- Germany

- /

- Real Estate

- /

- XTRA:TEG

How Investors May Respond To TAG Immobilien (XTRA:TEG) Dividend Hike and Strong Earnings Momentum

Reviewed by Sasha Jovanovic

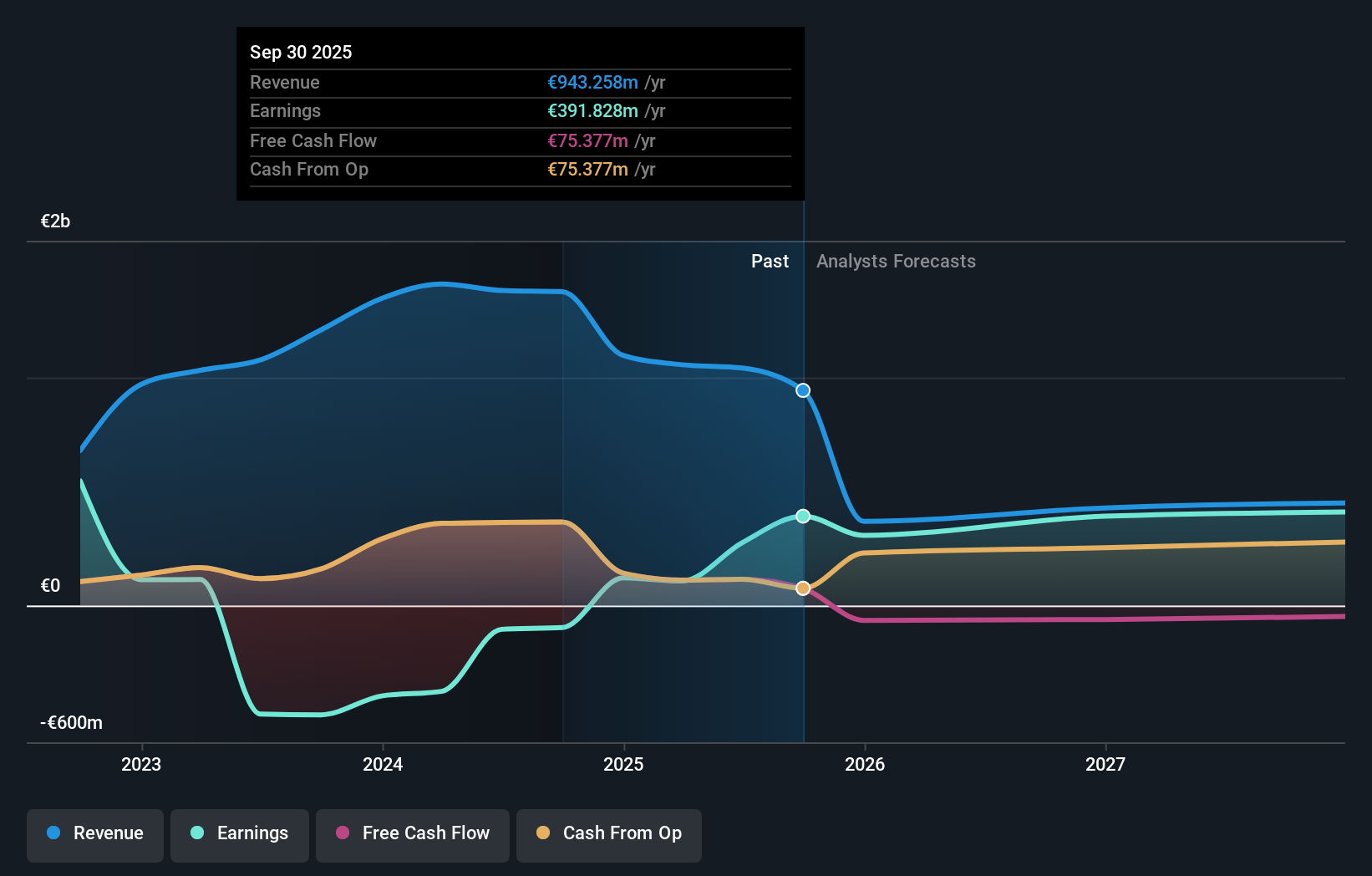

- TAG Immobilien AG recently reported strong nine-month financial results for 2025, with net income rising to €301.18 million and basic earnings per share from continuing operations increasing to €1.72, compared to the previous year.

- The company also announced an anticipated 30% rise in dividend per share for 2026, targeting a 50% payout ratio of FFO I, subject to shareholder approval, a move highlighting management’s confidence and an increased focus on capital returns to shareholders.

- We will examine how the planned increase in dividend payout shapes the outlook for TAG Immobilien’s long-term shareholder value.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TAG Immobilien Investment Narrative Recap

Investors in TAG Immobilien AG need to believe in the company's ability to sustain growth through robust rental markets in Germany and Poland while managing elevated leverage and the risks of project delays in Poland. TAG’s announcement of a 30% anticipated rise in the 2026 dividend, tied to a 50% FFO I payout ratio, sends a positive signal but does not materially change the key short-term catalyst, which remains strong rental demand in both markets, and the biggest risk, namely the timing and execution of apartment handovers in Poland. Among recent announcements, the stand-out is TAG's nine-month 2025 results reporting a sharp jump in net income to €301.18 million and earnings per share to €1.72, compared to €0.17 previously. Given that a substantial portion of recognized revenue is dependent on timely Polish apartment handovers, these results highlight just how heavily short-term earnings rely on prompt project completion and favorable market demand. However, investors should keep in mind that if the pace of construction or handovers slows, the attractive dividend outlook could face pressure…

Read the full narrative on TAG Immobilien (it's free!)

TAG Immobilien's outlook projects €431.7 million in revenue and €355.0 million in earnings by 2028. This scenario assumes a 25.4% annual decline in revenue and a €79.1 million increase in earnings from the current €275.9 million level.

Uncover how TAG Immobilien's forecasts yield a €18.15 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered three independent fair value estimates for TAG Immobilien AG, ranging from €8.89 to €20.86 per share. With strong rental growth in both Germany and Poland identified as the main catalyst, investor opinions reflect widely different outlooks, explore several perspectives to better understand what could drive future performance.

Explore 3 other fair value estimates on TAG Immobilien - why the stock might be worth 38% less than the current price!

Build Your Own TAG Immobilien Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TAG Immobilien research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TAG Immobilien research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TAG Immobilien's overall financial health at a glance.

No Opportunity In TAG Immobilien?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAG Immobilien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TEG

TAG Immobilien

A real estate company, engages in the acquisition, development, and management of residential real estate properties in Germany.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives