In a week marked by mixed performances across major U.S. stock indexes and geopolitical uncertainties in Europe, investors are increasingly seeking stable income sources amid fluctuating market conditions. Dividend stocks, particularly those yielding up to 6%, can offer a reliable stream of income, making them an attractive option for those looking to navigate the current economic landscape with more predictability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.61% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.99% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.41% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

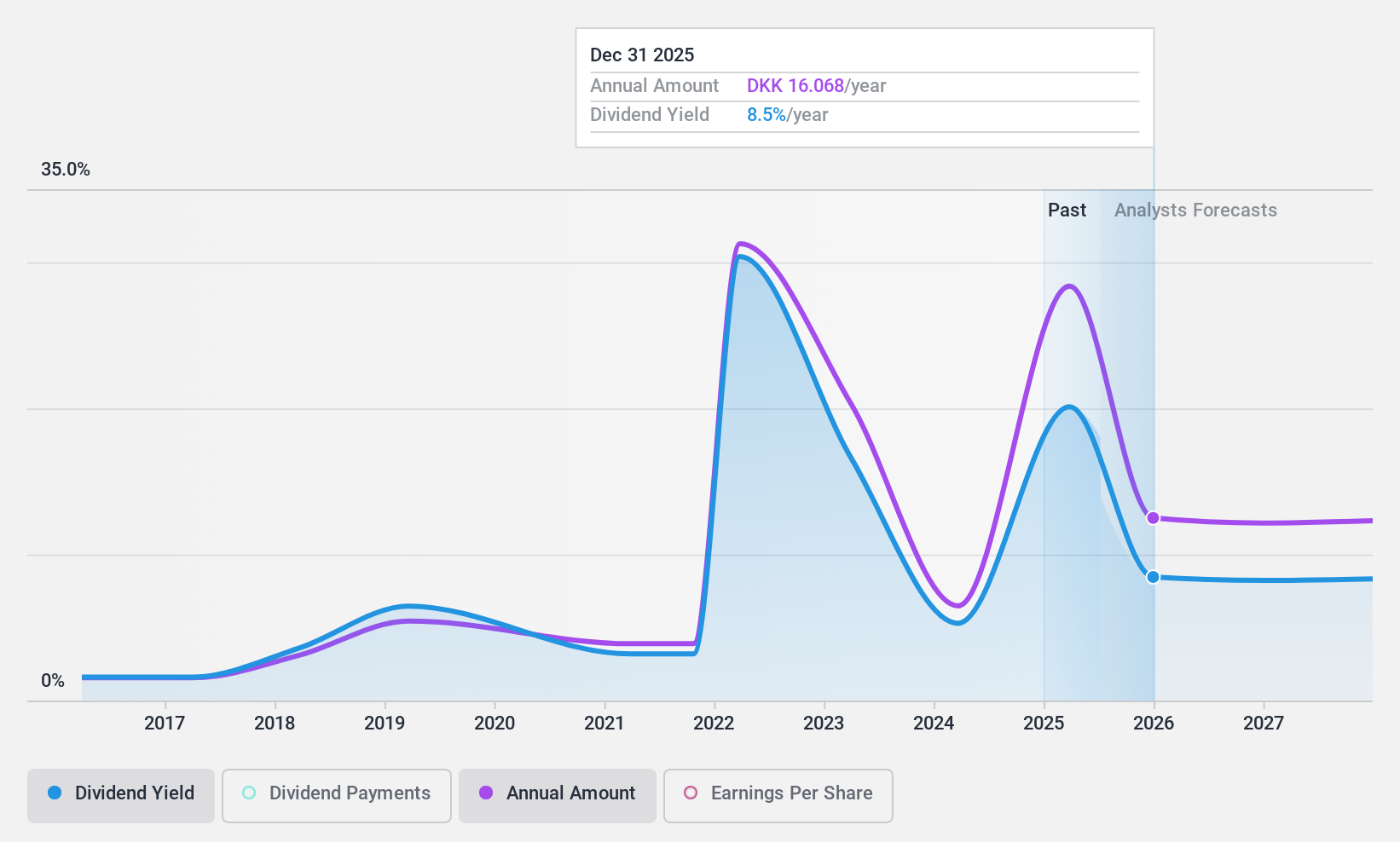

Føroya Banki (CPSE:FOBANK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Føroya Banki, with a market cap of DKK1.55 billion, offers personal and corporate banking services across the Faroe Islands, Denmark, and Greenland through its subsidiaries.

Operations: Føroya Banki generates revenue from several segments, including DKK293.77 million from personal banking, DKK129.13 million from corporate banking, and DKK29.41 million from non-life insurance in the Faroe Islands.

Dividend Yield: 5.1%

Føroya Banki, now Bankivik, offers a mixed dividend profile. Its low payout ratio of 24.4% suggests dividends are well covered by earnings, but the track record is unstable with past volatility and unreliability in payments. Despite a recent increase in net income to DKK 238.08 million for nine months ending September 2024, high bad loans (5.2%) and low allowance for these loans (38%) pose risks to dividend sustainability.

- Take a closer look at Føroya Banki's potential here in our dividend report.

- The valuation report we've compiled suggests that Føroya Banki's current price could be quite moderate.

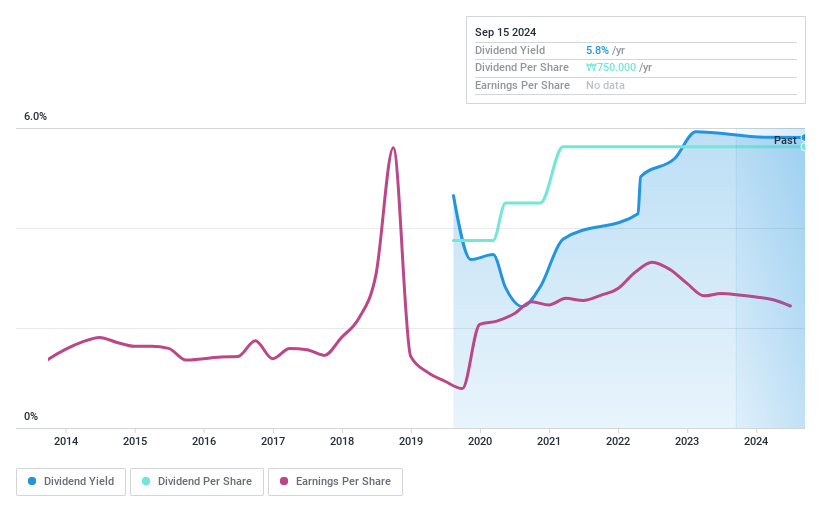

Hyosung ITX (KOSE:A094280)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyosung ITX Co. Ltd offers business solutions in South Korea and has a market cap of ₩146.71 billion.

Operations: Hyosung ITX Co. Ltd generates revenue from its Data Processing segment, amounting to ₩502.95 million.

Dividend Yield: 6%

Hyosung ITX's dividend is appealing for its high yield of 6.04%, positioning it among the top 25% of dividend payers in the Korean market. Despite a short history of five years, dividends have been stable and growing, supported by a low cash payout ratio of 26.4%. The payout ratio stands at 80.3%, indicating earnings coverage is adequate but not overly conservative. Recent buyback plan extensions may impact future cash flow allocations.

- Navigate through the intricacies of Hyosung ITX with our comprehensive dividend report here.

- Our expertly prepared valuation report Hyosung ITX implies its share price may be lower than expected.

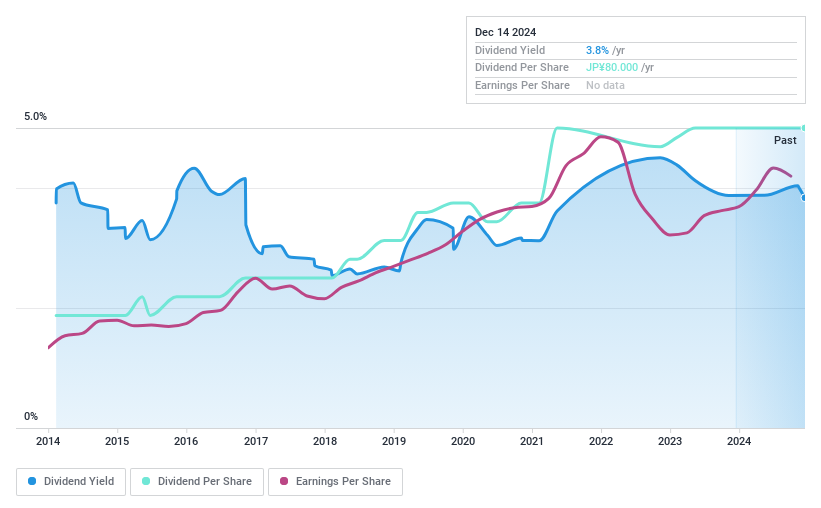

Sankyo FrontierLtd (TSE:9639)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sankyo Frontier Co., Ltd. engages in the production, sale, and rental of modular buildings, self-storage units, and multistory parking devices both in Japan and internationally, with a market cap of ¥46.12 billion.

Operations: Sankyo Frontier Ltd's revenue segments include ¥55.76 billion from the House Business.

Dividend Yield: 3.8%

Sankyo Frontier Ltd.'s dividend yield of 3.84% places it in the top quartile of Japanese dividend payers, supported by a sustainable payout ratio of 47.6% and a cash payout ratio of 30.1%. However, its dividend history has been volatile over the past decade, with significant annual drops exceeding 20%, suggesting an unreliable track record despite recent growth in earnings averaging 2.1% annually over five years.

- Delve into the full analysis dividend report here for a deeper understanding of Sankyo FrontierLtd.

- Insights from our recent valuation report point to the potential undervaluation of Sankyo FrontierLtd shares in the market.

Key Takeaways

- Investigate our full lineup of 1944 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FOBANK

Føroya Banki

Provides personal and corporate banking services in the Faroe Islands, Denmark, and Greenland.

Undervalued with proven track record and pays a dividend.