Assessing Munich Re (XTRA:MUV2) Valuation After Recent Subtle Shifts in Market Sentiment

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 6% Undervalued

According to the most widely followed narrative, Münchener Rückversicherungs-Gesellschaft in München is trading at a notable discount to its estimated fair value. Analysts believe there is meaningful upside potential, shaped by forward-looking growth and risk-adjusted projections.

Prudent risk management, selective underwriting, and deliberate cycle management, such as actively reducing exposure in lines with inadequate returns while reallocating capacity to higher-margin areas, help maintain high profitability despite top-line headwinds from FX or pricing normalization. This approach stabilizes future earnings and margins.

Want to know what’s propelling this 6% undervaluation call? The heart of this narrative is all about forward earnings performance and well-defended margins. What are the ambitious targets and underlying financial bets that analysts see as game-changers for Munich Re? Get the full breakdown of the forecast to see if you’d agree with the headline valuation.

Result: Fair Value of €556.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent foreign exchange volatility and management’s active reduction of certain business lines could still disrupt Munich Re’s projected growth path.

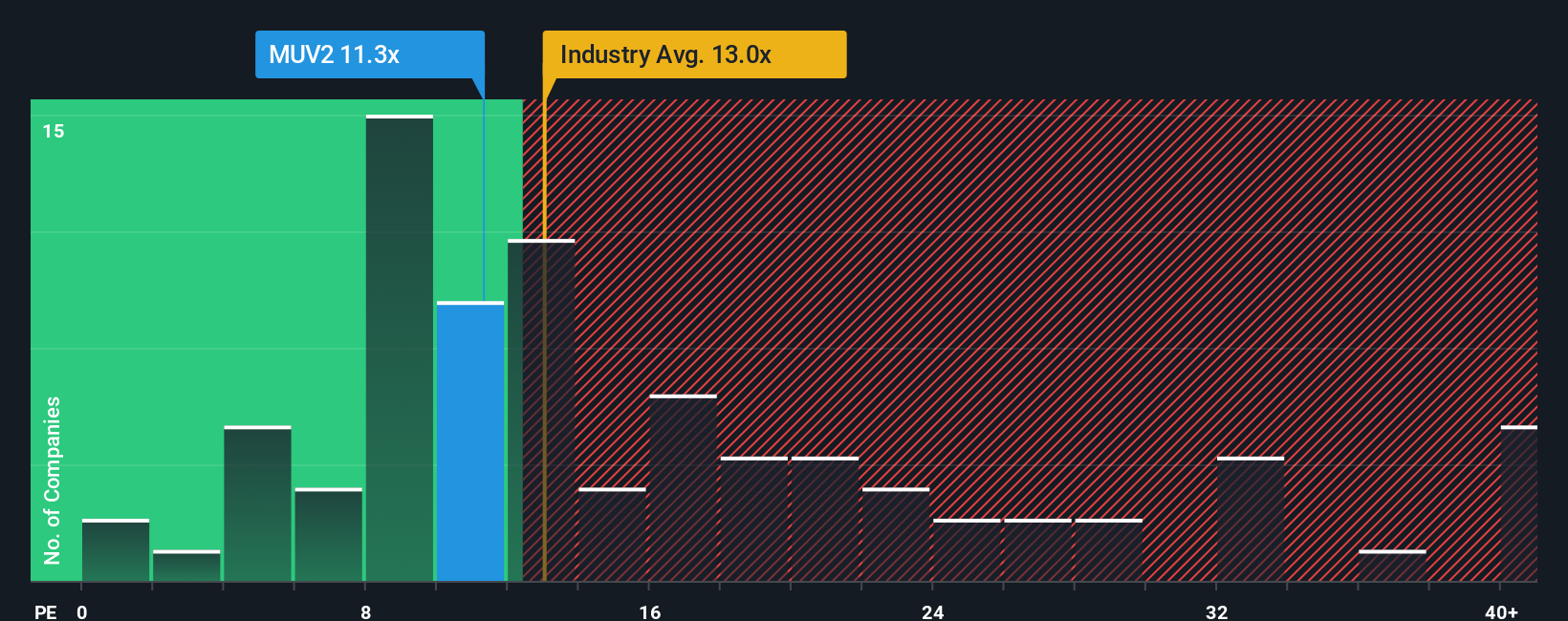

Find out about the key risks to this Münchener Rückversicherungs-Gesellschaft in München narrative.Another View: Multiples Tell a Different Story

While the first valuation points to upside, market-based measures send a cautionary signal. The company is currently more expensive than the European Insurance industry in this respect, suggesting investors may already be paying a premium. Is the optimism overdone, or does value hide in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Münchener Rückversicherungs-Gesellschaft in München to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Münchener Rückversicherungs-Gesellschaft in München Narrative

If you see the numbers and think there might be another angle worth exploring, dive into the data yourself and craft a narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Münchener Rückversicherungs-Gesellschaft in München.

Ready for More Winning Investment Ideas?

Don't let your next smart move slip through the cracks. Broaden your watchlist by checking out hand-picked stock groups built from real growth and value signals.

- Accelerate your search for future tech champions by checking out AI companies making waves in automation, data intelligence, and digital transformation with AI penny stocks.

- Capture cash flow bargains by uncovering undervalued stocks that might be under Wall Street's radar through the power of undervalued stocks based on cash flows.

- Boost your income with companies delivering robust yields by exploring leading businesses paying dividends above 3% via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUV2

Münchener Rückversicherungs-Gesellschaft in München

Engages in the insurance and reinsurance businesses worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives