Evonik (XTRA:EVK) Margins Fall to 0.7% on €242M Loss, Testing Turnaround Narrative

Reviewed by Simply Wall St

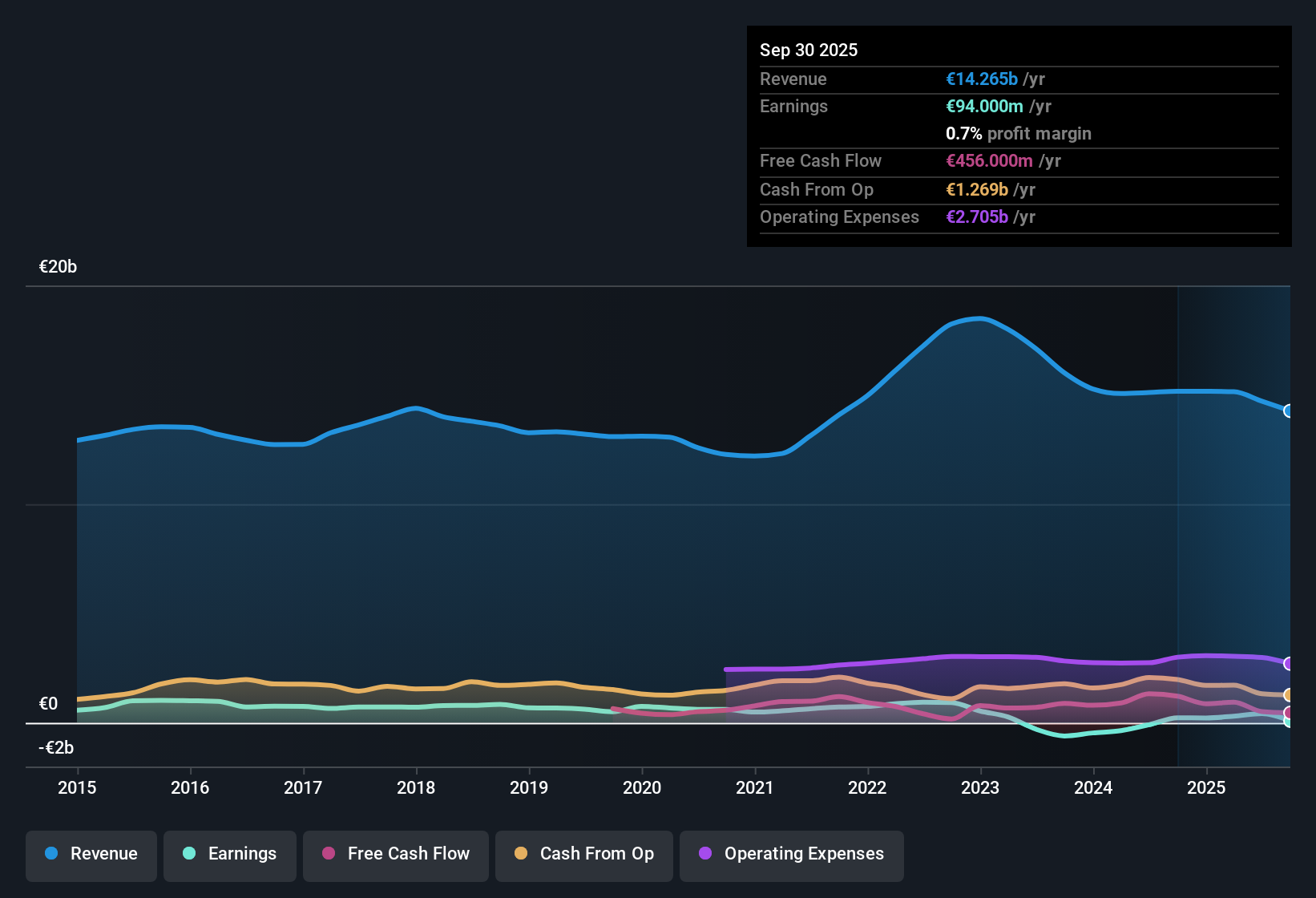

Evonik Industries (XTRA:EVK) posted a mixed set of results for investors, as EPS was pressured by a one-off €242 million loss over the past 12 months, dragging net profit margins down to 0.7% from 1.5% last year. Earnings have declined at an average annual rate of 32.4% over the past five years, but projections are turning heads. The company now expects earnings to grow 35.7% annually, which is significantly higher than the German market's 16.9% yearly growth forecast. While EVK's revenue growth outlook lags the wider market, the stock's deep discount to an estimated fair value has become just as much a talking point as its recent margin squeeze.

See our full analysis for Evonik Industries.Next up, we’ll see how these latest figures measure up to the dominant community narratives. Some outlooks may shift, and others could be confirmed.

See what the community is saying about Evonik Industries

Profit Margins Set for Turnaround

- Profit margins are forecast to rise from 2.9% today to 5.1% by 2028, even though net profit margins have been squeezed to 0.7% in the most recent year after a large €242 million one-off loss.

- Analysts' consensus view expects strategic cost-cutting programs and a shift to high-value specialty chemicals will reinforce margin recovery.

- Site closures and headcount reductions are projected to lower operating costs, supporting this expansion.

- However, improvement hinges on portfolio moves away from lower-margin commodity businesses. This suggests margin gains may lag if transitions stall.

- Results backing up this optimistic consensus should prompt investors to see if the company can actually convert cost savings to real margin gains as planned. 📊 Read the full Evonik Industries Consensus Narrative.

Growth Outlook Tied to Specialty Shifts

- Revenue is forecast to grow just 1.8% per year, underperforming the German market’s 6.1%. However, the production ramp-up in new specialty plants is expected to boost medium-term sales from regulatory and demographic trends.

- Consensus narrative notes the company’s move to expand in healthcare, nutrition, and biopharma, building on new facilities in Singapore and Slovakia, adds stable revenue streams.

- Ongoing reliance on cyclical sectors and lagging exit from commodity chemicals threatens growth targets if sector demand weakens or the product mix cannot pivot fast enough.

- This suggests Evonik's future growth hinges more on business transformation than on broader market tailwinds.

Valuation Deep Discount Amid Risks

- Evonik trades at €14.18, sharply below its DCF fair value of €47.51, with a price-to-earnings ratio of 17.8x. This is more expensive than GB Chemicals but less than the forecasted industry average of 22.0x by 2028.

- Analysts' consensus view points out that this valuation gap partly reflects skepticism about turnaround execution.

- The analyst price target of 18.12 is 27.8% above today’s price, so upside exists if earnings hit forecasts.

- Yet, persistent weak demand, exposure to low-margin commodities, and macro risks are seen as key reasons why the market remains cautious about closing this discount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Evonik Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Shape your perspective into a fresh narrative in just a few minutes. Do it your way

A great starting point for your Evonik Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Evonik’s inconsistent revenue growth and exposure to cyclical, low-margin sectors highlight a lack of steady performance compared to broader market leaders.

If you’d prefer companies that consistently grow earnings and revenue regardless of the cycle, consider searching for steadier choices among stable growth stocks screener (2074 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evonik Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives