A Fresh Look at Evonik Industries (XTRA:EVK) Valuation Following Third Quarter Earnings and Sales Decline

Reviewed by Simply Wall St

Evonik Industries (XTRA:EVK) just released its third quarter earnings, showing a net loss and a year-on-year dip in sales. This update provides investors with valuable insight into how the company is navigating the current environment.

See our latest analysis for Evonik Industries.

Evonik Industries' latest earnings miss appears to have weighed on investor sentiment, with the share price now down nearly 17% since the start of the year and total shareholder returns slipping over 18% in the last twelve months. Even as the company navigates a tough operating environment, recent momentum suggests caution is prevailing over optimism for a near-term turnaround.

If you're open to finding opportunities beyond the chemicals sector, it's the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and a notable intrinsic discount, investors are left to consider whether Evonik Industries is presenting a compelling value opportunity. Alternatively, the current price may already reflect expectations for tougher times ahead.

Most Popular Narrative: 23.9% Undervalued

The most widely followed narrative sees a fair value meaningfully higher than the recent close, as analysts factor in both structural challenges and renewed growth initiatives. With a discount rate of 5.08% anchoring the analysis, changing sector dynamics and company strategies take center stage.

Strategic cost optimization programs, including significant headcount reductions and site closures (notably in Silica), are expected to lower operating costs and support net margin expansion throughout 2025 as savings become fully visible by year-end. Ramp-up of new production capacities, especially the alkoxides plant in Singapore and the RNA/lipids plant in Slovakia, positions the company to capture incremental volume opportunities tied to sustainable materials and biopharmaceutical applications. This supports medium-term revenue growth.

Want to know the formula behind this deep discount? The calculations hinge on dramatic cost savings and major bets on new technology production lines. Curious which forecasts are bold enough to back this high target? There is a key twist hidden in future profit margins and volume assumptions that might surprise you.

Result: Fair Value of $18.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand and heavy reliance on cyclical sectors could quickly undermine the bullish case for Evonik's recovery story.

Find out about the key risks to this Evonik Industries narrative.

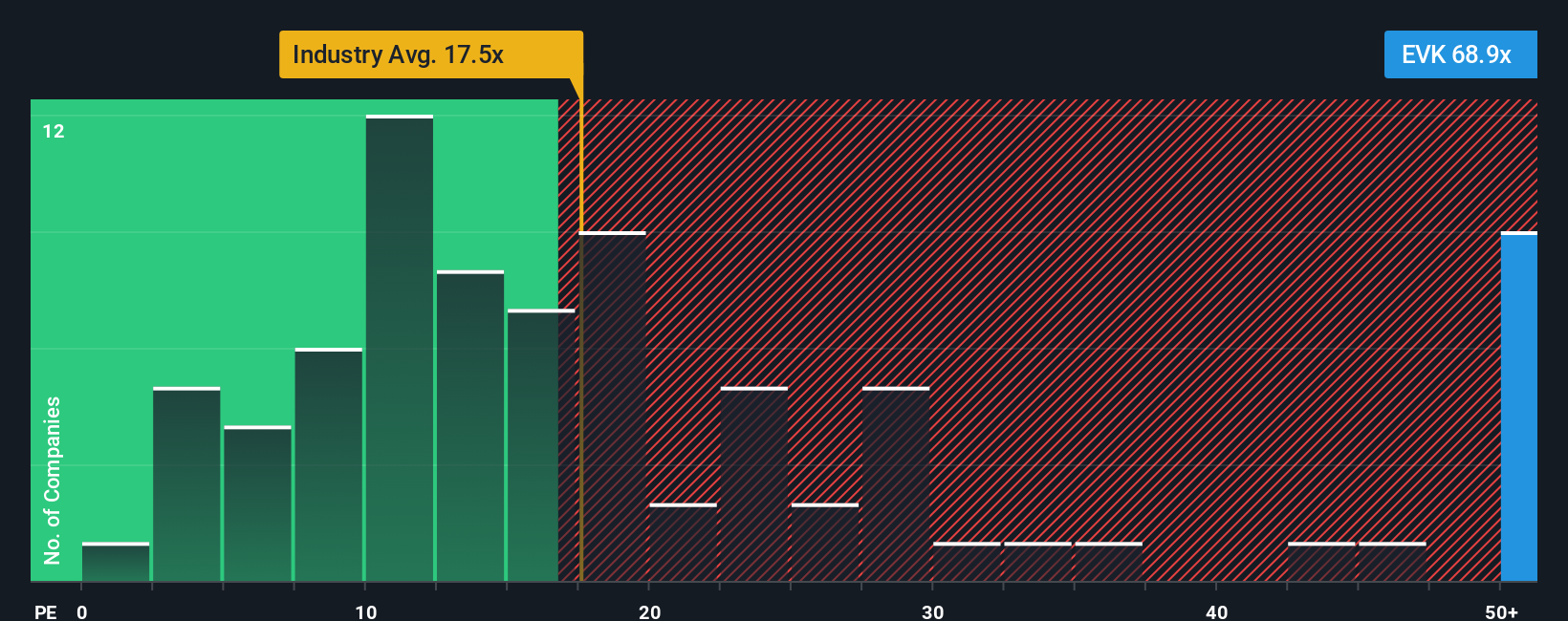

Another View: Market Multiples Reveal Caution

Looking through the lens of the price-to-earnings ratio, Evonik Industries is trading at 68.4x earnings, which is meaningfully higher than both the European Chemicals industry average of 17.5x and its fair ratio of 29.5x. This wide gap signals the market sees much higher risks, making the path to rerating uncertain. Are investors pricing in too much pessimism, or is there more weakness to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evonik Industries Narrative

If you see the story unfolding differently or want to shape your own view, you can dive in and build a personalized outlook in just a few minutes. Do it your way

A great starting point for your Evonik Industries research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing to the next level by uncovering unique opportunities beyond the obvious. Don’t miss out on these handpicked stock groups driving fresh trends and market momentum:

- Tap into the pulse of innovation and find breakthroughs in artificial intelligence with these 26 AI penny stocks that are poised for rapid growth.

- Secure reliable income streams by checking out these 15 dividend stocks with yields > 3% which offer attractive yields above 3% for your portfolio.

- Ride the wave of countless undervalued opportunities by starting your search among these 872 undervalued stocks based on cash flows that are now ready for your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evonik Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives