- Germany

- /

- Professional Services

- /

- XTRA:BDT

Top German Dividend Stocks For September 2024

Reviewed by Simply Wall St

As the European markets navigate the cautious optimism following the U.S. Federal Reserve's recent rate cut, Germany's DAX Index has shown a modest gain of 0.11%, reflecting investor sentiment towards monetary policy adjustments. In this context, dividend stocks in Germany continue to attract attention for their potential to provide steady income and stability amidst fluctuating market conditions. When evaluating dividend stocks, it's crucial to consider companies with a strong track record of consistent payouts and robust financial health, especially in light of current economic trends and policy shifts.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 7.04% | ★★★★★★ |

| All for One Group (XTRA:A1OS) | 3.25% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.23% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.69% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.48% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.25% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.64% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

FRoSTA (DB:NLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FRoSTA Aktiengesellschaft, with a market cap of €418.97 million, develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Operations: FRoSTA Aktiengesellschaft generates its revenue from the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe.

Dividend Yield: 3.3%

FRoSTA Aktiengesellschaft reported stable earnings for the half year ended June 30, 2024, with net income of €15.5 million. The company's dividends have been reliable and growing over the past decade, supported by a low payout ratio (40%) and cash payout ratio (19.3%). Although its dividend yield of 3.25% is lower than the top tier in Germany, FRoSTA's consistent dividend growth and coverage make it an attractive option for income-focused investors.

- Unlock comprehensive insights into our analysis of FRoSTA stock in this dividend report.

- Our comprehensive valuation report raises the possibility that FRoSTA is priced lower than what may be justified by its financials.

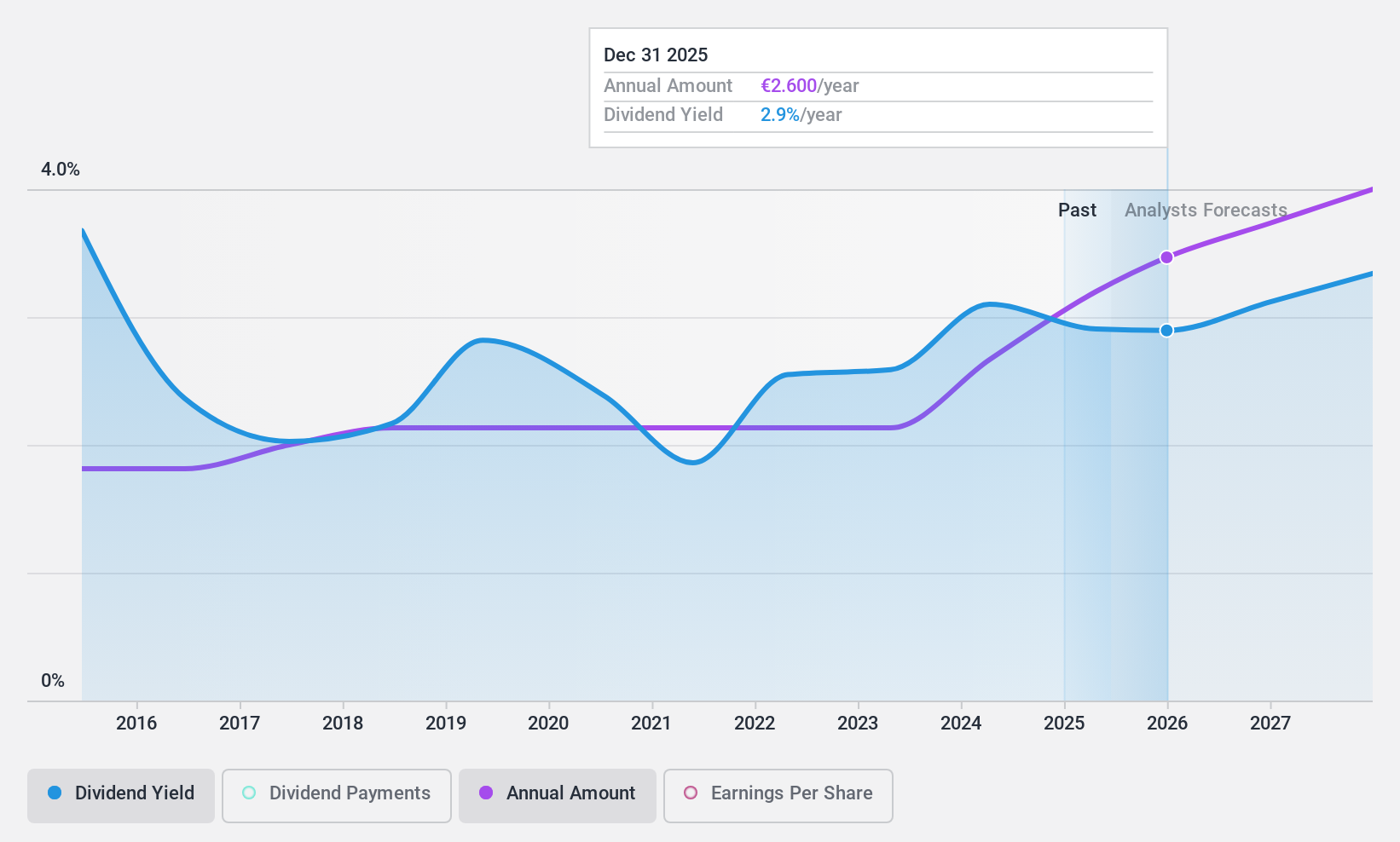

Bertrandt (XTRA:BDT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bertrandt Aktiengesellschaft, with a market cap of €209.19 million, provides engineering services.

Operations: Bertrandt Aktiengesellschaft generates revenue from three primary segments: Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

Dividend Yield: 5.8%

Bertrandt Aktiengesellschaft's dividend yield of 5.8% places it in the top 25% of German dividend payers, supported by a reasonable payout ratio (71.1%) and low cash payout ratio (26.8%). However, its dividends have been volatile over the past decade, with significant annual drops. Recent earnings showed a net loss for Q3 2024 and reduced net income for nine months ending June 30, 2024, impacting its profit margins and overall financial stability.

- Delve into the full analysis dividend report here for a deeper understanding of Bertrandt.

- The analysis detailed in our Bertrandt valuation report hints at an deflated share price compared to its estimated value.

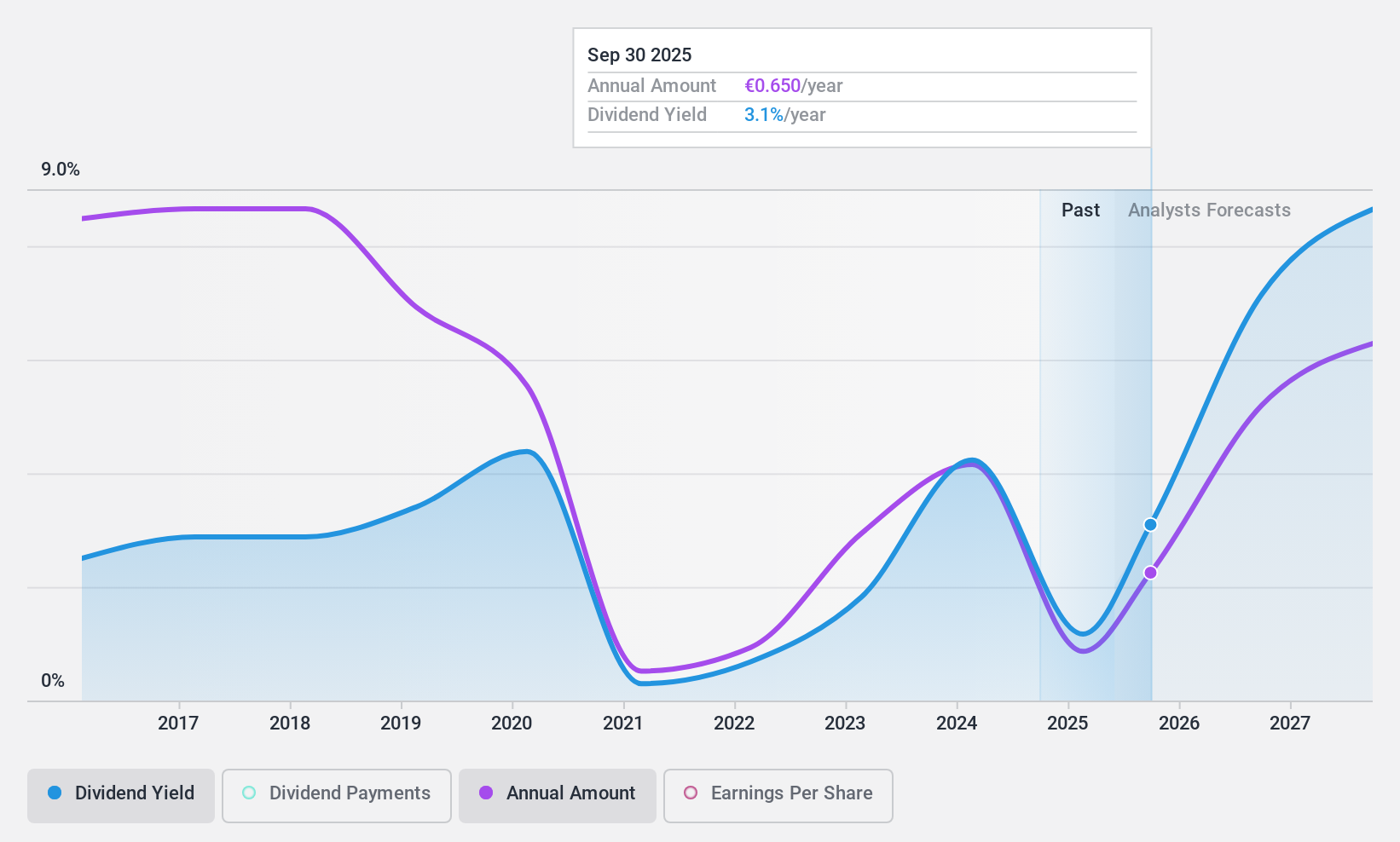

EDAG Engineering Group (XTRA:ED4)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EDAG Engineering Group AG develops vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle industries globally, with a market cap of €230 million.

Operations: EDAG Engineering Group AG's revenue segments include Vehicle Engineering (€485.66 million), Production Solutions (€276.56 million), and Electrics/Electronics (€110.02 million).

Dividend Yield: 6%

EDAG Engineering Group's dividend yield of 5.98% ranks it among the top 25% of German dividend payers, supported by a reasonable payout ratio (54.1%) and low cash payout ratio (28.5%). However, its dividends have been volatile over the past eight years. Recent earnings reports show a decline in net income to €3.46 million for Q2 2024 from €5.63 million a year ago, indicating potential financial instability impacting future dividends.

- Navigate through the intricacies of EDAG Engineering Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of EDAG Engineering Group shares in the market.

Next Steps

- Unlock our comprehensive list of 33 Top German Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bertrandt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BDT

Undervalued with excellent balance sheet and pays a dividend.