High Growth Tech Stocks In Germany Including adesso And 2 More

Reviewed by Simply Wall St

As global markets react to the recent Federal Reserve rate cut, European indices have shown mixed results, with Germany's DAX index posting a modest gain. In this dynamic environment, high-growth tech stocks in Germany present intriguing opportunities for investors looking to capitalize on innovation and market resilience. Identifying strong candidates involves assessing their growth potential and how well they navigate current economic conditions.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.46% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally with a market cap of €443.38 million.

Operations: The company generates revenue primarily from IT services (€1385.63 million) and IT solutions (€128.12 million), with some offsets due to consolidation (-€267.88 million) and reconciliation (-€20.92 million).

Despite a challenging half-year with sales rising to €633.47 million, adesso SE faced a deepening net loss of €9.86 million, reflecting intensified competitive pressures and higher operational costs in the tech sector. The firm's R&D expenses are critical for its rebound, marked by an aggressive strategy to innovate within the digital transformation space. Notably, adesso's revenue growth forecast at 11.7% annually outpaces the German market average of 5.5%, indicating potential for recovery and expansion in its software solutions segment. With earnings expected to surge by 46.45% per year, the company is poised for a significant turnaround, banking on its enhanced product offerings and strategic market positioning to drive future profitability.

- Unlock comprehensive insights into our analysis of adesso stock in this health report.

Explore historical data to track adesso's performance over time in our Past section.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG, a biotechnology company, develops biosimilar drugs in Germany and Switzerland with a market cap of €930.52 million.

Operations: The company generates revenue primarily from its Drug Delivery Systems segment, which accounted for €60.80 million.

Formycon AG, navigating a turbulent period, reported a substantial revenue drop to €26.89 million from the previous year's €43.79 million, alongside a shift to a net loss of €10.09 million. Despite these challenges, the company's commitment to innovation is evident in its R&D expenses which are pivotal for future prospects. Notably, Formycon has projected an impressive annual earnings growth of 30.5% and revenue growth forecast at 31.8%, outstripping the German market's average significantly. These figures suggest potential resilience and recovery through strategic focus on high-growth sectors within biotech, underscored by recent presentations at major industry events in Munich and Amsterdam that could bolster investor confidence moving forward.

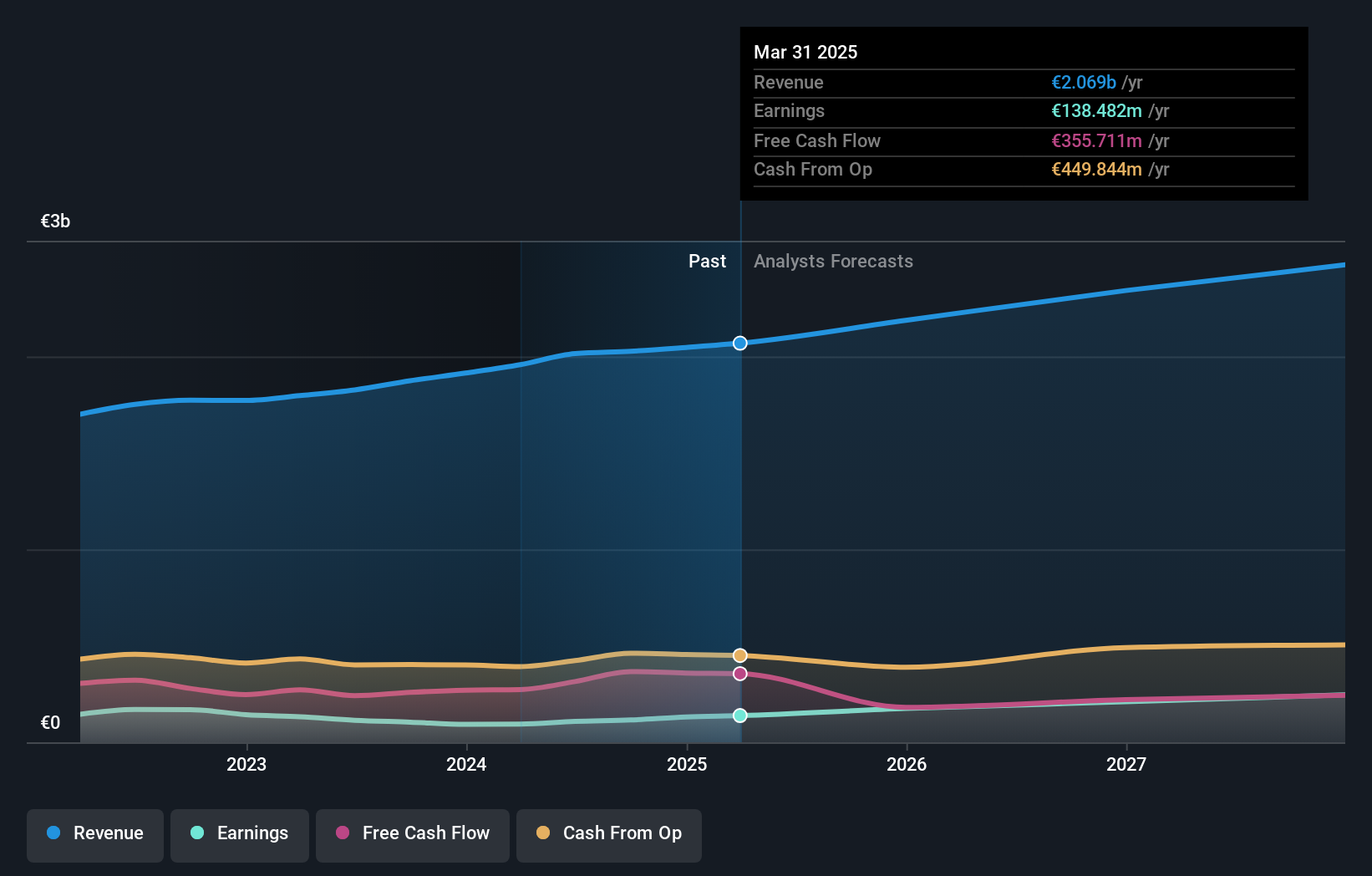

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA offers out-of-home media and online advertising solutions in Germany and internationally, with a market cap of €3.20 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily from Out-Of-Home Media (€922.53 million) and Digital & Dialog Media (€862.76 million), with a smaller contribution from Daas & E-Commerce (€357.19 million). The company focuses on leveraging its advertising solutions across various platforms in both domestic and international markets.

Ströer SE & Co. KGaA, amidst its active participation in multiple industry conferences, has demonstrated robust financial performance with a notable increase in sales to €511.52 million for Q2 2024, up from €454.78 million the previous year. This growth is underpinned by a strategic emphasis on R&D which is crucial for maintaining its competitive edge in the tech-driven advertising sector. The company’s earnings have impressively risen by 29.9% annually, outpacing the German market's average growth rate of 20%. Additionally, Ströer's revenue is projected to grow at 7.4% per year, further highlighting its potential within high-growth tech sectors despite a challenging economic landscape marked by high debt levels.

- Dive into the specifics of Ströer SE KGaA here with our thorough health report.

Review our historical performance report to gain insights into Ströer SE KGaA's's past performance.

Key Takeaways

- Gain an insight into the universe of 42 German High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

Undervalued with high growth potential.