- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:UTDI

United Internet (XTRA:UTDI): Assessing Valuation Following Lowered 2025 Sales Guidance and Improved Profitability

Reviewed by Simply Wall St

United Internet (XTRA:UTDI) has revised its 2025 earnings guidance, trimming expected consolidated sales for the year while publishing its nine-month results. The updated outlook comes alongside stronger year-over-year profitability and offers investors fresh context on the company’s trajectory.

See our latest analysis for United Internet.

United Internet’s share price has soared by over 60% year-to-date, showing impressive momentum even after this week’s pullback following the revised 2025 sales outlook. The 1-year total shareholder return stands at 70.6%, reflecting solid long-term gains despite some recent turbulence. This suggests that investors are weighing profit improvements against lowered future guidance.

If you’re curious about what else might be gathering steam in the broader market, now is an ideal moment to explore fast growing stocks with high insider ownership.

With profits on the rise but future sales expectations now trimmed, investors may wonder if United Internet’s strong share price already reflects all the good news. Alternatively, this could present an attractive opening for value-focused investors.

Most Popular Narrative: 20% Undervalued

United Internet’s most widely followed narrative values the company at roughly €30.76 per share, about 20% above the latest closing price of €24.60. This notable premium suggests that market participants see material upside if the company can deliver on key strategic initiatives.

The ongoing large-scale rollout and upgrade of United Internet's own fiber-optic and mobile (Open RAN/5G) infrastructure is expected to meaningfully reduce dependency on third-party networks, lower wholesale access costs, and drive improved net margins and long-term earnings as wholesale payments to former providers (like Deutsche Telekom) end and own-network migration advances.

What ambitious assumptions power this bullish valuation? The narrative hinges on a transformed profit structure and a runway for high-margin growth, suggesting that future numbers may surprise. Find out which turning points and forecast leaps are built into the case for a higher price.

Result: Fair Value of €30.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high capital expenditures and heavy reliance on the German market could put pressure on cash flow and make future growth less predictable.

Find out about the key risks to this United Internet narrative.

Another View: What Are Investors Paying For?

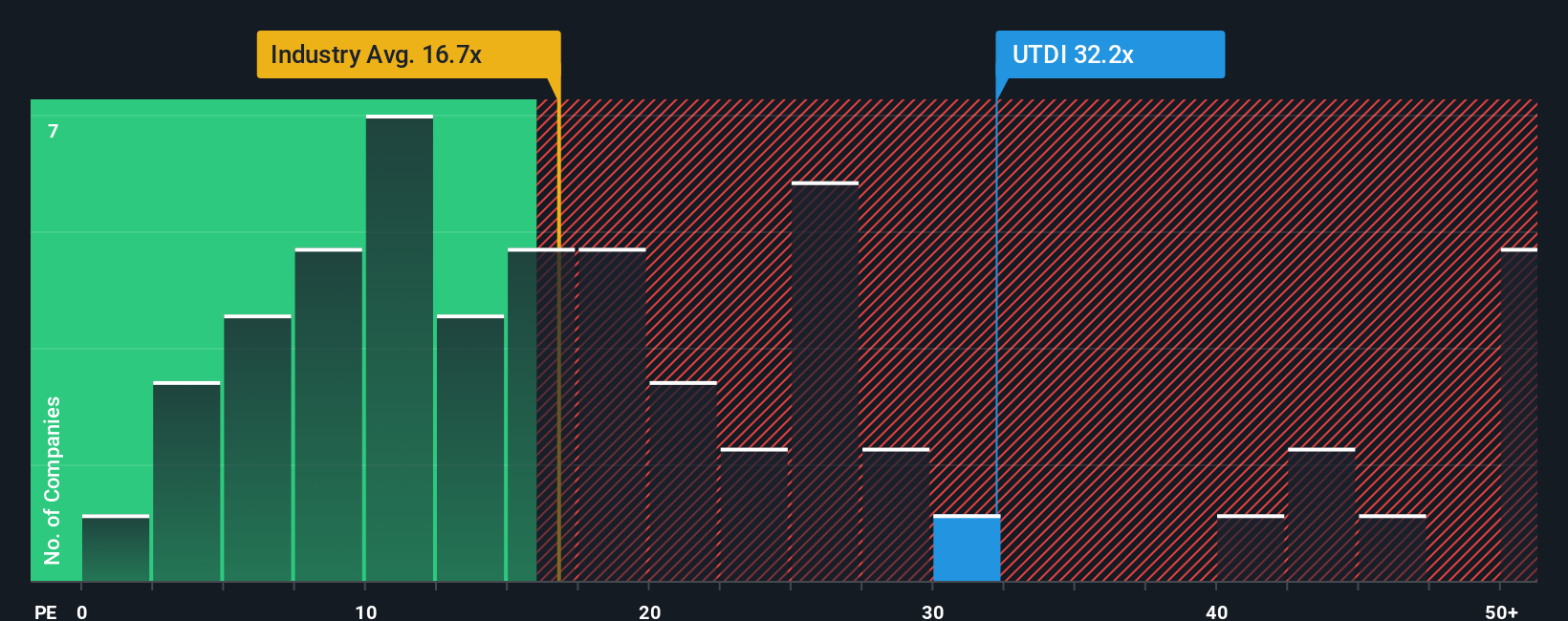

While the narrative points to undervaluation, United Internet’s current price-to-earnings ratio of 32.8x stands out as much higher than both its peer average of 17.6x and the European telecom industry average of 16.9x. Even compared to the fair ratio of 27.9x, the stock looks expensive. This suggests investors are pricing in strong future growth. Is this optimism justified, or is there hidden risk in paying a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Internet Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can quickly craft your own United Internet narrative in just a few minutes. Do it your way.

A great starting point for your United Internet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You deserve to stay ahead of the curve, so don’t just stop with United Internet. Power up your portfolio with a few more proven ideas that could elevate your returns.

- Capture the income advantage by checking out these 15 dividend stocks with yields > 3% and explore stocks paying standout yields above 3% this year.

- Fuel your portfolio’s growth potential by reviewing these 27 AI penny stocks that are shaping tomorrow’s breakthroughs across artificial intelligence and automation.

- Boost your search for undervalued gems by exploring these 3592 penny stocks with strong financials offering robust financials and the potential for outsized gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:UTDI

United Internet

Through its subsidiaries, operates as an Internet service provider worldwide.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives