- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

German Growth Companies With Insider Ownership Up To 26%

Reviewed by Simply Wall St

The German market has faced recent declines, with the DAX dropping 3.20% amid renewed fears about global economic growth. As investors navigate these turbulent times, identifying growth companies with high insider ownership can offer a measure of confidence and stability. In this article, we will explore three German growth companies where insiders hold up to 26% ownership, highlighting their potential resilience and alignment of interests between management and shareholders in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 70.6% |

| Stemmer Imaging (XTRA:S9I) | 25.2% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| adidas (XTRA:ADS) | 16.6% | 41.8% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Beyond Frames Entertainment (DB:8WP) | 10.8% | 112.2% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 52.1% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 24.6% |

| elumeo (XTRA:ELB) | 25.8% | 120.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €294.62 million.

Operations: The firm's revenue is primarily derived from its Security Technologies segment (€37.03 million) and Financial Technologies segment (€174.59 million).

Insider Ownership: 26.6%

Brockhaus Technologies is forecasted to grow revenue by 16.8% annually, outpacing the German market's 5.4%. Despite a net loss of €6.65 million in H1 2024, up from €0.765 million last year, the company expects significant revenue growth, targeting €220-240 million for 2024 and €290-320 million for 2025. Trading at a substantial discount to its estimated fair value and with earnings projected to grow by 93% per year, Brockhaus aims for profitability within three years despite low anticipated return on equity (5.3%).

- Take a closer look at Brockhaus Technologies' potential here in our earnings growth report.

- Our valuation report here indicates Brockhaus Technologies may be undervalued.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

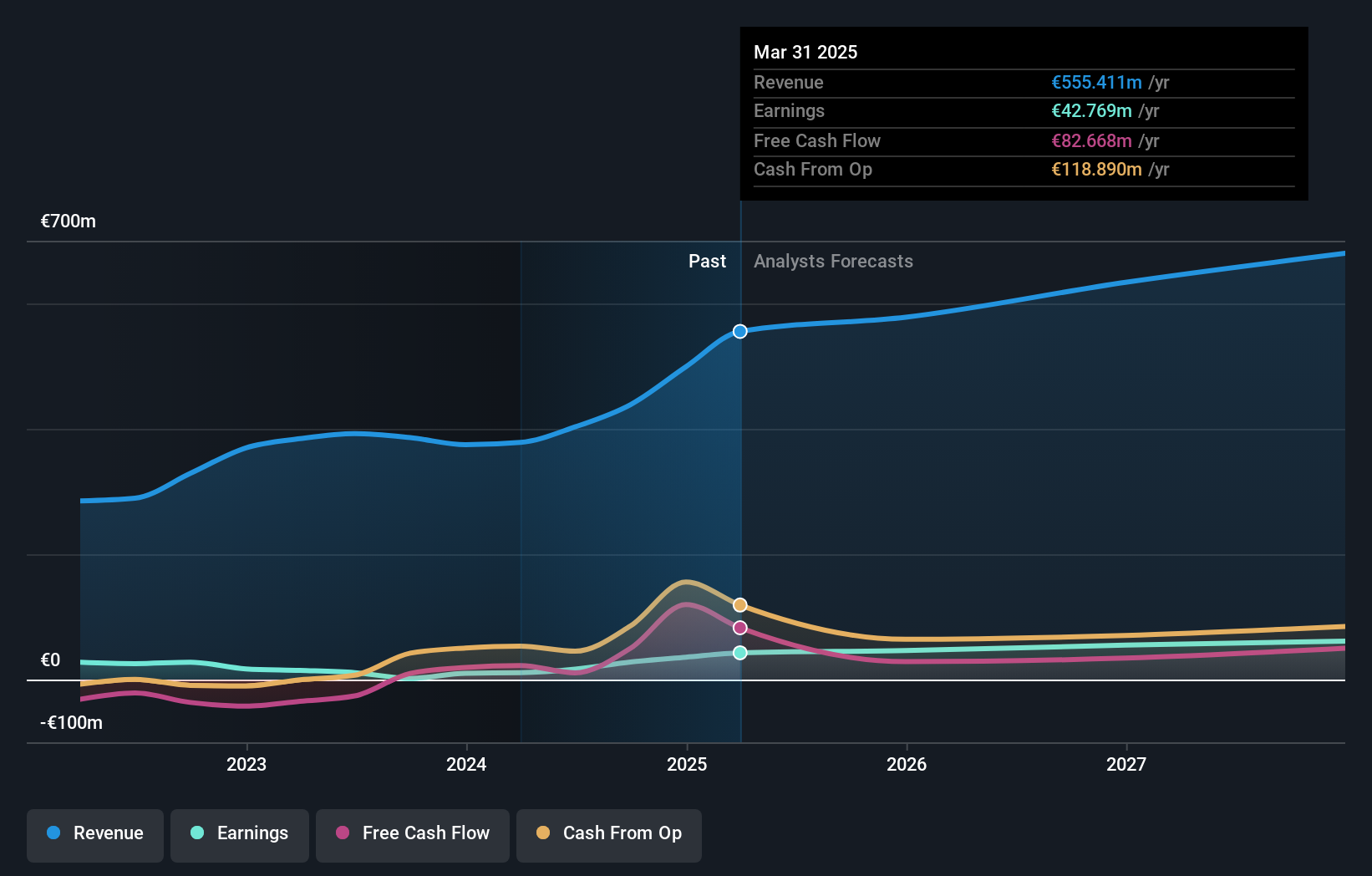

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.49 billion.

Operations: The company's revenue segments include €1.74 billion from the DACH region and €391 million from international markets.

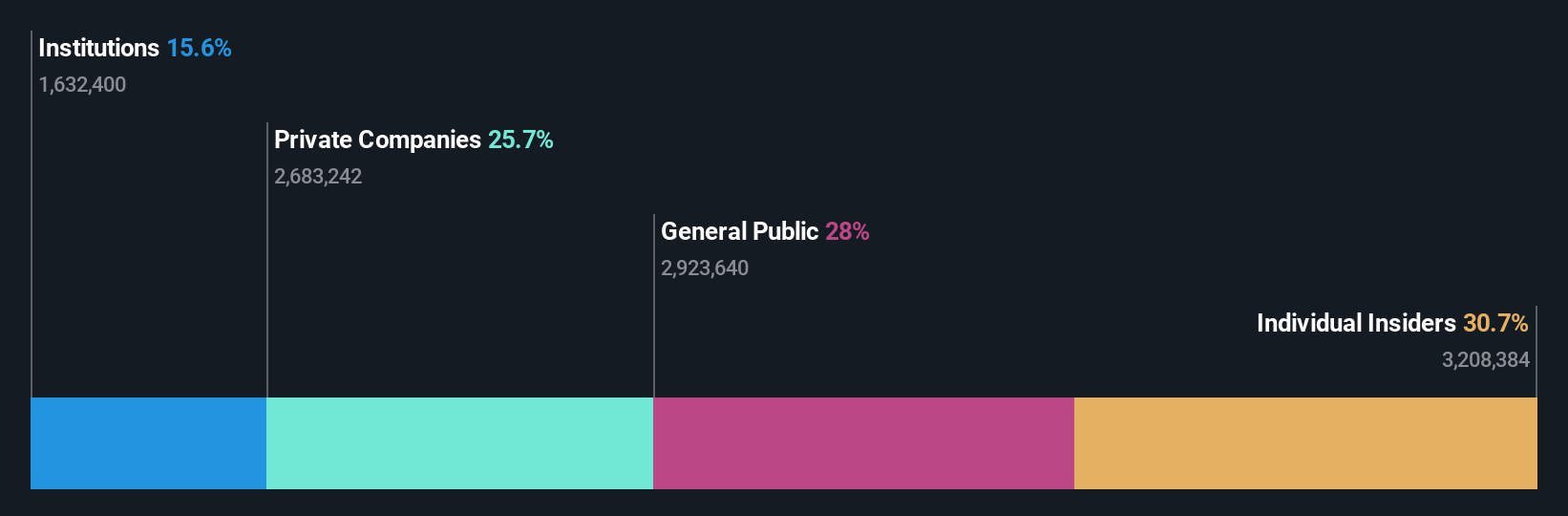

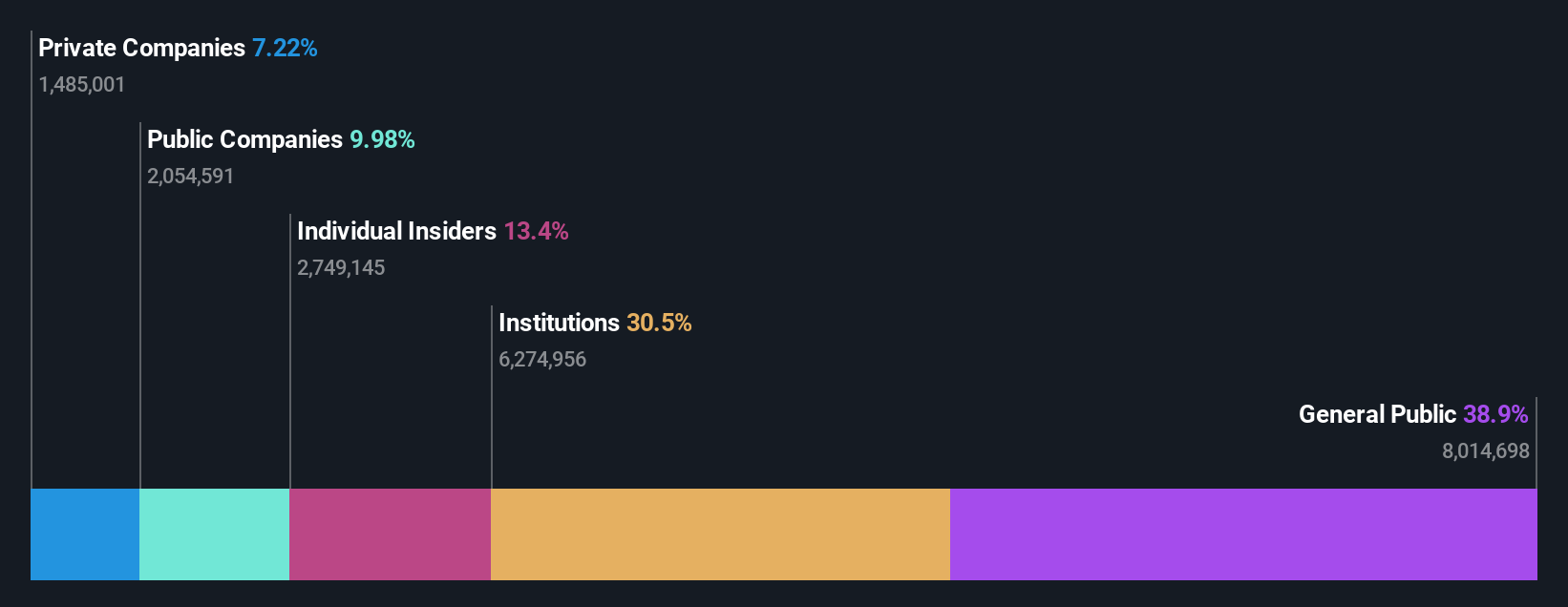

Insider Ownership: 17.7%

Redcare Pharmacy reported H1 2024 sales of €1.12 billion, up from €791.94 million a year ago, with a reduced net loss of €12.07 million compared to €14.78 million last year. Trading at 69.6% below its estimated fair value and forecasted to grow revenue by 17.1% annually, Redcare anticipates becoming profitable within three years despite recent shareholder dilution and high share price volatility. Insiders have substantially sold shares in the past three months.

- Click here to discover the nuances of Redcare Pharmacy with our detailed analytical future growth report.

- Our expertly prepared valuation report Redcare Pharmacy implies its share price may be too high.

Friedrich Vorwerk Group (XTRA:VH2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Friedrich Vorwerk Group SE offers solutions for the transformation and transportation of energy across Germany and Europe, with a market cap of €445 million.

Operations: The company's revenue segments include Electricity (€95.30 million), Natural Gas (€160.89 million), Clean Hydrogen (€28.38 million), and Adjacent Opportunities (€117.28 million).

Insider Ownership: 18%

Friedrich Vorwerk Group SE, with substantial insider ownership, reported strong Q2 2024 results: sales of €117.41 million and net income of €7.96 million, both significantly up from last year. The company expects over €410 million in revenue for FY 2024, indicating at least 10% growth. Earnings are forecast to grow at an impressive 24.63% annually over the next three years, outpacing market averages despite slower revenue growth projections and a modest future return on equity of 12%.

- Dive into the specifics of Friedrich Vorwerk Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility Friedrich Vorwerk Group's shares may be trading at a premium.

Where To Now?

- Navigate through the entire inventory of 22 Fast Growing German Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.