Stock Analysis

As the German economy faces a forecasted contraction for the second consecutive year, with factory orders experiencing significant declines, investors are closely monitoring high-growth sectors like technology that could potentially offer resilience amidst broader economic challenges. In this environment, identifying strong tech stocks involves looking for companies with robust innovation capabilities and adaptability to shifting market demands, which may position them well to navigate current uncertainties.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.50% | 29.71% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| Pantaflix | 20.93% | 113.65% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG develops, manufactures, and supplies supercomputer and quantum computer solutions with a market cap of €584 million.

Operations: ParTec AG focuses on providing advanced computing solutions, specifically in the realms of supercomputing and quantum computing. The company operates within a market valued at €584 million.

ParTec AG, amidst a volatile market, stands out with its aggressive growth trajectory in Germany's tech sector. With an expected annual revenue increase of 41.2%, the company outpaces the German market's average of 5.4%. This surge is bolstered by its recent presentations at significant industry events such as the Berenberg and Goldman Sachs German Corporate Conference and IEEE Quantum Week, signaling robust engagement with technological advancements and industry leaders. Moreover, ParTec is on a path to profitability with earnings projected to grow by 63.3% annually over the next three years. This potential turnaround is rooted deeply in their commitment to innovation, as evidenced by substantial R&D investments that align well with future revenue projections and market demands.

- Click here and access our complete health analysis report to understand the dynamics of ParTec.

Assess ParTec's past performance with our detailed historical performance reports.

Basler (XTRA:BSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Basler Aktiengesellschaft focuses on developing, manufacturing, and selling digital cameras for professional users both in Germany and internationally, with a market cap of €261.32 million.

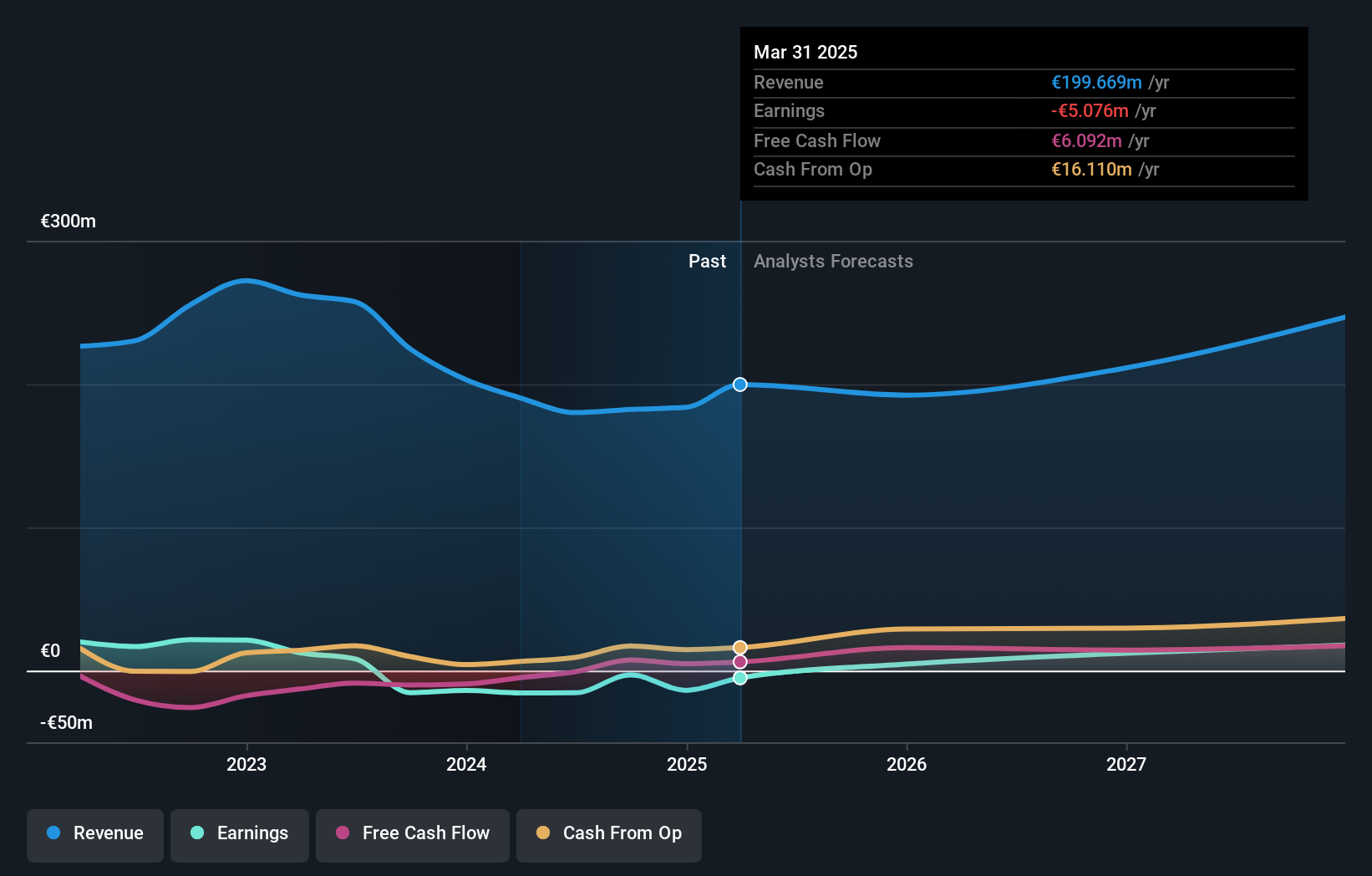

Operations: Basler generates revenue primarily through the sale of digital cameras, with a reported revenue of €180.06 million from this segment. The company's operations are centered on catering to professional users across both domestic and international markets.

In the dynamic landscape of Germany's tech sector, Basler is making strides despite recent challenges. The company's revenue is expected to grow at 14.6% annually, outpacing the broader German market average of 5.4%. This growth projection comes amidst a backdrop where Basler reported a decrease in sales to EUR 93 million from EUR 116 million year-over-year and shifted from a net loss of EUR 1.67 million to EUR 3.37 million in the first half of 2024. On a positive note, earnings are forecasted to surge by an impressive 97.6% per year as the company approaches profitability within three years, supported by strategic presentations at key industry events like the Berenberg and Goldman Sachs German Corporate Conference. This indicates not only recovery potential but also an active engagement with market trends and innovation demands, positioning Basler for impactful growth in a competitive environment.

- Navigate through the intricacies of Basler with our comprehensive health report here.

Examine Basler's past performance report to understand how it has performed in the past.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers applications, technology, and services on a global scale and has a market capitalization of approximately €245.06 billion.

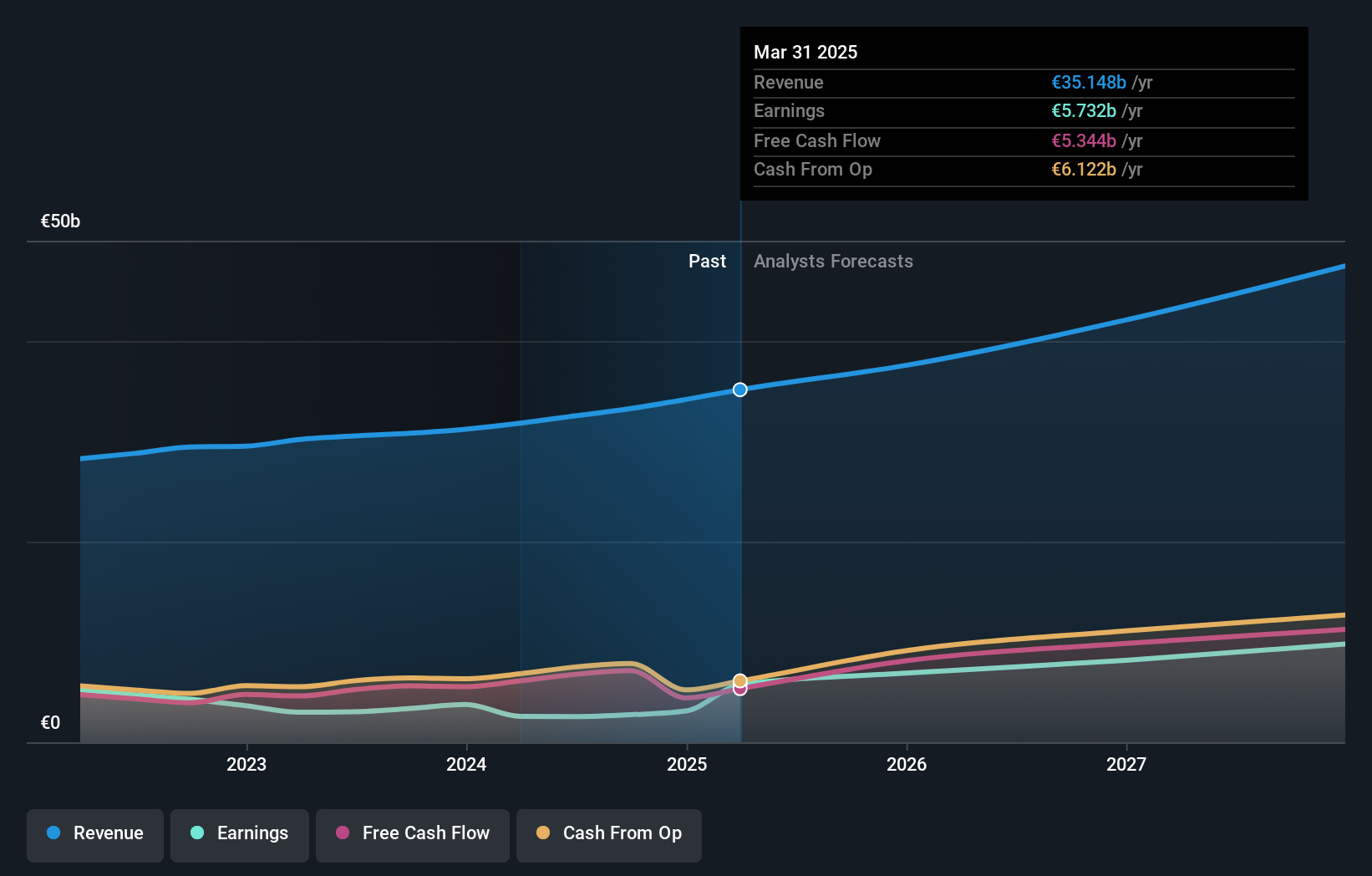

Operations: The company generates revenue primarily from its Applications, Technology & Services segment, totaling €32.54 billion.

Amidst a competitive tech landscape in Germany, SAP stands out with its robust commitment to innovation and strategic partnerships. The company's R&D expenses have surged by 9.6%, reflecting its dedication to advancing technological capabilities, particularly in AI and machine learning. This investment is part of SAP's broader strategy to integrate AI across its offerings, as evidenced by recent collaborations like the integration of UiPath with SAP Build Process Automation, enhancing enterprise-wide automation efficiencies. Moreover, these initiatives are set against a backdrop of significant revenue growth projections at 37.9% annually, underscoring the potential for substantial market impact and continued industry leadership.

- Click here to discover the nuances of SAP with our detailed analytical health report.

Evaluate SAP's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our German High Growth Tech and AI Stocks list of 43 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BSL

Basler

Engages in the development, manufacture, and sale of digital cameras for professional users in Germany and internationally.