- Denmark

- /

- Electrical

- /

- CPSE:VWS

Assessing Vestas (CPSE:VWS) Valuation After Strong Q3 Earnings, New Orders, and Upbeat 2025 Guidance

Reviewed by Simply Wall St

Vestas Wind Systems (CPSE:VWS) just posted third quarter results showing strong net income growth compared to last year, while also landing new wind turbine orders in the USA, Canada, and across Europe. The revised 2025 revenue guidance suggests ongoing confidence in the company’s growth trajectory.

See our latest analysis for Vestas Wind Systems.

Vestas Wind Systems has seen a surge in momentum lately, with the share price climbing 25.8% over the past month and 56.7% so far this year. The stock’s 1-year total shareholder return stands at an impressive 65.7%, signaling renewed optimism after a challenging few years for the wind sector.

If you’re inspired by Vestas’ rebound and want to uncover more market standouts, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With such a rapid rise in the share price and upbeat financial updates, the key question for investors is whether Vestas is still undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 15.4% Overvalued

With Vestas Wind Systems closing at DKK164.05 and the most followed narrative estimating a fair value of DKK142.17, analysts see the stock trading above where it should be. The main story behind this view comes down to ambitious growth projections and operational execution shaping expectations for the future.

Global prioritization of energy security and sustainability, with many governments accelerating grid investments and permitting reforms (for example, Germany, UK, EU-wide alignment), is expanding Vestas' addressable market and could materially increase order volume and top-line growth.

Want to know the real drivers beneath this valuation call? The assumptions hinge on powerful policy shifts, scale advantages, and a forecasted profit trajectory that aims to outpace the broader industry. Curious which aggressive financial targets and future profit margins make up the logic? Tap in and see the numbers that fuel this bold narrative.

Result: Fair Value of DKK 142.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price competition from Chinese manufacturers and ongoing regulatory uncertainty in key markets could undermine Vestas' optimistic growth outlook.

Find out about the key risks to this Vestas Wind Systems narrative.

Another View: Market Multiples Tell a Different Story

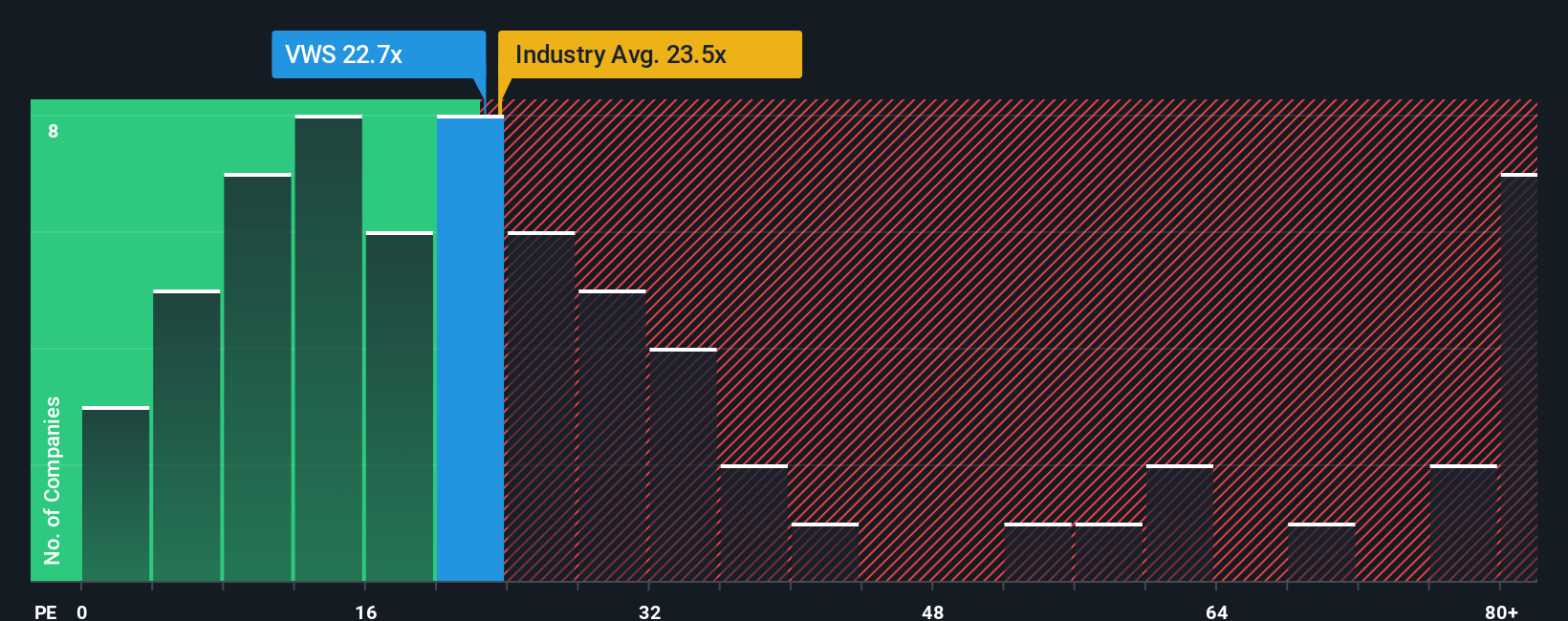

Looking at value through the lens of the price-to-earnings ratio, Vestas is trading at 22.7x earnings. This is slightly lower than both the European Electrical industry average of 22.8x and its peer group at 27.4x, and below the fair ratio of 27.3x, indicating relative value. However, with the share price already running up, does this market perspective suggest a real opportunity or simply reflect lingering lofty expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vestas Wind Systems Narrative

If you’re not convinced by the analysis above or want to dive deeper on your own terms, it’s easy to explore the numbers and craft a personal view in just a few minutes. Do it your way

A great starting point for your Vestas Wind Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take control of your investing future by tapping into powerful market trends before others do. Don’t miss these hand-picked opportunities that could reshape your portfolio:

- Supercharge your returns by targeting companies with robust earnings potential and value with these 857 undervalued stocks based on cash flows right now.

- Capture the next healthcare breakthrough, as medical innovation accelerates with these 32 healthcare AI stocks at your fingertips.

- Capitalize on resilient income streams by selecting from these 15 dividend stocks with yields > 3%, featuring yields above 3% for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives