Danske Bank (CPSE:DANSKE): Exploring Valuation as Share Price Strength Drives Fresh Investor Interest

Reviewed by Simply Wall St

See our latest analysis for Danske Bank.

Danske Bank’s share price has climbed 45.3% year-to-date, suggesting growing optimism around its fundamentals and outlook. The one-year total shareholder return of nearly 61% puts recent price gains in perspective as part of a much broader rally. That momentum reflects upbeat sentiment on future growth, rather than just a reaction to recent headlines or sector trends.

If steady gains like these have you rethinking your next move, now is the perfect time to explore fast growing stocks with high insider ownership.

With Danske Bank’s share price now trading near analyst targets and recent gains reflecting strong investor confidence, the question remains: is there real value still on the table, or has the market already priced in the bank’s future growth potential?

Most Popular Narrative: 0.9% Undervalued

Danske Bank’s prevailing narrative places its fair value just above the recent close. This suggests analysts see modest upside in the current price. This balance between market optimism and analyst caution sets the tone for the next big debate in valuation.

Broad-based growth, disciplined cost control, robust credit quality, and strategic digital investments are driving confidence in sustained earnings momentum and long-term shareholder value.

Want to know the real story behind the price target? This narrative is built on a set of financial forecasts that redefine what “fair value” really means for Danske. Discover which bold assumptions about revenue, profit margins, and market multiples are shaping analyst expectations. There is more to this calculation than meets the eye.

Result: Fair Value of $298.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty about sustaining high profit margins and intensified competition from fintechs could quickly shift the outlook for Danske Bank's steady momentum.

Find out about the key risks to this Danske Bank narrative.

Another View: Market Ratios Raise a Caution Flag

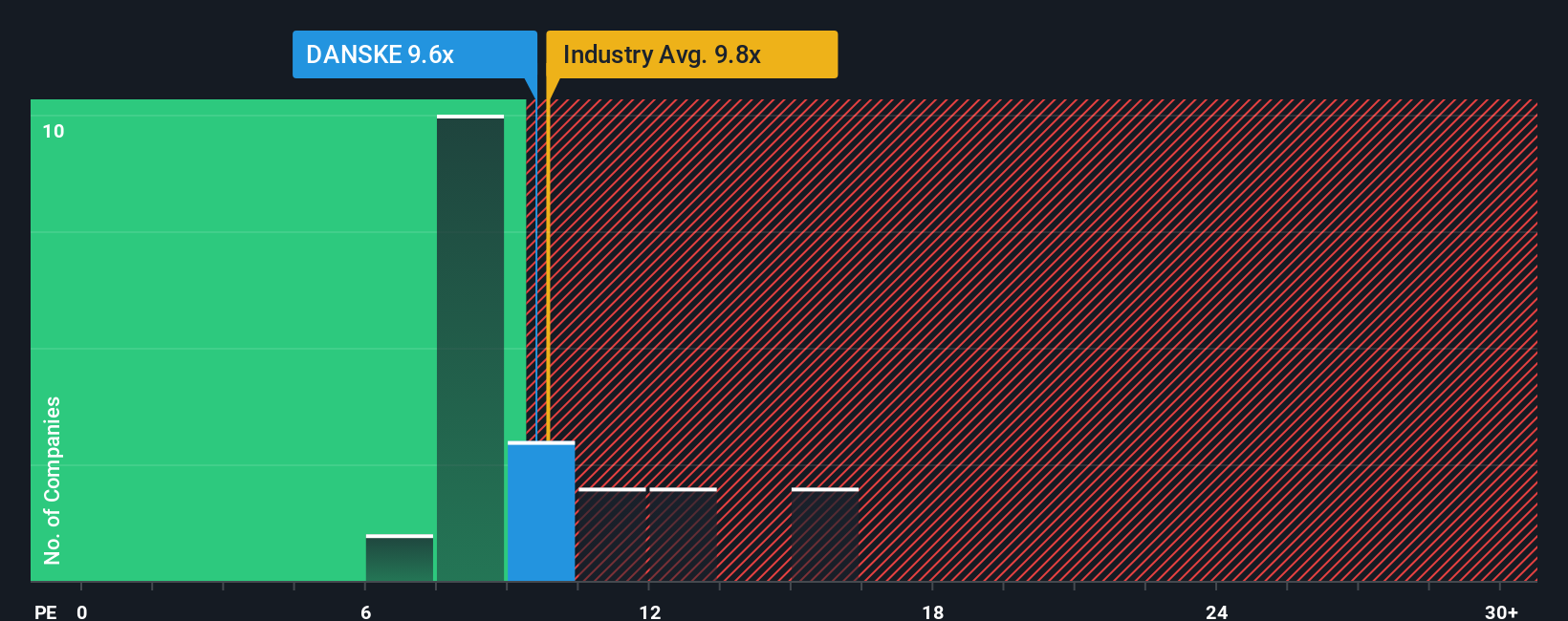

While one method points to Danske Bank being undervalued, a look at the company’s price-to-earnings ratio shows a different angle. Danske trades at 10.7x, which is higher than both industry and peer averages of 10.2x. However, it still sits below the fair ratio target of 13.5x. This mix suggests some investors see limited immediate upside, while others believe there is room for a rerating if performance improves. Could the market close that gap, or is the current premium a warning sign that optimism is already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danske Bank Narrative

If you are unconvinced by these perspectives or simply want to dig deeper, you can craft your personalized analysis in just a few minutes with Do it your way.

A great starting point for your Danske Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to spot the next big opportunity. Simply Wall Street’s Screener brings powerful investment themes right to your fingertips.

- Maximize your income potential with reliable companies by checking out these 15 dividend stocks with yields > 3%, offering yields over 3% for consistent returns.

- Capitalize on groundbreaking innovation by targeting these 28 quantum computing stocks, at the forefront of quantum computing advancements and future tech trends.

- Catch early-stage momentum and uncover growth possibilities with these 3556 penny stocks with strong financials that stand out for their robust financials and unique upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DANSKE

Danske Bank

Provides various banking products and services to corporate, institutional, and international clients.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026