Exploring ParTec And 2 Other High Growth Tech Stocks In Germany

Reviewed by Simply Wall St

The German tech market has seen significant fluctuations recently, with the DAX declining by 3.20% amid renewed concerns about global economic growth. Despite these challenges, high-growth tech stocks like ParTec continue to capture investor interest due to their potential for innovation and market disruption. In this environment, a good stock typically demonstrates robust fundamentals, a strong competitive position, and resilience in the face of economic uncertainty.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| medondo holding | 36.23% | 82.66% | ★★★★★☆ |

| Rubean | 59.40% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG develops, manufactures, and supplies supercomputer and quantum computer solutions with a market cap of €508 million.

Operations: ParTec AG generates revenue by developing, manufacturing, and supplying supercomputer and quantum computer solutions. The company has a market cap of €508 million.

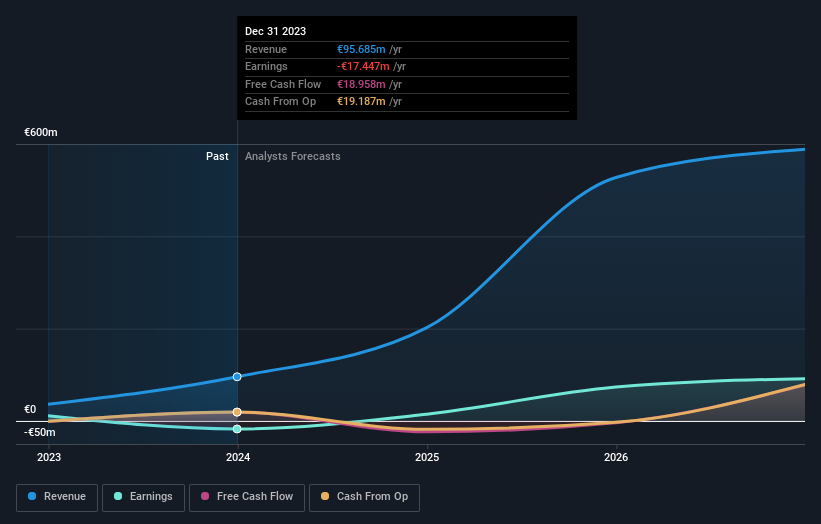

ParTec, a German tech firm, has seen its revenue surge by 165.1% over the past year, with future growth forecasted at 41.2% annually. Despite being currently unprofitable, earnings are expected to grow by 63.3% per year and the company is projected to achieve profitability within three years. ParTec's R&D expenses have been significant, reflecting its commitment to innovation in high-performance computing solutions for clients like TSMC and Apple. This strategic focus positions it well in the rapidly evolving tech landscape.

- Dive into the specifics of ParTec here with our thorough health report.

Understand ParTec's track record by examining our Past report.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG develops and operates high-performance computing (HPC) infrastructure solutions for businesses and research institutions worldwide, with a market cap of €1.67 billion.

Operations: Northern Data AG generates revenue primarily from Peak Mining (€156.13 million), Taiga Cloud (€22.13 million), and Ardent Data Centers (€31.46 million). The company also has contributions from Other Companies and Group Functions amounting to €46.31 million, while Consolidation shows a negative impact of -€178.50 million on the overall financials.

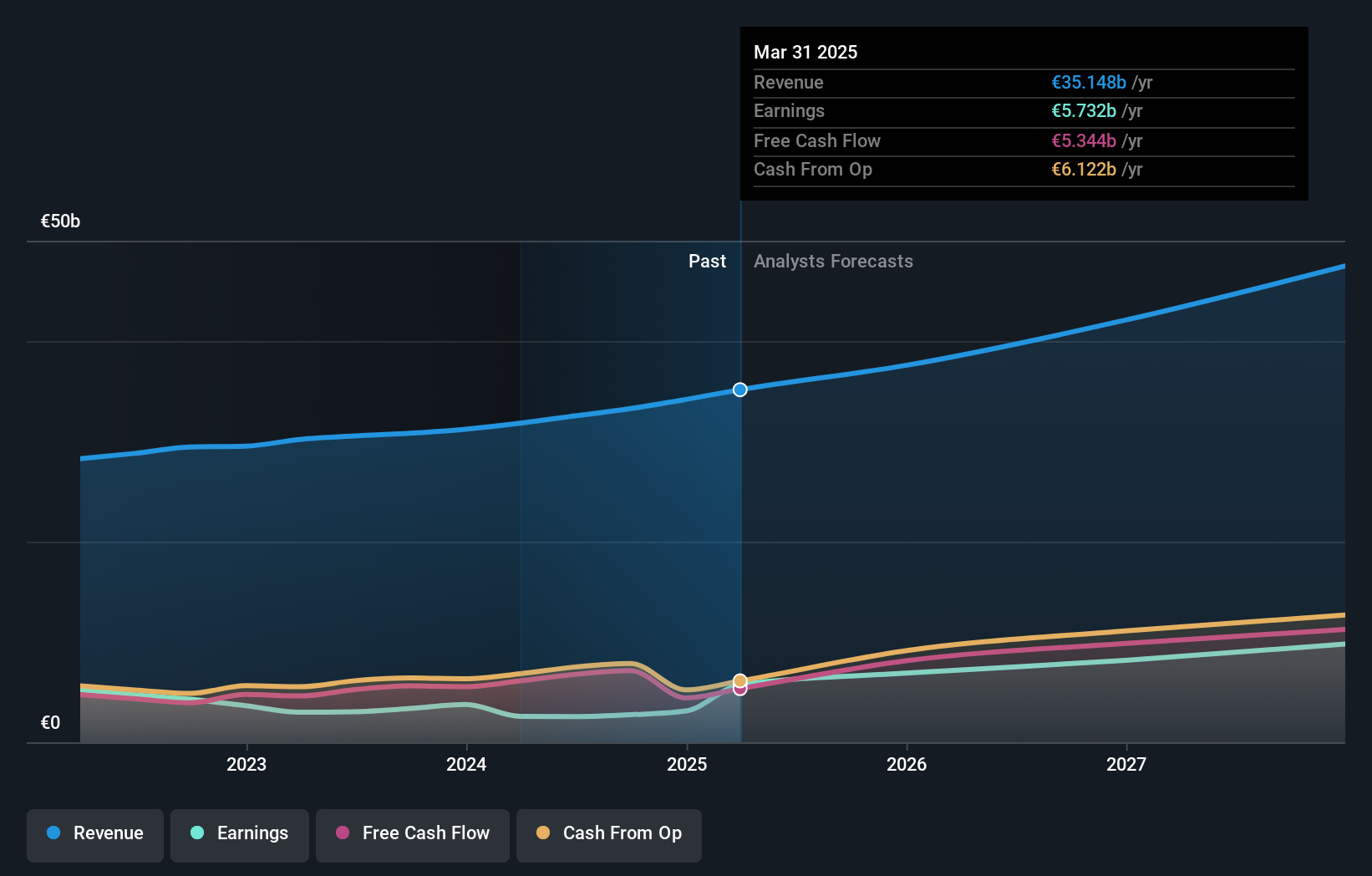

Northern Data, a German tech company, is forecasted to achieve profitability within three years and expects annual revenue growth of 32.5%, significantly outpacing the German market's 5.4% growth rate. Despite a net loss of €151.06 million in 2023, the company's aggressive R&D expenditure—amounting to €68.2 million—underscores its commitment to innovation in AI cloud computing and data centers. With projected revenues between €200 million and €240 million for fiscal year 2024, Northern Data's strategic focus on high-growth segments like Taiga (cloud computing) and Ardent (data centers) positions it well for future expansion.

- Navigate through the intricacies of Northern Data with our comprehensive health report here.

Explore historical data to track Northern Data's performance over time in our Past section.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services on a global scale and has a market cap of €232.08 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which brought in €32.54 billion. The company's gross profit margin stands at 72%.

SAP, a major player in the software industry, is navigating a transformative phase with an expected annual earnings growth of 37.9% over the next three years. Despite a significant one-off loss of €3.3 billion impacting its recent financial results, SAP's revenue is forecasted to grow at 10% annually, outpacing the German market's 5.4%. The company's substantial R&D expenditure underscores its commitment to innovation; for instance, it spent €5.65 billion on R&D in 2023 alone.

- Unlock comprehensive insights into our analysis of SAP stock in this health report.

Examine SAP's past performance report to understand how it has performed in the past.

Key Takeaways

- Investigate our full lineup of 44 German High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NB2

Northern Data

Develops and operates high-performance computing (HPC) infrastructure solutions to businesses and research institutions worldwide.

High growth potential with adequate balance sheet.