As hopes for interest rate cuts in Europe grow and Germany's DAX Index climbs, investors are increasingly eyeing dividend stocks as a stable income source amid market volatility. In this context, identifying robust dividend stocks becomes crucial, especially those that can provide consistent yields while navigating the current economic landscape.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.10% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.88% | ★★★★★★ |

| All for One Group (XTRA:A1OS) | 3.15% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.23% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.77% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.69% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.40% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.73% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.17% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

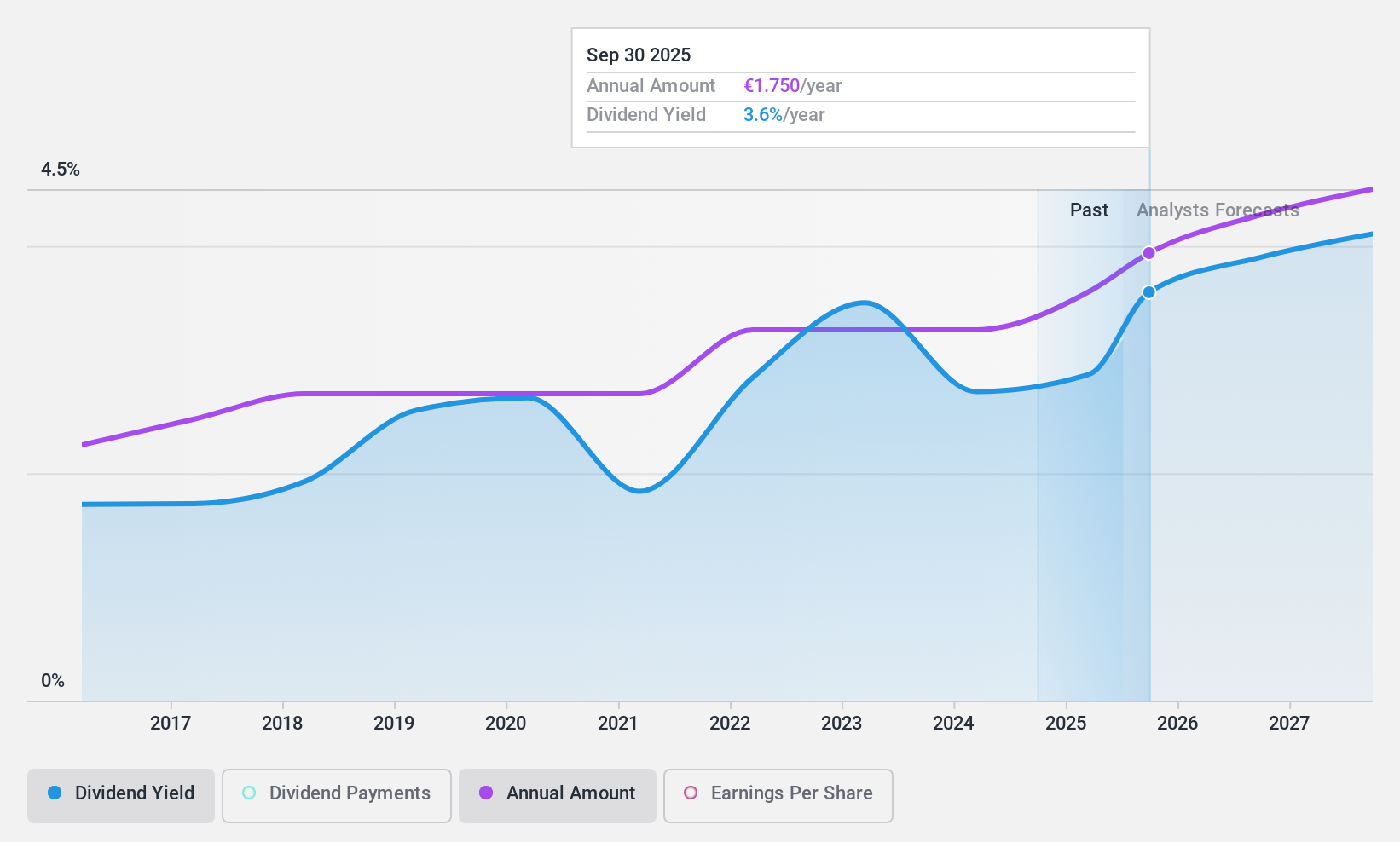

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, with a market cap of €225.27 million, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Operations: All for One Group SE's revenue segments include €77.01 million from LOB and €442.47 million from CORE.

Dividend Yield: 3.2%

All for One Group offers a stable and reliable dividend, with payments consistently growing over the past decade. The company’s dividends are well covered by both earnings (payout ratio: 49%) and cash flows (cash payout ratio: 19%). Despite its lower-than-top-tier dividend yield of 3.15%, A1OS is trading at a significant discount to its estimated fair value. Recent earnings show improved profitability, with net income rising to €10.29 million for the nine months ending June 30, 2024.

- Unlock comprehensive insights into our analysis of All for One Group stock in this dividend report.

- Our valuation report unveils the possibility All for One Group's shares may be trading at a discount.

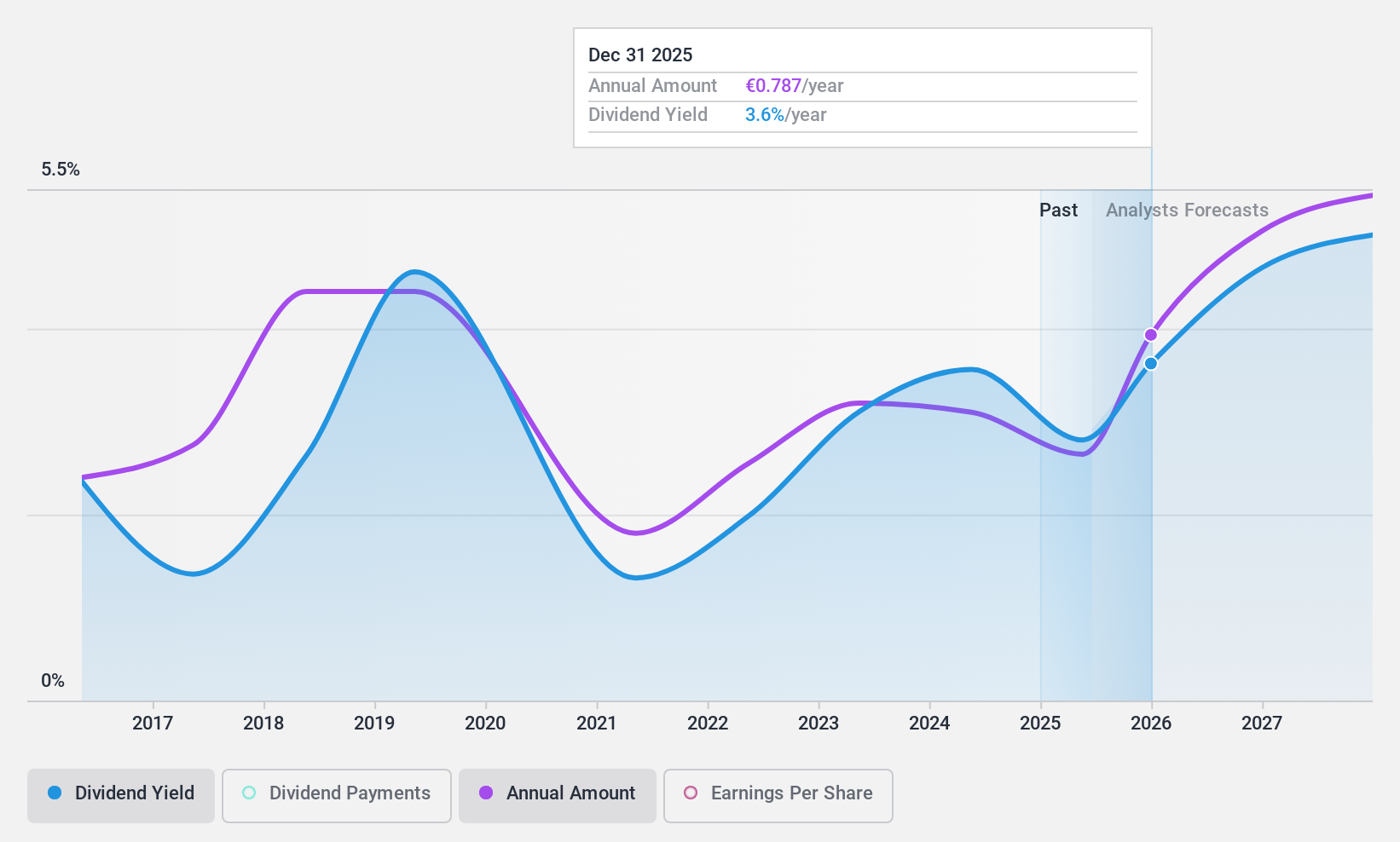

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Technotrans SE is a global technology and services company with a market cap of €116.74 million.

Operations: Technotrans SE generates revenue from two primary segments: €62.21 million from Services and €184.28 million from Technology.

Dividend Yield: 3.7%

Technotrans SE's dividend payments have been volatile over the past decade, despite recent increases. The company's dividends are well covered by earnings (payout ratio: 56.7%) and cash flows (cash payout ratio: 32.3%). Trading at 44% below its estimated fair value, technotrans offers potential capital appreciation. However, its current dividend yield of 3.67% is lower than the top quartile of German dividend payers. Recent earnings calls indicate a forecasted annual profit growth of 25%.

- Delve into the full analysis dividend report here for a deeper understanding of technotrans.

- Our valuation report here indicates technotrans may be undervalued.

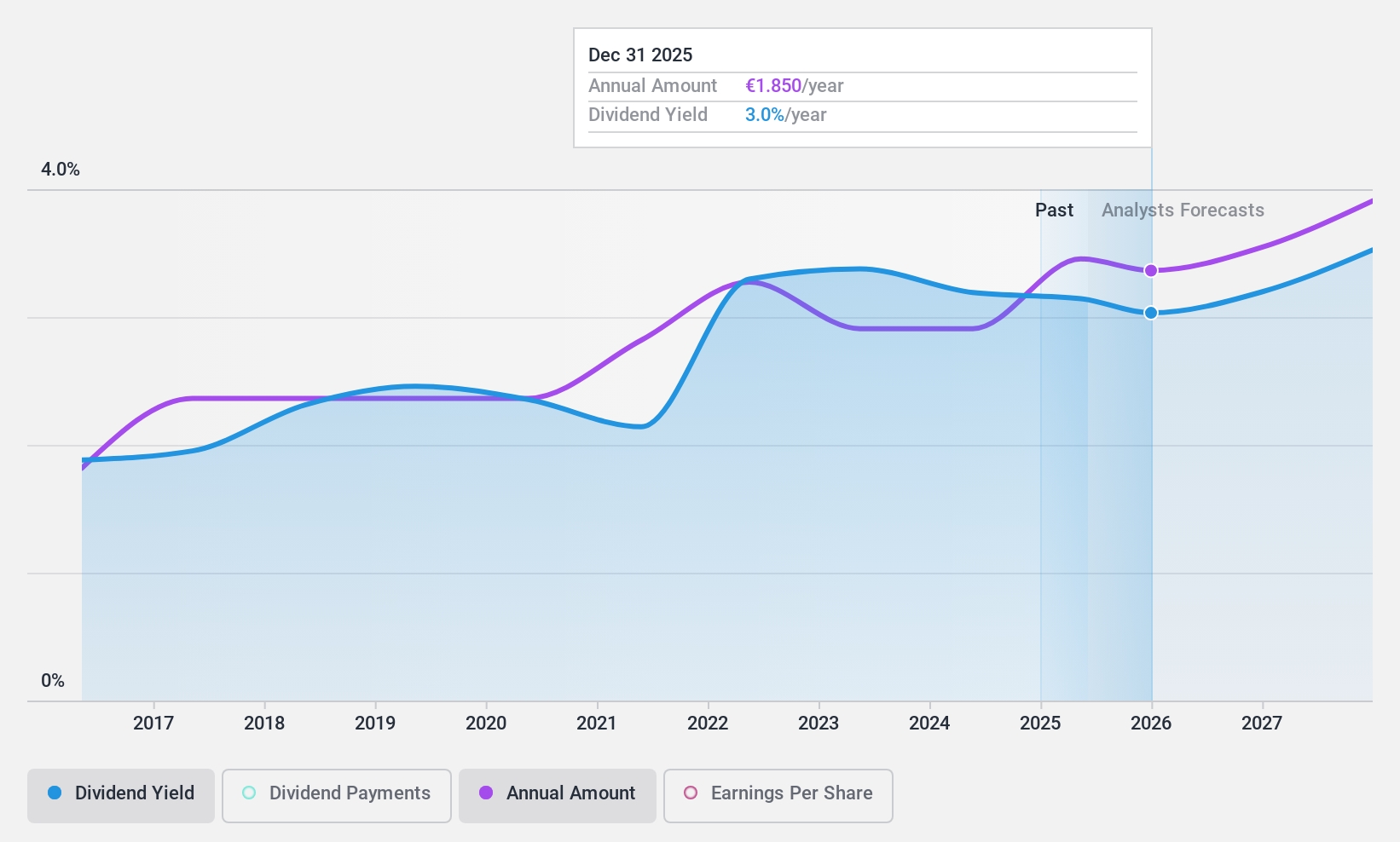

Uzin Utz (XTRA:UZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €237.08 million.

Operations: Uzin Utz SE generates revenue from several key segments: €81.64 million from Western Europe, €27.70 million from South/Eastern Europe, €73.60 million from USA - Laying Systems, €33.66 million from Netherlands - Wholesale, €209.68 million from Germany - Laying Systems, €83.59 million from Netherlands - Laying Systems, and €31.94 million and €34.21 million respectively from Germany's Machinery and Tools and Surface Care and Refinement sectors.

Dividend Yield: 3.4%

Uzin Utz SE offers a stable and growing dividend, with a yield of 3.4%, supported by a low payout ratio of 33.8% and cash payout ratio of 19.9%. The company's earnings per share increased to €2.45 from €2.19 year-over-year, reflecting net income growth to €12.38 million from €11.02 million despite slight revenue declines. Uzin Utz's price-to-earnings ratio of 9.9x indicates good value compared to the German market average of 17.3x.

- Click here and access our complete dividend analysis report to understand the dynamics of Uzin Utz.

- Our valuation report unveils the possibility Uzin Utz's shares may be trading at a premium.

Key Takeaways

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 28 more companies for you to explore.Click here to unveil our expertly curated list of 31 Top German Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.