- Germany

- /

- Transportation

- /

- XTRA:SIX2

A Fresh Look at Sixt (XTRA:SIX2) Valuation as North American Expansion Accelerates

Reviewed by Simply Wall St

Sixt (XTRA:SIX2) is expanding its reach in North America by adding three new airport branches, which strengthens its growing presence in key U.S. travel hubs. This latest move continues the company's strategy of targeting major mobility markets.

See our latest analysis for Sixt.

Sixt’s push into more North American airports has coincided with a healthy year for long-term investors: while recent share price momentum has cooled off, with the stock down 13.3% over the past 90 days, the stock’s 1-year total shareholder return sits at an impressive 11.6%. These high-profile recognitions and expansion wins have strengthened its profile and may be shaping fresh investor optimism for the future.

If Sixt’s latest moves have you thinking about where growth and leadership overlap, there’s no better time to discover fast growing stocks with high insider ownership

With Sixt trading below analyst price targets despite impressive recent growth and industry accolades, the key question remains: is this a window for investors to buy in at a discount, or is future upside already reflected in the share price?

Price-to-Earnings of 12.4x: Is it justified?

Sixt’s current price-to-earnings ratio stands at 12.4x, noticeably lower than both its peers and the broader market. With a last close of €75.05, this suggests investors may be undervaluing Sixt’s underlying earnings power.

The price-to-earnings multiple tells us how much investors are paying for each euro of profitability. For Sixt, this multiple is a key indicator, as it reflects the company’s ability to grow in a competitive transportation sector and how its recent earnings momentum is being priced in.

The market is offering Sixt at a marked discount compared to the average peer price-to-earnings ratio of 25.2x. The wider European Transportation industry stands at 15.8x and the German market at 17.7x. Relative to its estimated fair price-to-earnings ratio of 12.5x, Sixt appears attractively priced and could present an opportunity if earnings continue to hold up.

Explore the SWS fair ratio for Sixt

Result: Price-to-Earnings of 12.4x (UNDERVALUED)

However, slowing revenue growth along with recent share price declines could signal potential headwinds for Sixt if market conditions worsen further.

Find out about the key risks to this Sixt narrative.

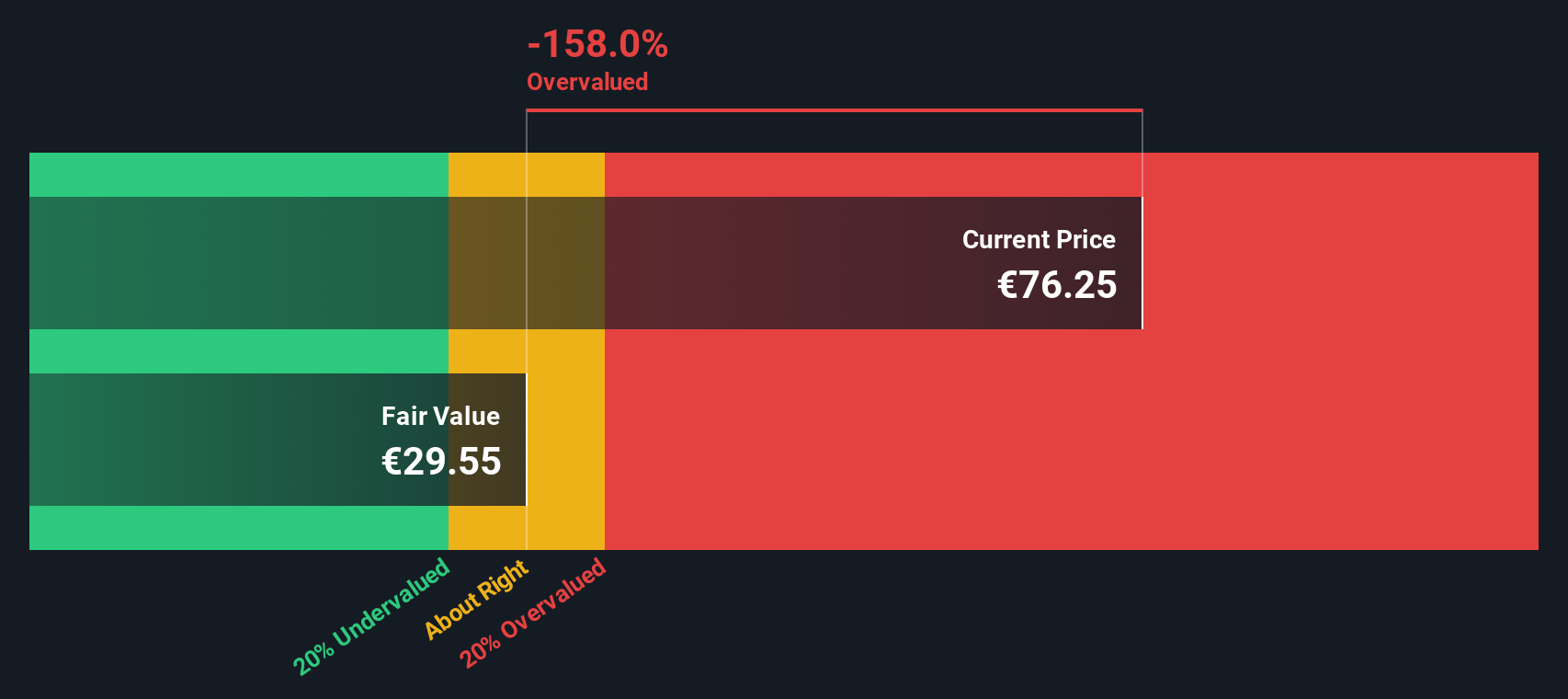

Another View: Discounted Cash Flow Model

While Sixt’s price-to-earnings ratio suggests shares may be attractively valued, our DCF model tells a different story. It values the company far below its current price, which could indicate Sixt is overvalued according to projected future cash flows. How should investors weigh these contrasting signals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sixt for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sixt Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own Sixt narrative takes less than three minutes. Do it your way

A great starting point for your Sixt research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your watchlist by seizing unique opportunities in fast-moving markets. If you’re only tracking Sixt, you could be missing untapped upside.

- Capture rapid changes in tomorrow’s disruptive tech by targeting these 26 AI penny stocks that are making waves in data, automation, and artificial intelligence breakthroughs.

- Grow your portfolio with strong income potential by choosing these 15 dividend stocks with yields > 3% with attractive yields and proven dividend reliability over time.

- Position yourself ahead of crypto market trends by backing these 82 cryptocurrency and blockchain stocks leading blockchain innovation and digital asset transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIX2

Sixt

Through its subsidiaries, provides mobility services through corporate and franchise branch network for private and business customers.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives