- Germany

- /

- Semiconductors

- /

- XTRA:AIXA

AIXTRON (XTRA:AIXA) Cuts Guidance Amid Margin Pressure and Weaker Q3 Results – What Comes Next?

Reviewed by Sasha Jovanovic

- AIXTRON SE reported third-quarter 2025 results, revealing sales of €119.56 million and net income of €13.03 million, both lower than the previous year, and announced a reduction in full-year revenue and margin guidance due to currency effects.

- This combination of weaker earnings and a downward adjustment to outlook signals ongoing challenges in the company's end markets and operational environment.

- We'll examine how AIXTRON's recent guidance cut and profit margin pressures could reshape its investment narrative and future expectations.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

AIXTRON Investment Narrative Recap

AIXTRON’s long-term story depends on the recovery of equipment demand for advanced semiconductor materials like silicon carbide and gallium nitride, driven by trends in EVs and optoelectronics. The latest guidance cut and margin downgrades highlight ongoing profit pressures and signal that persistent overcapacity and underutilization in key end markets remain the most immediate risk, possibly outweighing the biggest near-term catalyst: a rebound in high-volume tool orders as end-market absorption increases. For now, these results reinforce that risk rather than easing it.

Among recent announcements, AIXTRON’s partnership to supply 300 mm GaN substrates for power electronics stands out, especially as it links directly to the critical catalyst of broad adoption of compound semiconductors in electric vehicles and data centers. This initiative underscores the company’s ongoing effort to capture share when and if market demand stabilizes, but until order momentum strengthens across core applications, revenue and margin pressure may persist.

However, investors should also be aware of the potential for delayed recovery if “massive overcapacity” persists in SiC and GaN tools, leaving significant demand uncertainty ...

Read the full narrative on AIXTRON (it's free!)

AIXTRON's narrative projects €741.5 million in revenue and €113.5 million in earnings by 2028. This requires 5.4% yearly revenue growth and a €4.9 million earnings increase from the current €108.6 million.

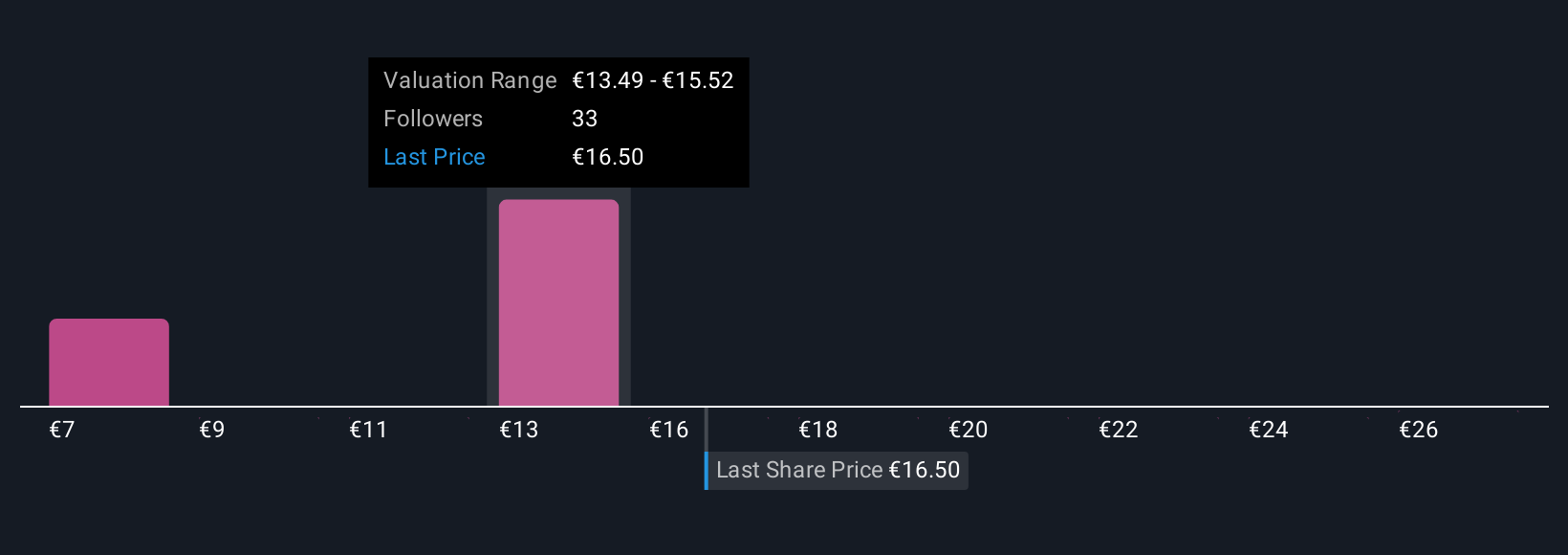

Uncover how AIXTRON's forecasts yield a €15.05 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members generated three independent fair value estimates for AIXTRON, ranging widely from €7.41 to €27.66 per share. With margin guidance now trimmed and near-term profit growth under pressure, this diversity of opinion highlights how sharply views can differ on the company’s direction and potential.

Explore 3 other fair value estimates on AIXTRON - why the stock might be worth as much as 43% more than the current price!

Build Your Own AIXTRON Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AIXTRON research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free AIXTRON research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AIXTRON's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AIXA

AIXTRON

Provides deposition equipment to the semiconductor industry in Asia, Europe, and the United States.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives