a lower fair value (DKK 1,000). Narratives bring your view to life and help you act confidently, in line with your outlook and the latest data.

Do you think there's more to the story for Genmab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives