Südwestdeutsche Salzwerke And 2 Other Undiscovered Gems In Germany

Reviewed by Simply Wall St

As the German market continues to show resilience, with the DAX climbing 3.38% recently, investors are increasingly looking towards small-cap stocks for potential growth opportunities. In this context, identifying undiscovered gems like Südwestdeutsche Salzwerke becomes crucial for those seeking to capitalize on unique investment prospects. A good stock in today's market is often characterized by strong fundamentals, a clear growth strategy, and the ability to navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 1.59% | 4.58% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

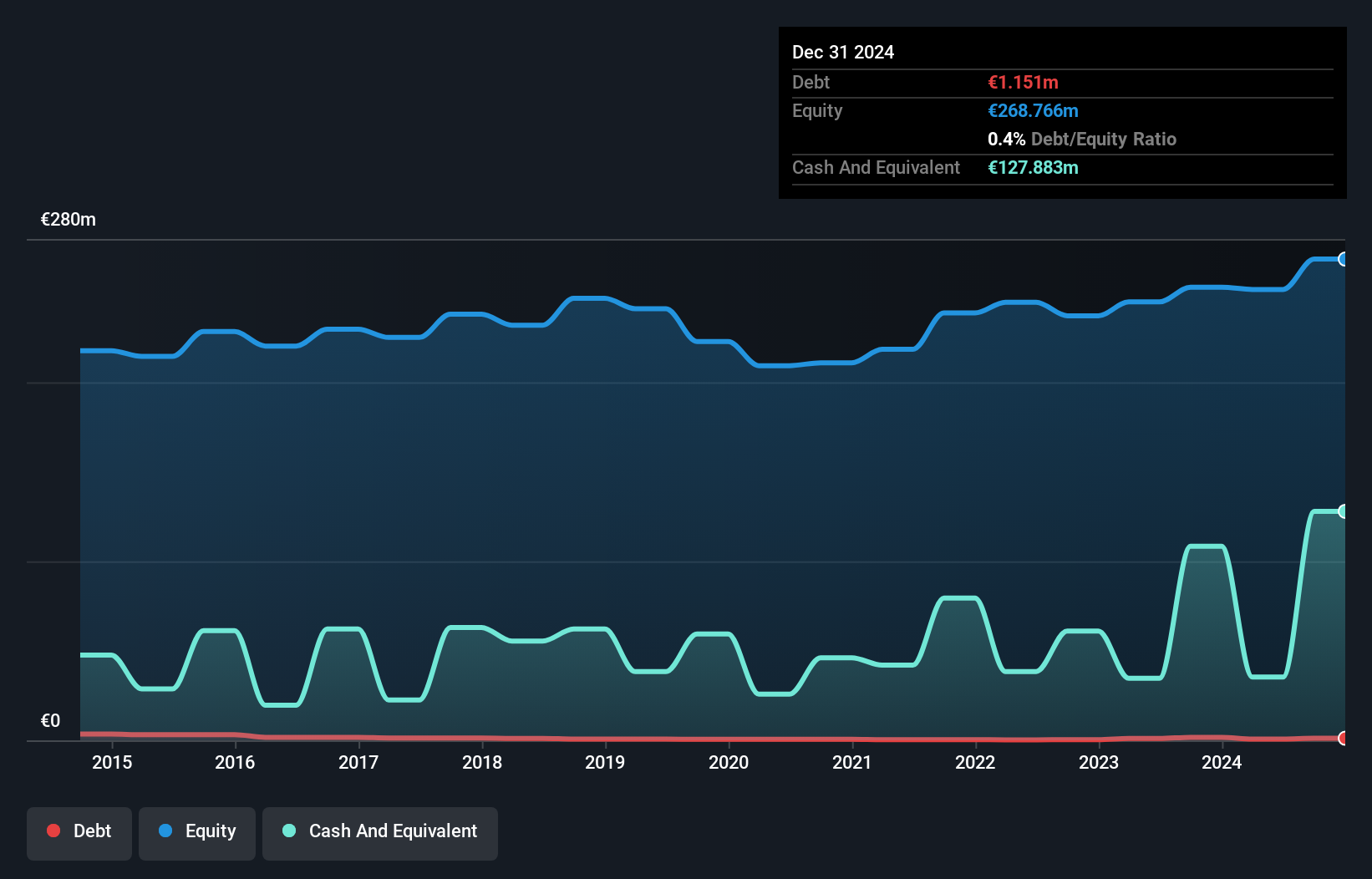

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €661.97 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Südwestdeutsche Salzwerke AG generates revenue primarily through the sale of salt. The company's net profit margin stands at 12.5%.

Südwestdeutsche Salzwerke (SSH) has shown impressive earnings growth, with a 4290.9% increase over the past year, far outpacing the Food industry’s 21.1%. Their price-to-earnings ratio of 17.1x is slightly below the German market average of 17.3x, suggesting potential value. Recent half-year results reported sales at €163 million and net income at €15.4 million, up from €7.96 million last year; basic earnings per share rose to €1.47 from €0.76

- Click to explore a detailed breakdown of our findings in Südwestdeutsche Salzwerke's health report.

Learn about Südwestdeutsche Salzwerke's historical performance.

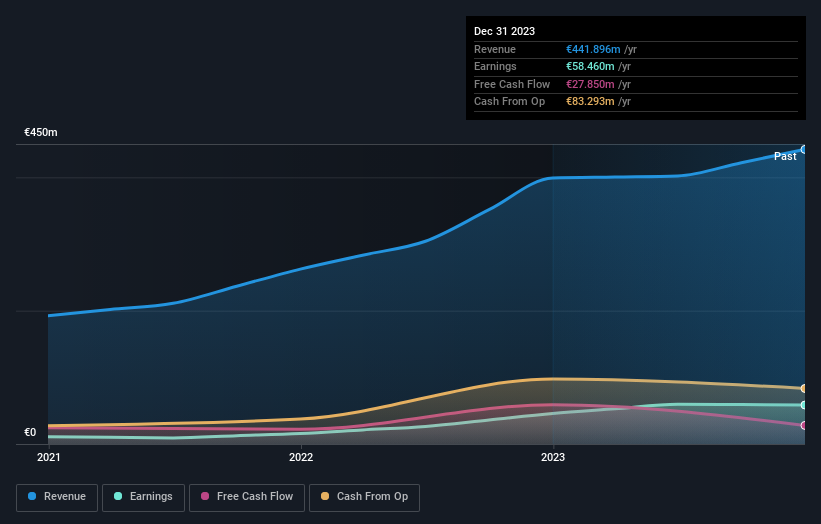

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries, including Germany, Italy, Great Britain, and the United States, with a market cap of €490.05 million.

Operations: Revenue for EnviTec Biogas AG comes primarily from Own Operation (Including Energy) at €236.10 million, followed by Plant Engineering at €132.13 million and Service at €48.58 million.

EnviTec Biogas, a small German company in the renewable energy sector, has shown promising financial health and growth. Over the past five years, its debt to equity ratio decreased from 41.7% to 38%, indicating improved leverage management. Impressively, its interest payments are well covered by EBIT at 419.7 times coverage. Additionally, EnviTec's earnings grew by 27.6% last year and it boasts a price-to-earnings ratio of 8.4x compared to the broader German market's 17.3x.

- Take a closer look at EnviTec Biogas' potential here in our health report.

Explore historical data to track EnviTec Biogas' performance over time in our Past section.

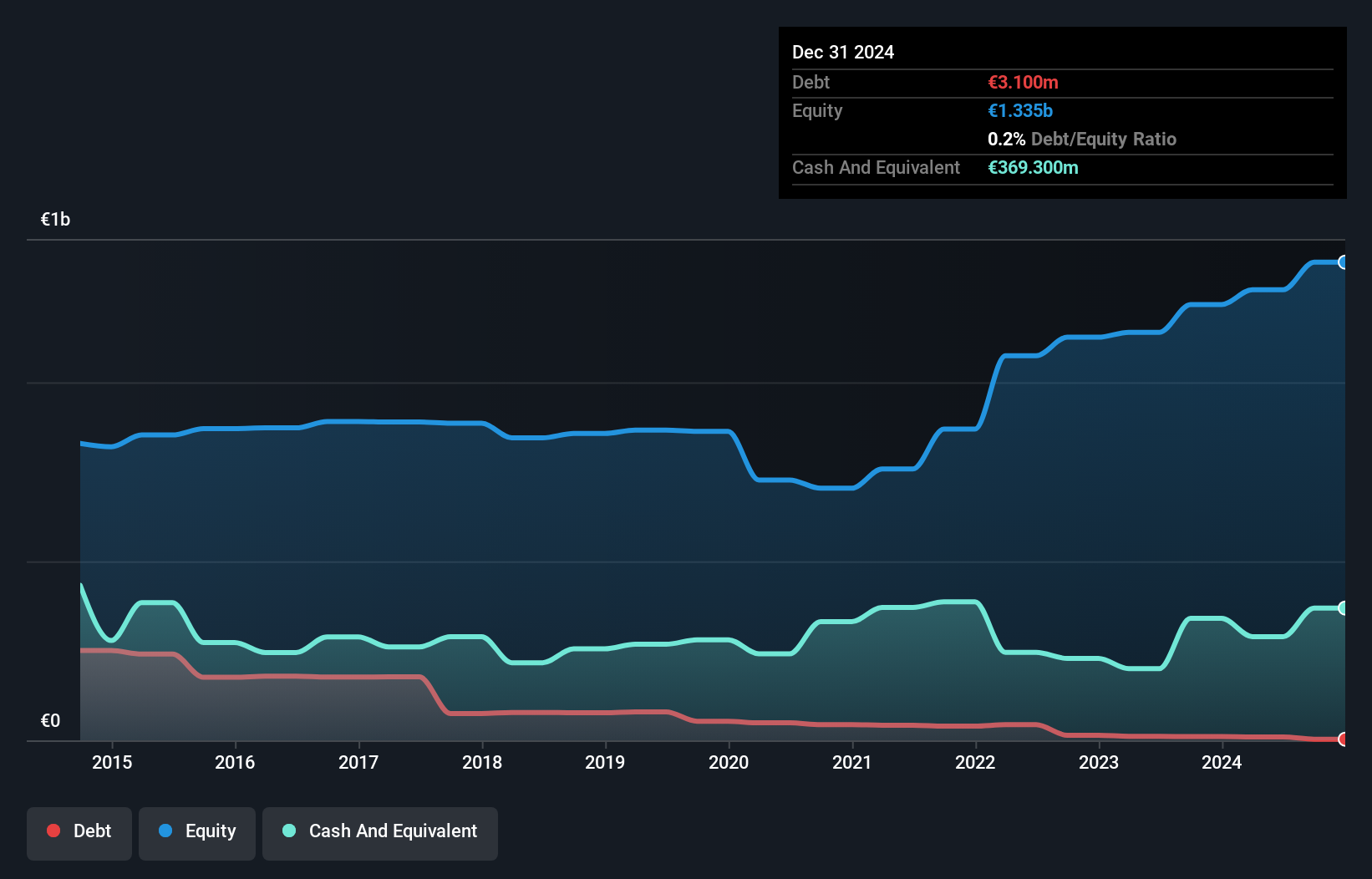

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, with a market cap of approximately €1.12 billion, is a global manufacturer and supplier of pumps, valves, and related services through its subsidiaries.

Operations: KSB SE & Co. KGaA generates revenue primarily from three segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million). The company's net profit margin is a key financial metric to consider in evaluating its profitability.

KSB SE KGaA has shown robust earnings growth of 16.8% over the past year, outpacing the Machinery industry's 3.2%. The company repurchased shares in 2024 and reported a significant one-off loss of €102.5M for the last twelve months ending June 30, 2024. Despite this, KSB's debt to equity ratio improved from 9.2% to 2.1% over five years and trades at a compelling value, being priced at 77.2% below estimated fair value.

- Get an in-depth perspective on KSB SE KGaA's performance by reading our health report here.

Review our historical performance report to gain insights into KSB SE KGaA's's past performance.

Summing It All Up

- Navigate through the entire inventory of 46 German Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KSB SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KSB

KSB SE KGaA

Manufactures and supplies pumps, valves, and related services worldwide.

Flawless balance sheet, undervalued and pays a dividend.