Amid heightened global trade concerns and significant stock market declines across Europe, investors are increasingly seeking stability through dividend stocks. In such volatile times, companies with a strong track record of consistent dividend payments can offer a measure of reliability and income potential.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.28% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| Mapfre (BME:MAP) | 6.19% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.19% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.87% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.91% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.94% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

Click here to see the full list of 256 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Thermador Groupe (ENXTPA:THEP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Thermador Groupe SA, along with its subsidiaries, operates in the distribution sector both in France and internationally, with a market cap of €604.35 million.

Operations: Thermador Groupe SA generates revenue through various segments, including Dpi (€33.02 million), Aello (€17.75 million), Odrea (€66.14 million), Fginox (€16.19 million), Syveco (€35.79 million), Axelair (€7.68 million), Sectoral (€34.78 million), Distrilabo (€7.27 million), Thermocome (€15.24 million), Jetly Pumps (€59.21 million), Alto Metering (€1.18 million), Sodeco Valves (€22.28 million), Mecafer and Domac (€31.84 million), Pbtub Tubes in Materials (€21.41million ), Sferaco Valves and Fittings(€94 .72million ), Isocel Manufacturers Boilers(€7 .10million ), and Thermador Accessories of Heating(€69 .15million ).

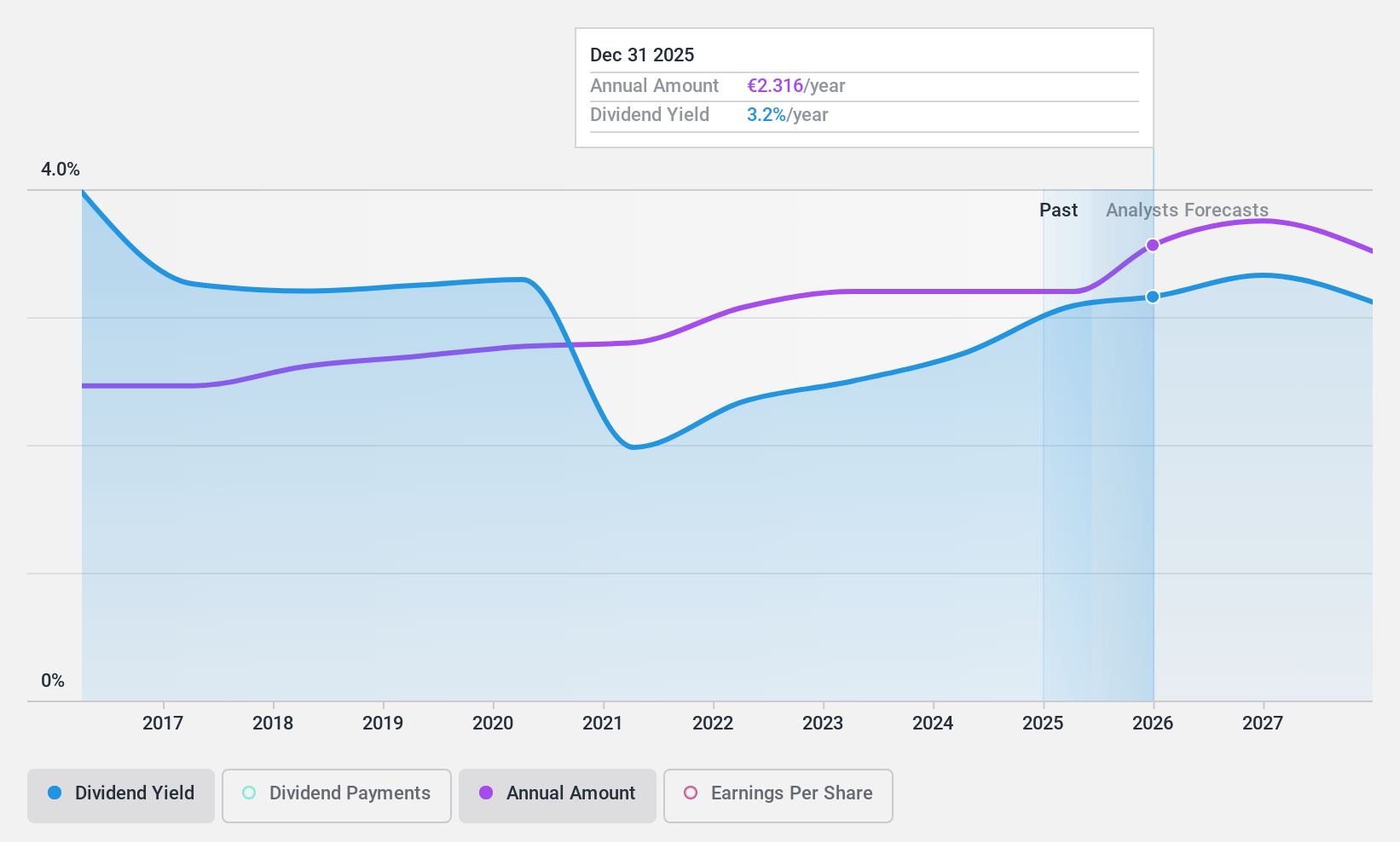

Dividend Yield: 3.2%

Thermador Groupe offers a stable dividend option with its annual dividend of €2.08 per share, supported by a low payout ratio of 42.6%, ensuring sustainability and coverage by earnings and cash flows. Despite recent declines in sales and net income, the company's dividends have grown steadily over the past decade without volatility. However, its current yield of 3.16% is below the top quartile in France, though it trades significantly below estimated fair value, suggesting potential for price appreciation.

- Unlock comprehensive insights into our analysis of Thermador Groupe stock in this dividend report.

- The analysis detailed in our Thermador Groupe valuation report hints at an deflated share price compared to its estimated value.

Orange Polska (WSE:OPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orange Polska S.A., with a market cap of PLN11.38 billion, offers telecommunications services to individual, business, and wholesale customers in Poland through its subsidiaries.

Operations: Orange Polska's revenue primarily comes from its telecommunications services segment, which generated PLN12.73 billion.

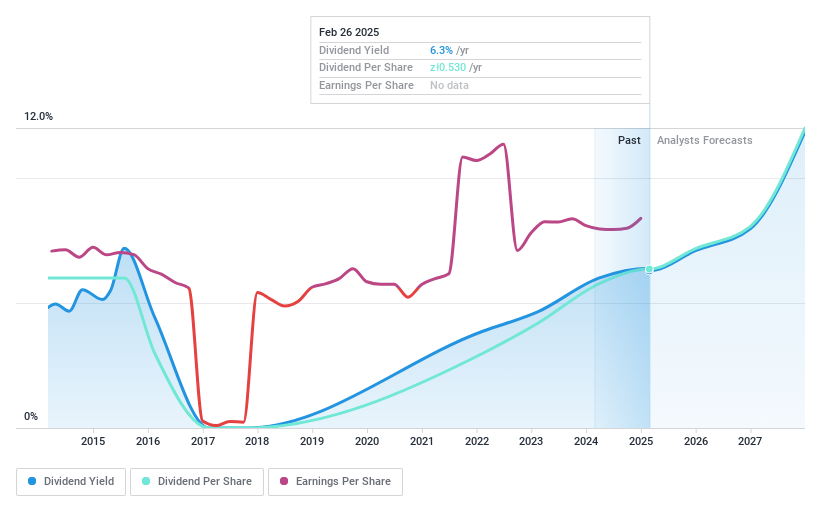

Dividend Yield: 6.1%

Orange Polska's recent dividend increase to PLN 0.53 per share, a 10% rise from last year, highlights its commitment to returning value despite a volatile dividend history. With earnings and cash payout ratios at 76.2% and 66.4%, respectively, dividends are well-covered by both profits and cash flows. Although its yield of 6.11% lags behind Poland's top-tier payers, consistent profit growth supports future stability amidst trading below fair value estimates.

- Click here to discover the nuances of Orange Polska with our detailed analytical dividend report.

- Our valuation report here indicates Orange Polska may be undervalued.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is engaged in the production and distribution of sparkling and semi-sparkling wine products across Europe and internationally, with a market cap of €110.09 million.

Operations: Schloss Wachenheim AG generates revenue of €447.09 million from its alcoholic beverages segment, focusing on sparkling and semi-sparkling wine products.

Dividend Yield: 4.3%

Schloss Wachenheim's dividends have been stable and growing over the past decade, though the 4.32% yield lags behind Germany's top-tier payers. Despite a low payout ratio of 45.4%, indicating earnings coverage, dividends are not well-supported by cash flows due to a high cash payout ratio of 189.2%. Recent earnings show growth with Q2 sales reaching €154.01 million and net income rising to €9.58 million, suggesting potential for future dividend sustainability improvements.

- Get an in-depth perspective on Schloss Wachenheim's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Schloss Wachenheim shares in the market.

Make It Happen

- Unlock our comprehensive list of 256 Top European Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives