- Germany

- /

- Electronic Equipment and Components

- /

- XTRA:BKHT

June 2024 Insight Into German Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainty and fluctuating market indices in Europe, Germany's own DAX index has not been immune to these pressures, reflecting broader regional trends. In such a climate, growth companies with high insider ownership in Germany may offer a unique investment perspective, as high insider ownership can be an indicator of confidence from those most familiar with the companies' potential and challenges.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| Deutsche Beteiligungs (XTRA:DBAN) | 35.4% | 31.6% |

| YOC (XTRA:YOC) | 24.8% | 22.2% |

| NAGA Group (XTRA:N4G) | 14.1% | 58.1% |

| Exasol (XTRA:EXL) | 25.3% | 107.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 22% |

| elumeo (XTRA:ELB) | 25.8% | 99.1% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Underneath we present a selection of stocks filtered out by our screen.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG operates as a private equity firm and has a market capitalization of approximately €325.97 million.

Operations: Brockhaus Technologies AG generates revenue primarily through its Security Technologies and Financial Technologies segments, with contributions of €39.43 million and €153.43 million respectively.

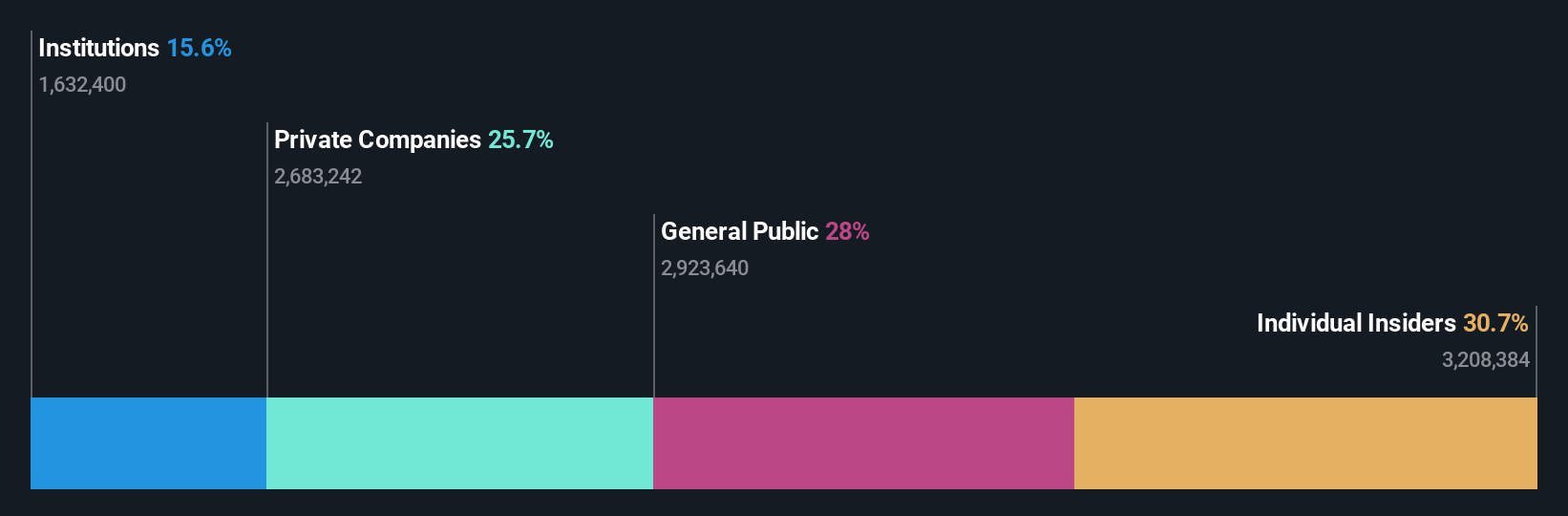

Insider Ownership: 26.6%

Earnings Growth Forecast: 74.2% p.a.

Brockhaus Technologies AG, a German growth company with significant insider ownership, has shown a mixed financial performance recently. In 2024, the firm reported increased sales but also a higher net loss compared to the previous year. Despite these challenges, Brockhaus anticipates robust revenue growth for 2024, projecting an increase of 18% to 29% over 2023. The company also initiated its first dividend payment and completed a substantial share buyback program last year, signaling confidence in its future profitability and growth prospects.

- Click here to discover the nuances of Brockhaus Technologies with our detailed analytical future growth report.

- Our valuation report unveils the possibility Brockhaus Technologies' shares may be trading at a discount.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE operates in Germany and internationally, designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences, with a market capitalization of approximately €568.90 million.

Operations: The company generates its revenue by designing and manufacturing solutions for in-vitro diagnostics and life sciences across Germany, the European Union, and other global markets.

Insider Ownership: 30.9%

Earnings Growth Forecast: 22% p.a.

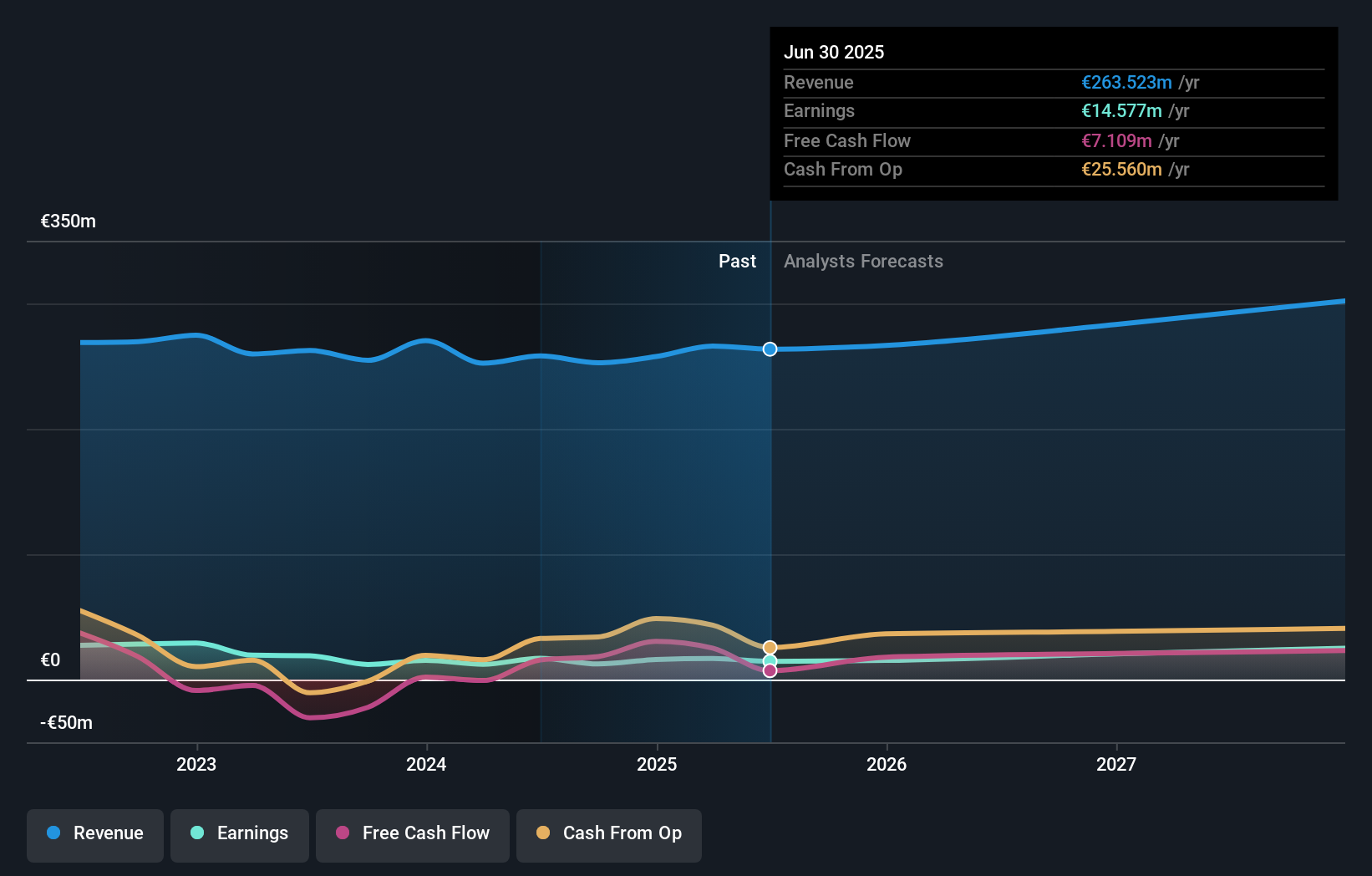

Stratec SE, a German company with high insider ownership, recently showed a downturn in its financials, with sales and net income declining in the latest quarter and full year reports. Despite this, Stratec is trading at 41.6% below its estimated fair value and has promising forecasts with expected earnings growth of 22% per year. However, it faces challenges such as lower profit margins compared to last year and debt not well covered by operating cash flow.

- Click to explore a detailed breakdown of our findings in Stratec's earnings growth report.

- Our comprehensive valuation report raises the possibility that Stratec is priced higher than what may be justified by its financials.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE specializes in solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €0.36 billion.

Operations: The company generates revenue through segments including electricity (€72.07 million), natural gas (€157.60 million), clean hydrogen (€28.59 million), and adjacent opportunities (€118.73 million).

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

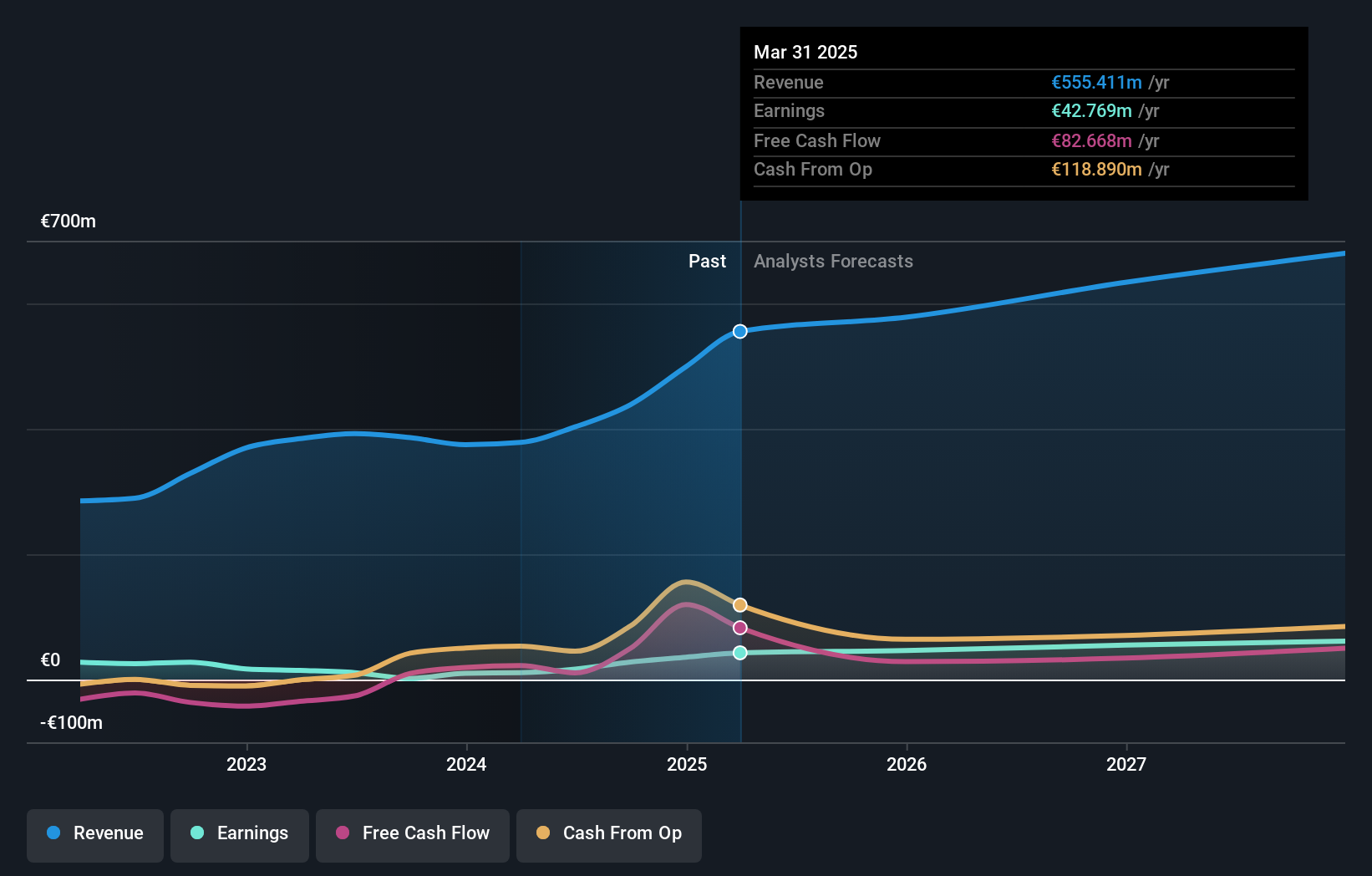

Friedrich Vorwerk Group SE, a German growth company with high insider ownership, reported increased sales and net income in its recent quarterly results. With revenue expected to grow at 7.9% annually, outpacing the German market's 5.2%, and projected earnings growth of 30.4% per year, the company shows promising financial trends despite a forecasted low return on equity of 11%. However, there has been no substantial insider buying or selling in the past three months.

- Navigate through the intricacies of Friedrich Vorwerk Group with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Friedrich Vorwerk Group implies its share price may be too high.

Taking Advantage

- Discover the full array of 18 Fast Growing German Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Brockhaus Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BKHT

Excellent balance sheet and good value.