Ringkjøbing Landbobank (CPSE:RILBA): A Closer Look at Valuation Following Recent Gains

Reviewed by Simply Wall St

Ringkjøbing Landbobank (CPSE:RILBA) has seen its stock climb slightly over the past week, and investors are taking a closer look at its recent performance. The bank’s year-to-date gains are drawing renewed attention from the Danish financial sector.

See our latest analysis for Ringkjøbing Landbobank.

Ringkjøbing Landbobank’s latest share price of 1,439 DKK reflects a steady run this year, climbing 18.1% on a year-to-date basis, with a robust 23.1% total shareholder return over the last twelve months. While recent weeks have seen modest movement, the bank’s long-term performance suggests momentum is still on its side as investor confidence builds around its growth and valuation story.

If you’re curious to see which other companies have caught the market’s attention lately, this is the perfect time to discover fast growing stocks with high insider ownership

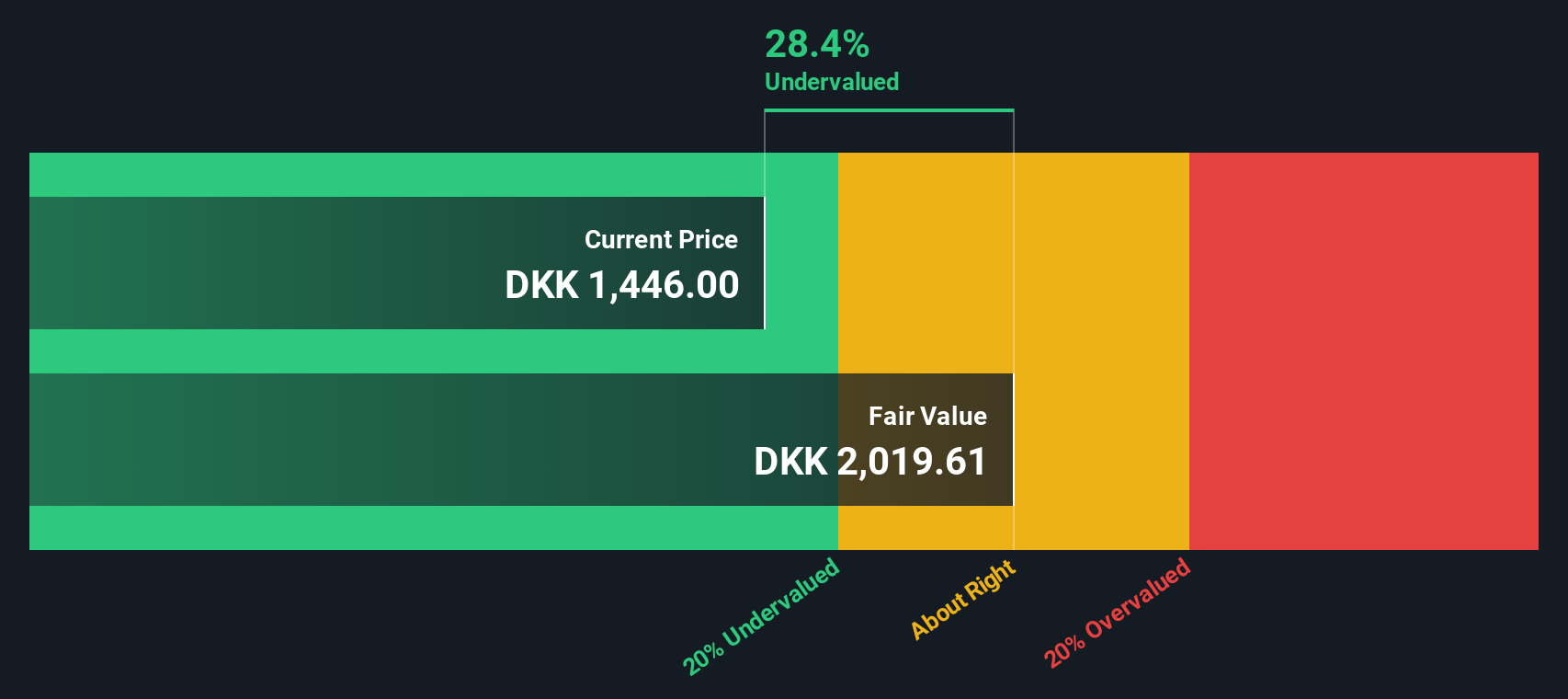

But with shares now trading at a 13% discount to analyst price targets and as much as 36% below some intrinsic value estimates, is there still room for upside, or has the market already priced in the bank’s future prospects?

Price-to-Earnings of 15.4x: Is it justified?

Ringkjøbing Landbobank is currently trading at a price-to-earnings (P/E) ratio of 15.4, which means investors are paying a premium over the industry average for each unit of current earnings.

The P/E ratio tells us how much investors are willing to pay for a company's earnings relative to its profitability. In the banking sector, this measure can signal perceived future growth, stability, or a premium in the eyes of the market.

For Ringkjøbing Landbobank, the current P/E is well above both its peer average of 11.5x and the European Banks industry average of 10.2x. This elevated multiple means the market expects the company to outperform or sees lower risk relative to its competitors. However, our estimate of a fair P/E ratio for the bank is 11.5x, suggesting the current market valuation could readjust toward this level if growth lags expectations.

Explore the SWS fair ratio for Ringkjøbing Landbobank

Result: Price-to-Earnings of 15.4x (OVERVALUED)

However, slower revenue growth and only modest annual net income gains could dampen future returns if market expectations remain high.

Find out about the key risks to this Ringkjøbing Landbobank narrative.

Another View: Discounted Cash Flow Signals Undervaluation

Looking from another angle, our DCF model paints a much more optimistic picture for Ringkjøbing Landbobank. The share price is currently trading at a hefty 35.8% discount to our estimated fair value, based on projected future cash flows. Could the market be missing a hidden value story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ringkjøbing Landbobank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ringkjøbing Landbobank Narrative

If you have a different perspective or prefer digging through the details yourself, you can craft your own Ringkjøbing Landbobank narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ringkjøbing Landbobank.

Looking for more investing ideas?

Don’t let fresh opportunities pass you by. Use the Simply Wall Street screener to find stocks matching your goals and sharpen your investing advantage today.

- Target reliable income and steady growth as you browse these 14 dividend stocks with yields > 3% with high yields and strong fundamentals.

- Get ahead of the next big tech wave by checking out these 25 AI penny stocks which are driving innovation in artificial intelligence.

- Seize tomorrow’s potential by examining these 928 undervalued stocks based on cash flows identified as trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:RILBA

Ringkjøbing Landbobank

Provides various financial products and services in Denmark.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026