- Germany

- /

- Medical Equipment

- /

- XTRA:AFX

Will ZEISS and LG Chem’s Photopolymer Alliance Shape Carl Zeiss Meditec’s (XTRA:AFX) Automotive Ambitions?

Reviewed by Sasha Jovanovic

- ZEISS and LG Chem recently announced a strategic alliance to ensure a robust and sustainable supply of innovative photopolymer films for industrial-scale integration into ZEISS's holographic windshield displays for the automotive sector, with serial production targeted for 2029.

- This collaboration establishes a stable supply chain for cutting-edge photopolymer materials, positioning both companies at the forefront of a new era in automotive display and holographic technology.

- We’ll explore how securing a reliable photopolymer supply through this alliance could support Carl Zeiss Meditec’s ambitions in automotive innovation.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Carl Zeiss Meditec Investment Narrative Recap

To believe in Carl Zeiss Meditec, investors need confidence in the company’s efforts to expand into innovative markets such as automotive holographic displays, while managing margin pressures and international market challenges. The recent alliance with LG Chem provides material supply certainty but does not directly address the near-term risk of revenue softening from China, which remains the core short-term challenge.

Among recent updates, the early approval of VISUMAX 800 in China stands out. While distinct from the LG Chem partnership, this regulatory milestone targets immediate revenue growth, contrasting with the longer-term horizon of automotive innovation.

In contrast to supply breakthroughs, investors should not overlook the lingering risk that weak market conditions in China could still negatively affect...

Read the full narrative on Carl Zeiss Meditec (it's free!)

Carl Zeiss Meditec's narrative projects €2.6 billion in revenue and €266.9 million in earnings by 2028. This requires 6.3% yearly revenue growth and a €116.8 million increase in earnings from €150.1 million today.

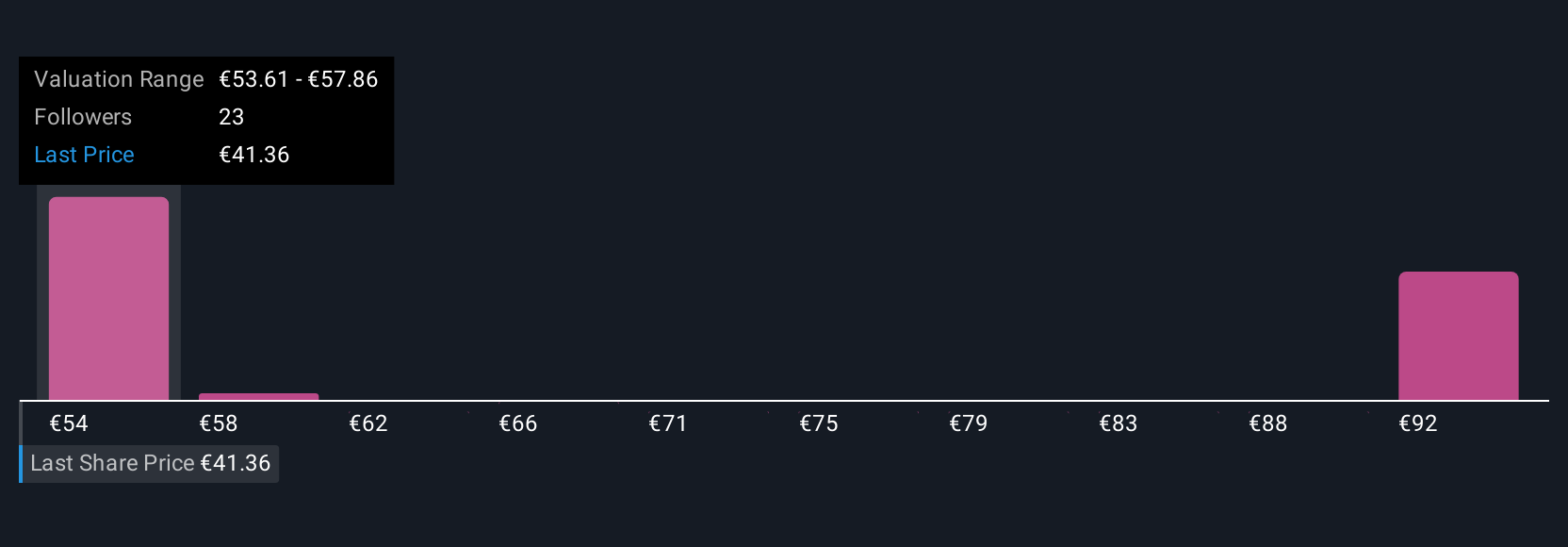

Uncover how Carl Zeiss Meditec's forecasts yield a €53.61 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community fall between €53.61 and €92.99. While opinions from market participants vary widely, ongoing challenges in China highlight the importance of considering a range of outcomes for Carl Zeiss Meditec’s future performance.

Explore 6 other fair value estimates on Carl Zeiss Meditec - why the stock might be worth over 2x more than the current price!

Build Your Own Carl Zeiss Meditec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carl Zeiss Meditec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carl Zeiss Meditec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carl Zeiss Meditec's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives