Novozymes (CPSE:NSIS B) Is Up 11.4% After Raising 2025 Sales Growth Outlook and Reporting Strong YTD Results

Reviewed by Sasha Jovanovic

- Novozymes recently raised its full-year 2025 earnings guidance, now projecting organic sales growth of 7-8%, and announced third-quarter results showing sales of €1.06 billion and nine-month net income of €460.8 million.

- While third-quarter net income was lower than the previous year, the company’s nine-month net income more than doubled, reflecting strong year-to-date performance and the impact of favorable sales timing.

- With the updated earnings forecast, we'll explore how increased guidance for organic sales growth shapes Novozymes' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Novozymes' Investment Narrative?

Owning Novozymes is all about believing in the company’s ability to deliver consistent growth from its biosolutions platform, despite premium valuation and sector pressures. The latest guidance upgrade, projecting up to 8% organic sales growth for 2025 (and even 9% when country exits are excluded), gives fresh momentum to the short-term story, supporting optimism around year-end catalysts such as continued product rollouts and partnerships, plus the company’s capacity to offset temporary headwinds like sales timing shifts. While the upgraded sales outlook leans positive, bigger-picture risks linger, particularly around board inexperience, a high price-to-earnings ratio compared to peers, and a recent “one-off” loss on the books. If investors focus on profit quality and governance issues, the impact of these may become more central following this earnings update.

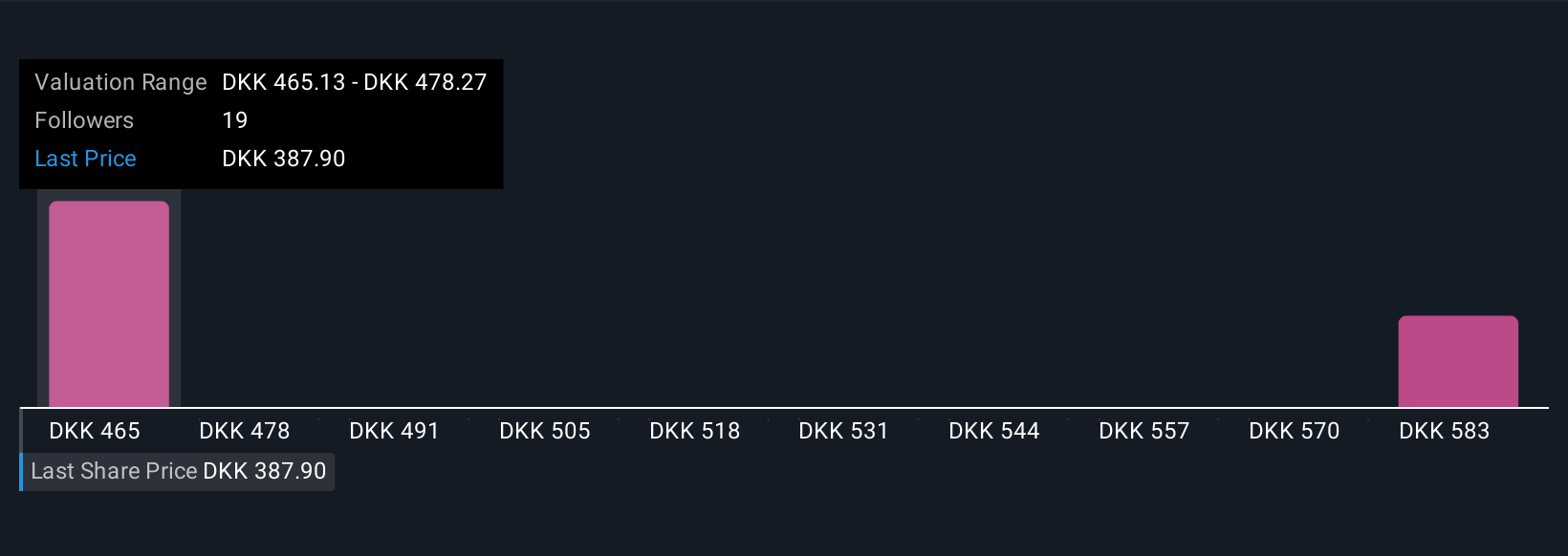

But not everyone will overlook those board and profit concerns. Novozymes' shares have been on the rise but are still potentially undervalued by 42%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Novozymes - why the stock might be worth as much as 71% more than the current price!

Build Your Own Novozymes Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novozymes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novozymes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novozymes' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novozymes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NSIS B

Novozymes

Produces and sells industrial enzymes, functional proteins, and microorganisms in Denmark, rest of Europe, North America, the Asia Pacific, the Middle East, Africa, Latin America, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives