- Germany

- /

- Real Estate

- /

- XTRA:AT1

Does Aroundtown’s €1 Billion Perpetual Notes Buyback Strengthen the Bull Case for (XTRA:AT1)?

Reviewed by Sasha Jovanovic

- In October 2025, Aroundtown SA announced the completion of a major tender offer to buy back €1 billion in perpetual notes, reducing its outstanding perpetual notes by approximately €500 million while issuing €200 million in new notes at a lower 5.25% coupon.

- This refinancing action is expected to deliver about €50 million in annualized coupon savings, directly enhancing funds from operations and improving the company's credit metrics under S&P's methodology.

- We'll examine how Aroundtown's move to refinance perpetual notes and cut annual coupon expenses may shape its investment outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Aroundtown Investment Narrative Recap

To be a shareholder in Aroundtown, you would need to believe in its ability to optimize its capital structure and unlock value through disciplined refinancing, especially as macro uncertainties and high interest rates continue to challenge the real estate sector. The recent €1.2 billion perpetual note buyback, paired with the €200 million issuance at a lower coupon, directly impacts the key short-term catalyst: improving net margin and cash flow flexibility. While this supports some credit metrics, the most pressing risk, earnings pressure from potential continued market volatility, remains only partially addressed.

The October 23, 2025, announcement of a €500 million perpetual note issuance at a 5.25% coupon, five times oversubscribed, is closely related to the recent tender offer. Strong investor demand suggests ongoing confidence in Aroundtown's refinancing approach and its immediate efforts to manage interest expense, which aligns with the broader catalyst of strengthening financial fundamentals during a volatile period.

However, investors should also recognize that, despite improved coupon costs, the risk of margin compression due to unpredictable real estate valuations and revenue headwinds is still present...

Read the full narrative on Aroundtown (it's free!)

Aroundtown's narrative projects €1.6 billion revenue and €499.7 million earnings by 2028. This requires 2.1% yearly revenue growth and a €273.6 million earnings increase from €226.1 million today.

Uncover how Aroundtown's forecasts yield a €3.12 fair value, a 3% downside to its current price.

Exploring Other Perspectives

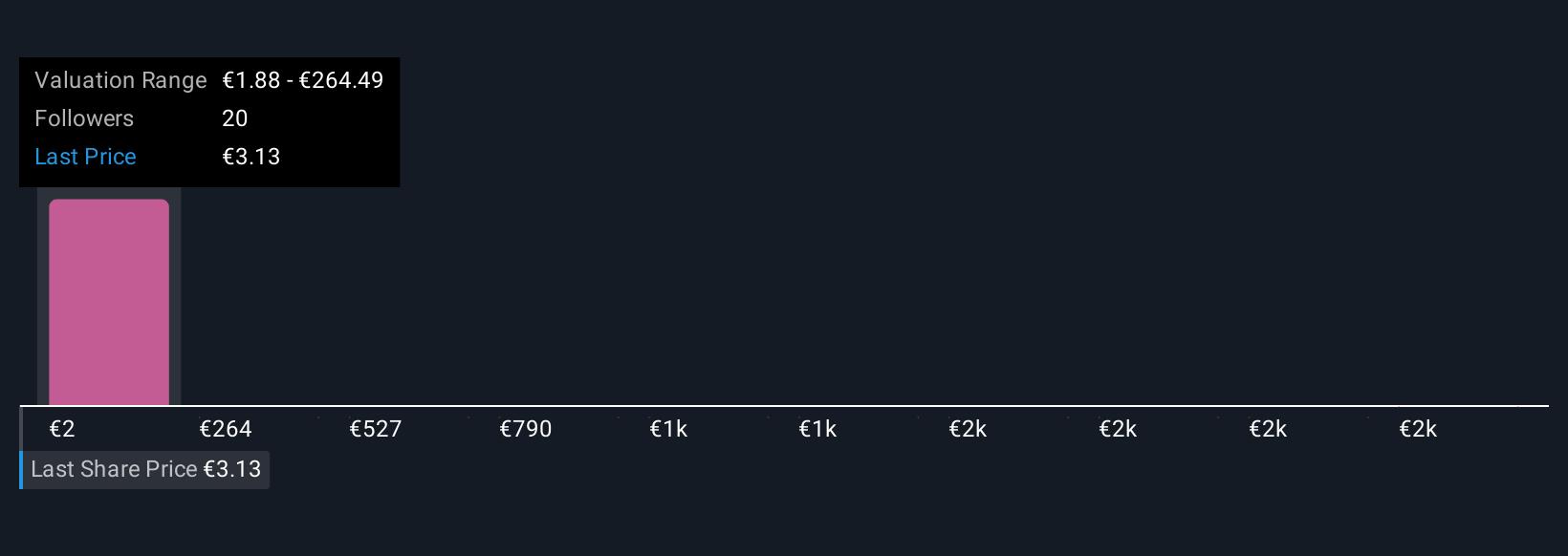

Eight different Simply Wall St Community members estimated fair value for Aroundtown, with figures ranging from €1.88 to €2,627.93. Although refinancing moves may aid net margins short term, you should consider the wide gap in sentiment and what it could mean for the company's future stability.

Explore 8 other fair value estimates on Aroundtown - why the stock might be worth 41% less than the current price!

Build Your Own Aroundtown Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aroundtown research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aroundtown research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aroundtown's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AT1

Aroundtown

Operates as a real estate company in Germany, the Netherlands, the United Kingdom, Belgium, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives