- Switzerland

- /

- Semiconductors

- /

- SWX:UBXN

European Equity Gems Priced Below Estimated Value

Reviewed by Simply Wall St

As European markets navigate a period of mixed performance, with the STOXX Europe 600 Index ending slightly lower amid varied national index outcomes, investors are keenly assessing monetary policy decisions and economic indicators. In this context, identifying stocks that are priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies and the broader economic environment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Witted Megacorp Oyj (HLSE:WITTED) | €1.395 | €2.70 | 48.2% |

| Truecaller (OM:TRUE B) | SEK42.14 | SEK82.30 | 48.8% |

| Stille (OM:STIL) | SEK208.00 | SEK403.50 | 48.5% |

| Prosegur Cash (BME:CASH) | €0.707 | €1.38 | 48.8% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.30 | NOK59.69 | 49.2% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €25.90 | €50.67 | 48.9% |

| E-Globe (BIT:EGB) | €0.68 | €1.32 | 48.5% |

| Atea (OB:ATEA) | NOK141.80 | NOK280.40 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK262.00 | SEK506.25 | 48.2% |

Let's uncover some gems from our specialized screener.

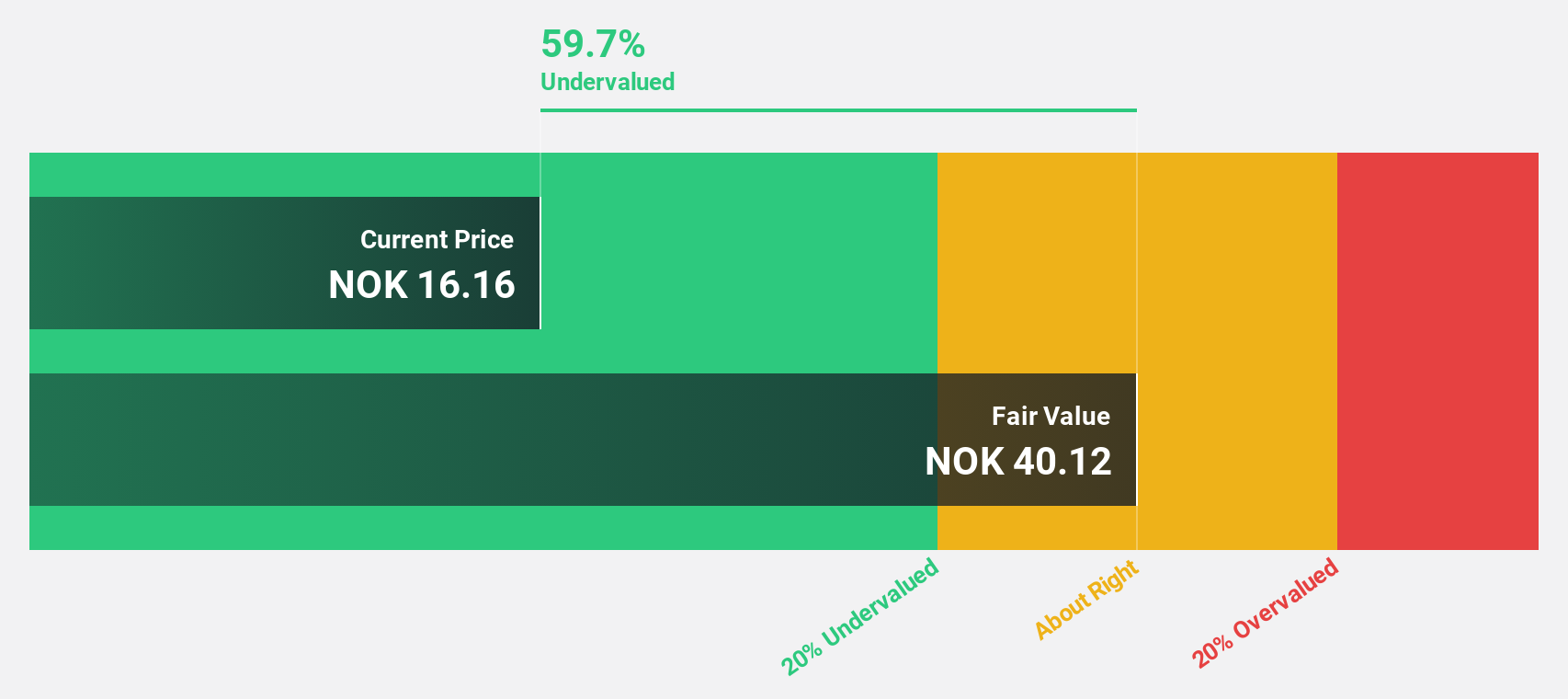

BEWI (OB:BEWI)

Overview: BEWI ASA, along with its subsidiaries, is engaged in the production, marketing, and sale of packaging, components, and insulation solutions both in Norway and internationally; it has a market cap of NOK4.07 billion.

Operations: The company's revenue segments are comprised of €56.80 million from Circular, €318.60 million from Packaging and Components, and €427.60 million from Insulation & Construction.

Estimated Discount To Fair Value: 41.1%

BEWI is trading at NOK17.22, significantly below its estimated fair value of NOK29.25, indicating potential undervaluation based on cash flows. Despite a recent net loss and shareholder dilution, BEWI's revenue growth forecast of 7.4% annually surpasses the Norwegian market average. However, interest payments are not well covered by earnings, and return on equity remains low at 3.9%. Recent debt refinancing efforts might impact future financial flexibility positively or negatively depending on execution success.

- The growth report we've compiled suggests that BEWI's future prospects could be on the up.

- Dive into the specifics of BEWI here with our thorough financial health report.

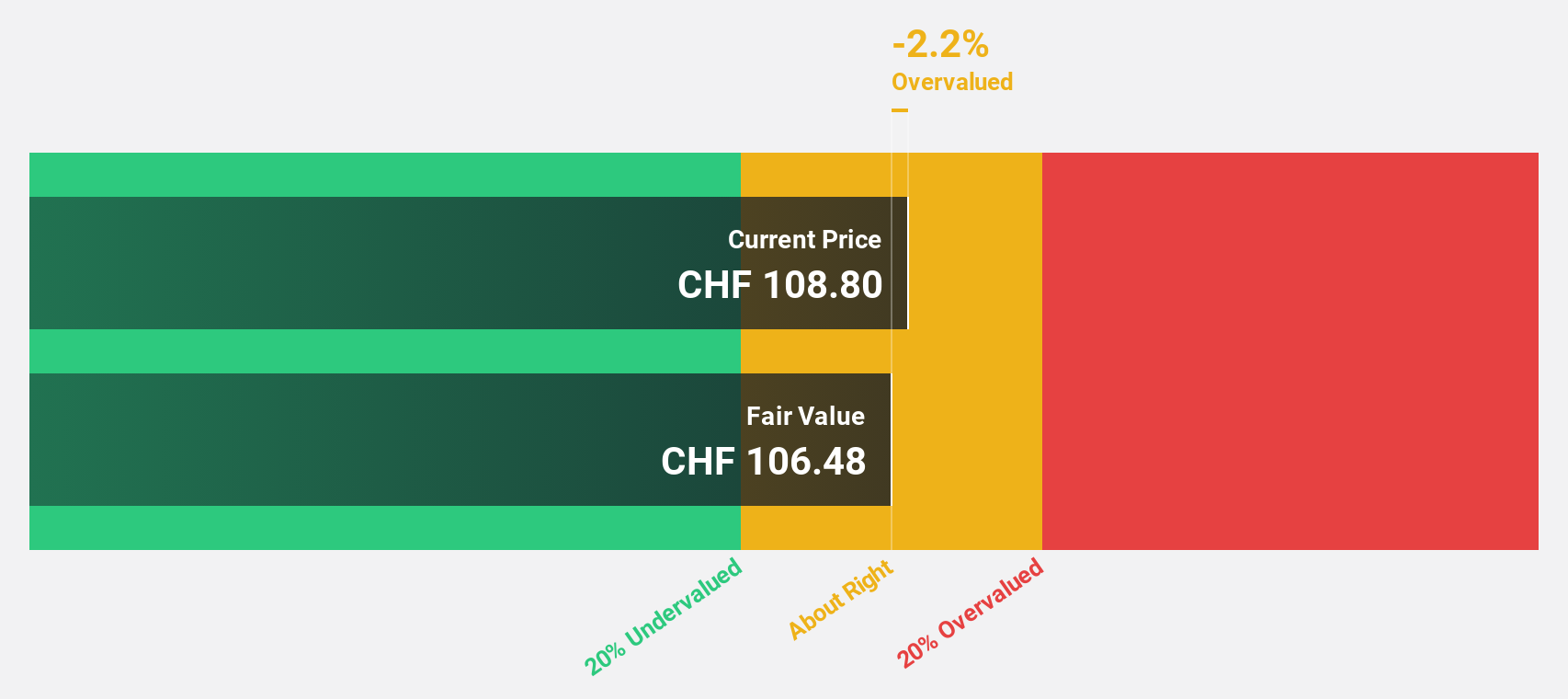

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets products and services for GPS/GNSS satellite positioning systems across various sectors such as automotive, healthcare, and industrial automation with a market cap of CHF1.03 billion.

Operations: The company's revenue from Wireless Communications Equipment amounts to CHF292.48 million.

Estimated Discount To Fair Value: 27.6%

u-blox Holding is trading at CHF 134.4, below its estimated fair value of CHF 185.75, suggesting undervaluation based on cash flows. Despite a recent net loss and share price volatility, the company is projected to achieve profitability within three years with earnings growth forecasted at over 100% annually. Revenue growth of 13.3% per year outpaces the Swiss market average but remains below optimal levels, while return on equity is expected to remain modest at 14.8%.

- According our earnings growth report, there's an indication that u-blox Holding might be ready to expand.

- Click here to discover the nuances of u-blox Holding with our detailed financial health report.

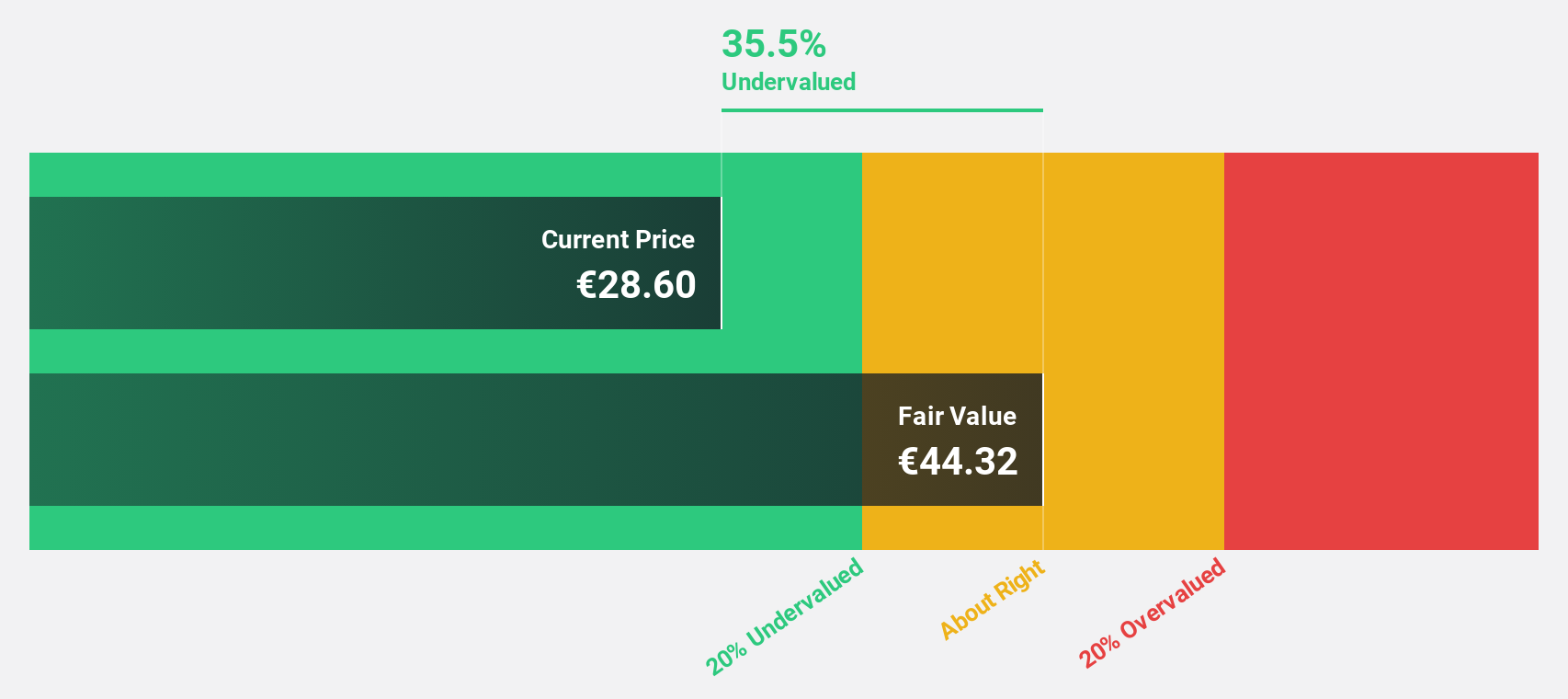

PSI Software (XTRA:PSAN)

Overview: PSI Software SE develops and integrates software solutions to optimize energy and material flows for utilities and industries globally, with a market cap of €422.82 million.

Operations: The company's revenue segments include Grid & Energy Management (€129.01 million), Process Industries & Metals (€71.86 million), Logistics (€34.23 million), and Discrete Manufacturing (€33.56 million).

Estimated Discount To Fair Value: 38.6%

PSI Software is trading at €27.3, significantly below its estimated fair value of €44.45, indicating potential undervaluation based on cash flows. Despite a recent net loss reduction from €22.55 million to €1.43 million in six months, the company is expected to achieve profitability within three years with earnings growth forecasted at 64.87% annually. Revenue growth of 9.4% per year surpasses the German market average, although return on equity remains low at 18.4%.

- The analysis detailed in our PSI Software growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of PSI Software stock in this financial health report.

Make It Happen

- Discover the full array of 210 Undervalued European Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if u-blox Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBXN

u-blox Holding

Develops, manufactures, and markets products and services supporting GPS/GNSS satellite positioning systems for the automotive and transport, healthcare, asset tracking and management, industrial automation and monitoring, and consumer markets.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives