- Germany

- /

- Real Estate

- /

- XTRA:AT1

Aroundtown (XTRA:AT1): Assessing Valuation After Major €1bn Perpetual Notes Buyback and Refinancing

Reviewed by Simply Wall St

Aroundtown (XTRA:AT1) just completed a major tender offer, buying back €1 billion of perpetual notes and issuing new perpetual notes at a lower coupon rate. This reshaping of its debt profile has immediate financial implications for investors.

See our latest analysis for Aroundtown.

Aroundtown’s latest move to refinance its debt comes after a steady year. The share price is up 12.5% year-to-date, and longer-term investors have enjoyed a 17.5% total shareholder return over the past year. This signals that momentum is picking up as the company strengthens its balance sheet.

If Aroundtown’s renewed focus on financial stability has your attention, you might want to broaden your horizons and discover fast growing stocks with high insider ownership

With the recent restructuring and ongoing profitability improvements, is Aroundtown’s current share price reflecting all these positive changes, or could there still be an attractive buying opportunity for those anticipating future growth?

Most Popular Narrative: Fairly Valued

With Aroundtown's most widely followed estimate suggesting a fair value of €3.12, the current market price of €3.22 sits just above the narrative's benchmark. This positions the stock as trading almost perfectly in line with consensus expectations, making the underlying assumptions all the more important to unpack.

The company's proactive operational strategy, including the reopening and upgrading of hotel properties and converting office spaces into service apartments, is expected to contribute to robust operational growth and increased revenue. The diversification of Aroundtown’s asset base, especially focusing on residential and hotel portfolios, positions it well for continued strong demand, thereby supporting revenue growth and potentially improving net income.

What's the real story behind this razor-thin margin between fair value and live prices? Underneath the surface are ambitious revenue expansion, accelerating profit margins, and bold bets on future PE ratios. The full narrative unpacks how these moving parts connect to today’s share price. See the catalysts fueling this market call and what it takes for the bull case to play out.

Result: Fair Value of €3.12 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and rising financing costs could still threaten Aroundtown’s revenue growth and put pressure on margins going forward.

Find out about the key risks to this Aroundtown narrative.

Another View: Deep Value on Cash Flow?

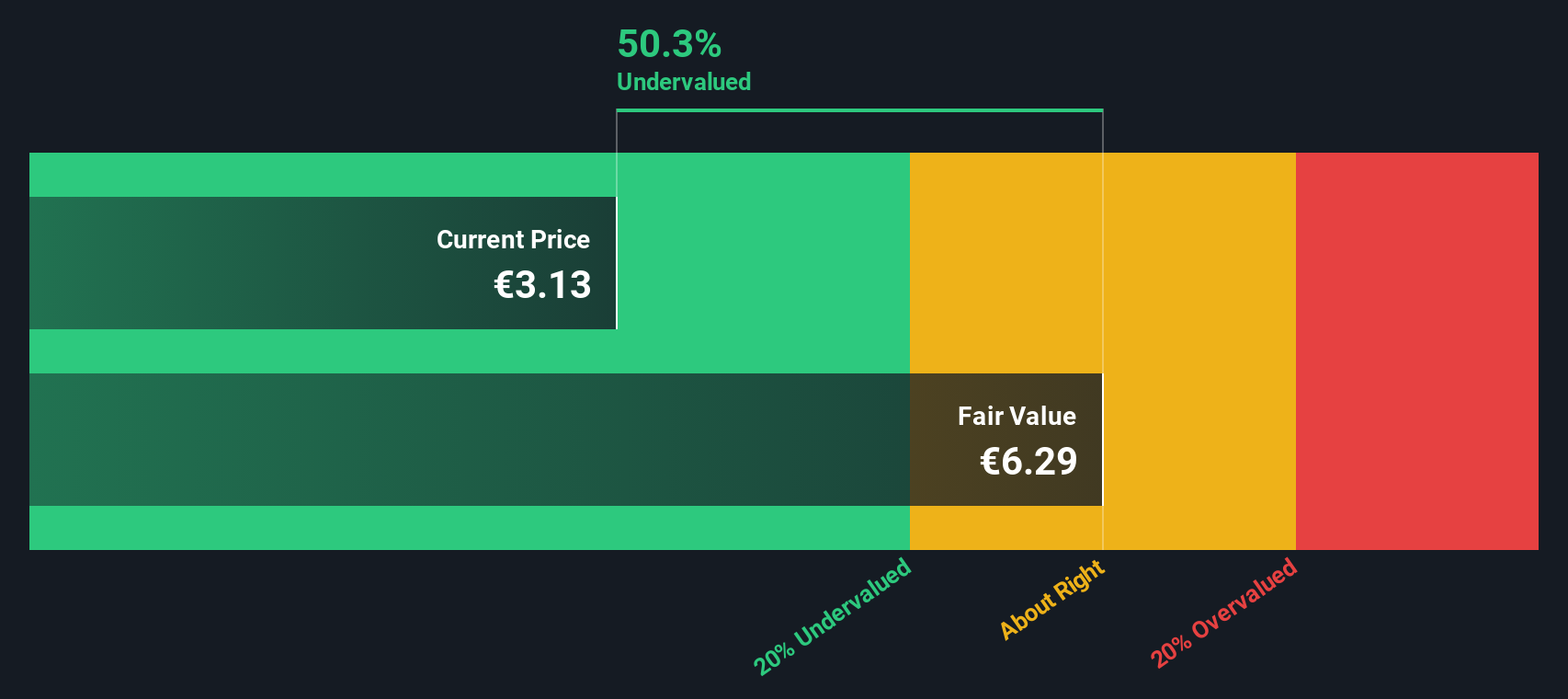

While consensus puts Aroundtown’s fair value right in line with the market, our SWS DCF model offers a very different perspective. According to this approach, the shares are actually trading nearly 49% below intrinsic value. This suggests the potential for significant upside, provided that cash flow projections prove accurate. But can such an optimistic view hold up under real-world pressures?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aroundtown Narrative

If you want to dig deeper or have a different perspective, you can review the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Aroundtown research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on the market's most exciting opportunities. Now is your chance to get ahead with unique strategies and trending sectors on Simply Wall Street.

- Tap into breakthrough innovations by checking out these 25 AI penny stocks and see which companies are making waves in artificial intelligence this year.

- Capitalize on attractive yields when you explore these 14 dividend stocks with yields > 3% offering reliable income from market-proven businesses with strong dividend track records.

- Seize potential bargains and uncover hidden gems with these 865 undervalued stocks based on cash flows poised for growth based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AT1

Aroundtown

Operates as a real estate company in Germany, the Netherlands, the United Kingdom, Belgium, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives