- Germany

- /

- Infrastructure

- /

- XTRA:FRA

Assessing Fraport (XTRA:FRA) Valuation Following Strong Q3 Earnings and Rising Investor Interest

Reviewed by Simply Wall St

Fraport (XTRA:FRA) has just released its third-quarter and nine-month earnings report, showing a jump in net income and earnings per share compared to last year. These results are drawing fresh attention from investors.

See our latest analysis for Fraport.

Fraport’s recent results have clearly fueled momentum in the stock, with a stronger net income helping lift sentiment. After a standout 1-day share price return of 6.48%, the shares are now up 27.97% year-to-date, while the 1-year total shareholder return stands at an impressive 54.59%. This is evidence that long-term holders have benefited from both resilience and renewed growth expectations.

If this kind of momentum has you exploring what else is out there, now's a perfect time to discover fast growing stocks with high insider ownership

With shares surging after strong results, the key question is whether Fraport remains undervalued at these levels or if the market has already priced in all the upside and future growth potential for investors.

Most Popular Narrative: Fairly Valued

Fraport’s narrative fair value now sits at €73.53, nearly matching the last closing price of €76.40. Market optimism remains balanced as analysts reassess future growth versus operational headwinds.

“Recent research on Fraport reflects a nuanced outlook, with price target changes illustrating both confidence in recovery potential and caution regarding the company's near- to medium-term performance. The analyst community has provided perspectives that can be grouped into two main views.”

Curious about what’s driving this razor-thin margin between fair value and the current price? One financial lever in the narrative might surprise you. The story unfolds with debates around earnings stability and a valuation ratio that pushes market norms. Dive in to uncover the specific assumptions that determine whether the balance tips in favor of the bulls or the bears.

Result: Fair Value of €73.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected cost pressures or currency volatility in emerging markets could quickly challenge the current fair value story for Fraport.

Find out about the key risks to this Fraport narrative.

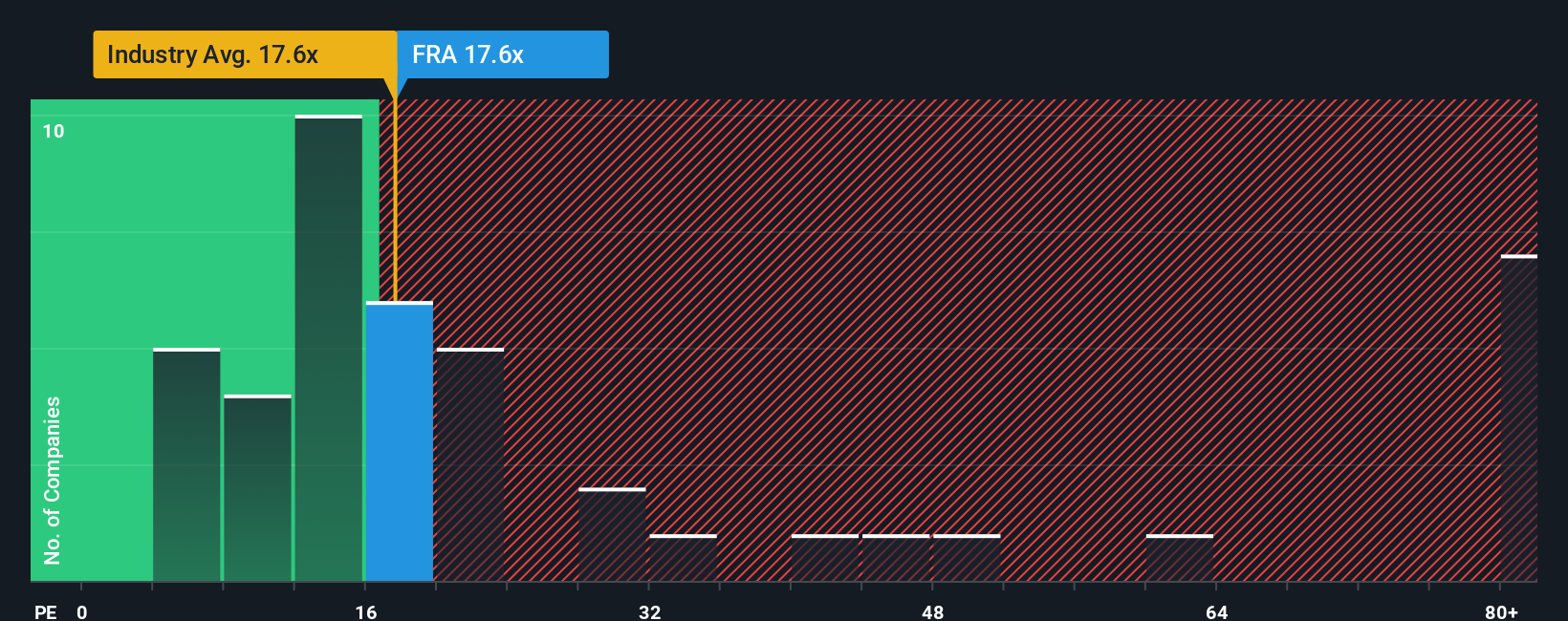

Another View: Multiples Comparison Raises Questions

Looking at Fraport’s share price through a price-to-earnings lens tells a different story. The company trades at 17.9x earnings, which is higher than both the European infrastructure industry average of 17x and well above the fair ratio of 11.1x. This gap suggests that the market could be assigning more optimism to Fraport than fundamentals support. Does that optimism hold up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fraport Narrative

If you see things differently or want to dig deeper into the numbers, you can easily put together your own take in just a few minutes with Do it your way.

A great starting point for your Fraport research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Investment Ideas?

Smart investors never stop looking for fresh angles and emerging trends. These targeted lists are your shortcut to companies shaking up industries and generating results.

- Maximize your income potential by tapping into these 15 dividend stocks with yields > 3%, which boasts yields over 3% and a track record of steady payouts.

- Target rapid technology adoption by checking out these 26 AI penny stocks, companies ahead of the curve in artificial intelligence innovation.

- Capitalize on tomorrow’s breakthroughs by reviewing these 27 quantum computing stocks, organizations at the forefront of quantum computing and next-gen capabilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FRA

Fraport

Owns and operates airports in Germany, rest of Europe, Asia, and the United States.

Fair value with questionable track record.

Similar Companies

Market Insights

Community Narratives