- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Uncovering Eckert & Ziegler And 2 Other Hidden German Small Cap Gems

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX index achieving modest gains amidst a cautious European outlook following the U.S. Federal Reserve's recent rate cut. In this context, small-cap stocks have garnered attention for their potential to outperform during periods of economic adjustment. Identifying promising small-cap stocks often involves looking for companies with robust fundamentals and unique market positions. In this article, we will explore three hidden gems in Germany's small-cap sector, starting with Eckert & Ziegler.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

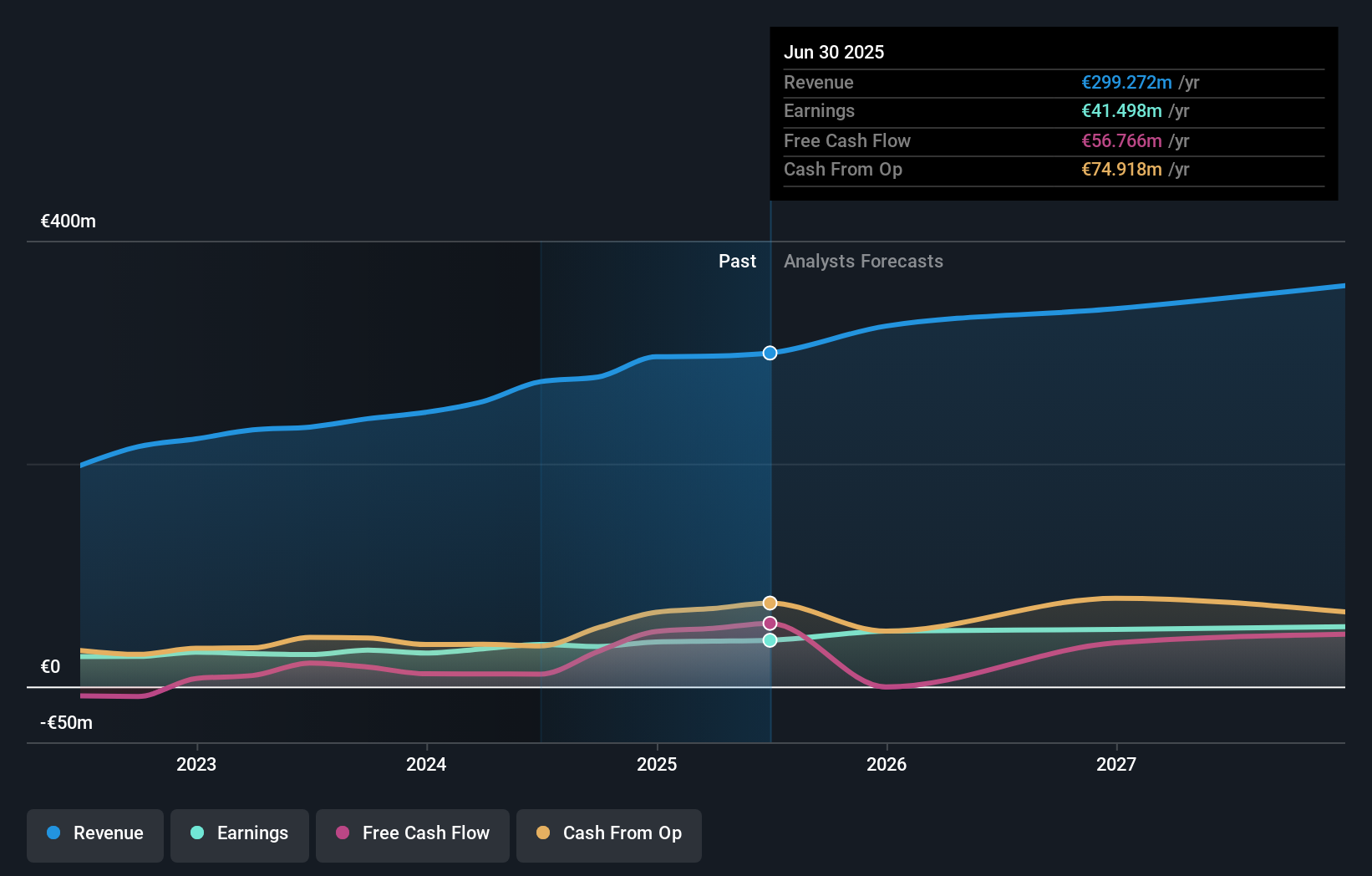

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide and has a market cap of €901.36 million.

Operations: The company's revenue streams include €132.80 million from Medical and €150.97 million from Isotope Products, with a segment adjustment of €0.07 million and an elimination of -€10.32 million.

Eckert & Ziegler, a small cap in the medical equipment sector, reported Q2 2024 sales of €77.76M and net income of €9.54M, up from €60.03M and €6.17M respectively last year. The company’s EBIT covers interest payments 20 times over, indicating strong financial health. Over the past year, earnings grew by 31.6%, outpacing the industry average of 16.2%. Additionally, EUZ's debt-to-equity ratio improved from 14.7% to 9.5% over five years.

- Dive into the specifics of Eckert & Ziegler here with our thorough health report.

Explore historical data to track Eckert & Ziegler's performance over time in our Past section.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

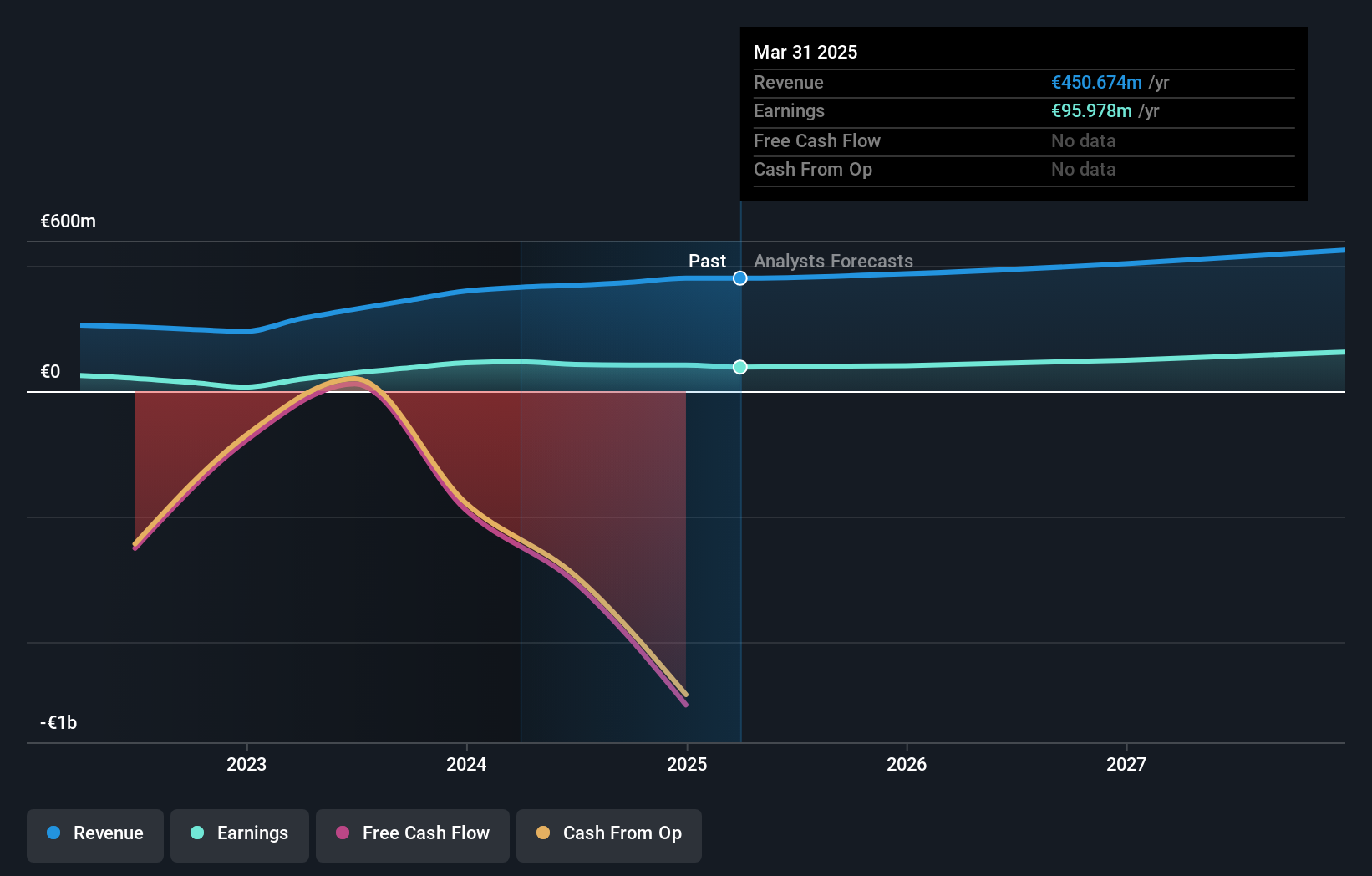

Overview: ProCredit Holding AG, together with its subsidiaries, provides commercial banking services for small and medium enterprises and private customers in Europe, South America, and Germany, with a market cap of €500.64 million.

Operations: ProCredit Holding generates revenue primarily from its banking segment, which reported €422.15 million. The company's market cap stands at €500.64 million.

ProCredit Holding, with total assets of €10.1B and equity of €1.0B, has a strong foundation in customer deposits, making up 83% of its liabilities. The company reported total deposits of €7.5B and loans amounting to €6.5B, alongside a net interest margin of 3.6%. Bad loans are sufficiently covered at 2.4% of total loans, and earnings grew by 46.7% over the past year compared to the industry average growth rate of 18.4%.

- Navigate through the intricacies of ProCredit Holding with our comprehensive health report here.

Examine ProCredit Holding's past performance report to understand how it has performed in the past.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Value Rating: ★★★★★☆

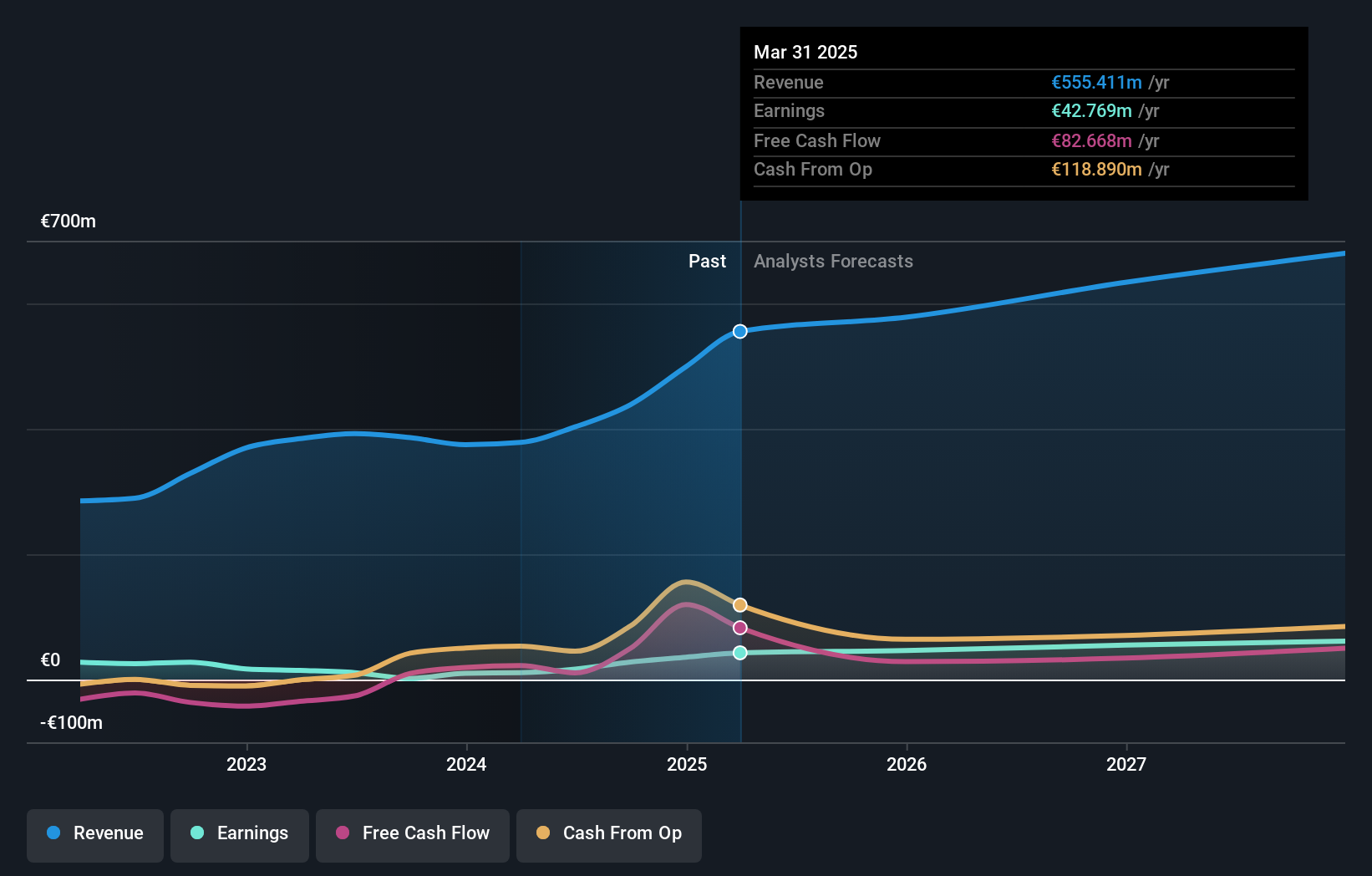

Overview: Friedrich Vorwerk Group SE specializes in providing solutions for the transformation and transportation of energy in Germany and Europe, with a market cap of €485 million.

Operations: The company generates revenue primarily from Natural Gas (€160.89 million), Electricity (€95.30 million), and Adjacent Opportunities (€117.28 million), with additional contributions from Clean Hydrogen (€28.38 million).

Friedrich Vorwerk Group's recent performance has been impressive, with earnings growth of 48.6% surpassing the Oil and Gas industry average of 27.6%. The company's net income for Q2 2024 was €7.96 million, up from €2.38 million a year ago, while revenue reached €121.04 million compared to €96.41 million previously. With EBIT covering interest payments 12.7 times over and a satisfactory net debt to equity ratio of 12%, Friedrich Vorwerk appears well-positioned for continued growth.

Key Takeaways

- Explore the 57 names from our German Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Flawless balance sheet with solid track record.