Did TeamViewer’s (XTRA:TMV) New Global Inside Sales Chief Just Quietly Redefine Its Growth Focus?

Reviewed by Sasha Jovanovic

- TeamViewer recently appointed former Americas president Finn Faldi as Executive Vice President Global Inside Sales, a new Senior Leadership Team role unifying inside sales across the Americas, EMEA, and APAC, while current Americas president Georg Beyschlag will leave at year-end after more than seven years with the company.

- Faldi’s return, after serving as a Senior Advisor since 2021, underlines management’s focus on tightening global sales execution in a channel that has been central to TeamViewer’s commercial progress.

- We’ll now examine how Faldi’s appointment to lead a unified global inside sales organization could reshape TeamViewer’s investment narrative and growth focus.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

TeamViewer Investment Narrative Recap

To own TeamViewer, you need to believe that its remote access and digital workplace tools can retain and expand a global customer base despite pressure in the SMB segment and intense competition. Faldi’s appointment sharpens execution around a key sales channel but does not, by itself, materially change the near term catalyst of improving ARR momentum or the key risk of SMB churn and pricing pressure.

The most relevant recent announcement here is the confirmation of 2025 revenue guidance at EUR 778m to EUR 797m despite ARR headwinds, which frames how important efficient sales conversion has become. Unifying global inside sales under a leader who knows TeamViewer’s playbook well could be particularly important as the company works to align its sales engine with new offerings like DEX Essentials and TeamViewer ONE and to stabilise growth across regions.

Yet while the leadership change aims to tighten sales execution, investors should also be aware of the risk that concentrated exposure to a volatile SMB base could...

Read the full narrative on TeamViewer (it's free!)

TeamViewer's narrative projects €943.2 million revenue and €199.5 million earnings by 2028.

Uncover how TeamViewer's forecasts yield a €10.56 fair value, a 89% upside to its current price.

Exploring Other Perspectives

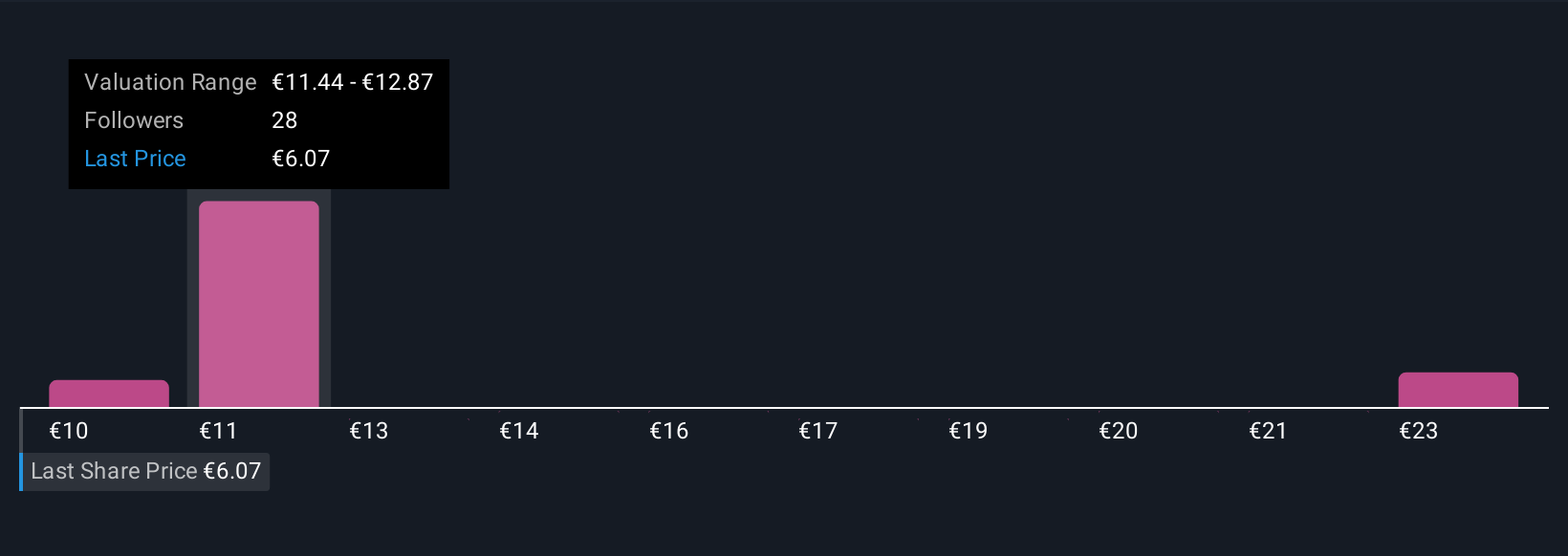

Nine members of the Simply Wall St Community value TeamViewer between €10.02 and €23.25, highlighting a wide spread in expectations. Against this backdrop, the dependence on a churn prone SMB segment becomes a central question for the company’s longer term performance, so it is worth weighing several contrasting views.

Explore 9 other fair value estimates on TeamViewer - why the stock might be worth over 4x more than the current price!

Build Your Own TeamViewer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TeamViewer research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TeamViewer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TeamViewer's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeamViewer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TMV

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026