- Germany

- /

- Oil and Gas

- /

- XTRA:DR0

3 European Dividend Stocks Yielding Over 4%

Reviewed by Simply Wall St

As European markets face challenges such as concerns over the valuation of artificial intelligence-related stocks and a pullback in major indices, investors are increasingly seeking stability and income through dividend-paying stocks. In this context, identifying companies with strong fundamentals and consistent dividend yields can provide a reliable source of returns amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.32% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.69% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.19% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.65% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.27% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.96% | ★★★★★★ |

| Evolution (OM:EVO) | 4.71% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.59% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.68% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

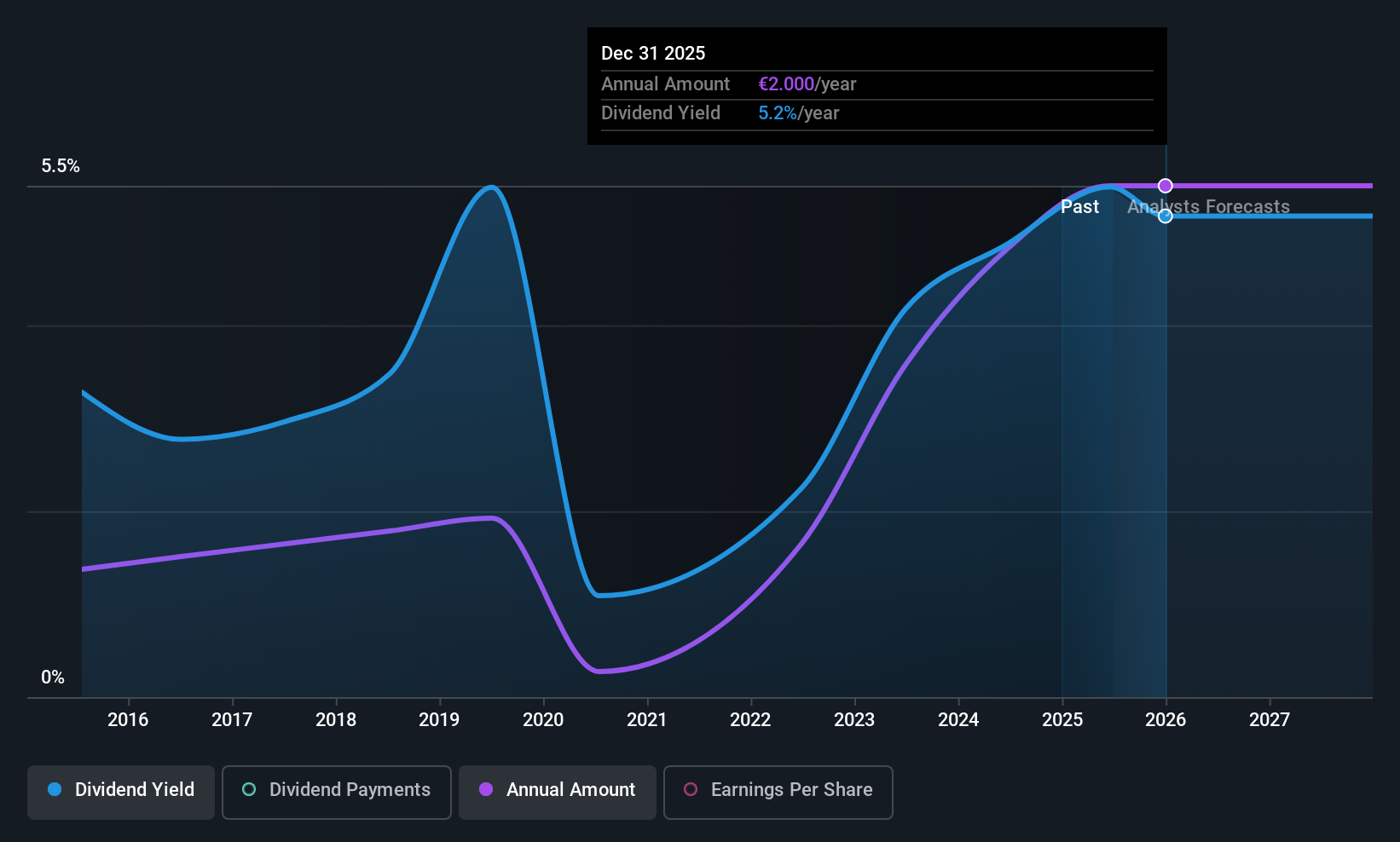

Credito Emiliano (BIT:CE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credito Emiliano S.p.A., along with its subsidiaries, operates in Italy providing commercial banking and wealth management services, with a market cap of €5.01 billion.

Operations: Credito Emiliano S.p.A. generates its revenue through commercial banking and wealth management activities in Italy.

Dividend Yield: 5.1%

Credito Emiliano's dividend yield of 5.1% ranks in the top 25% of Italian payers, supported by a low payout ratio of 38.2%, indicating dividends are well covered by earnings. Despite past volatility and an unstable track record, dividends have increased over the last decade. Recent earnings growth to €506.37 million for nine months ended September 2025 provides a positive backdrop, though future earnings are forecasted to decline annually by 8.2%.

- Delve into the full analysis dividend report here for a deeper understanding of Credito Emiliano.

- Our valuation report here indicates Credito Emiliano may be overvalued.

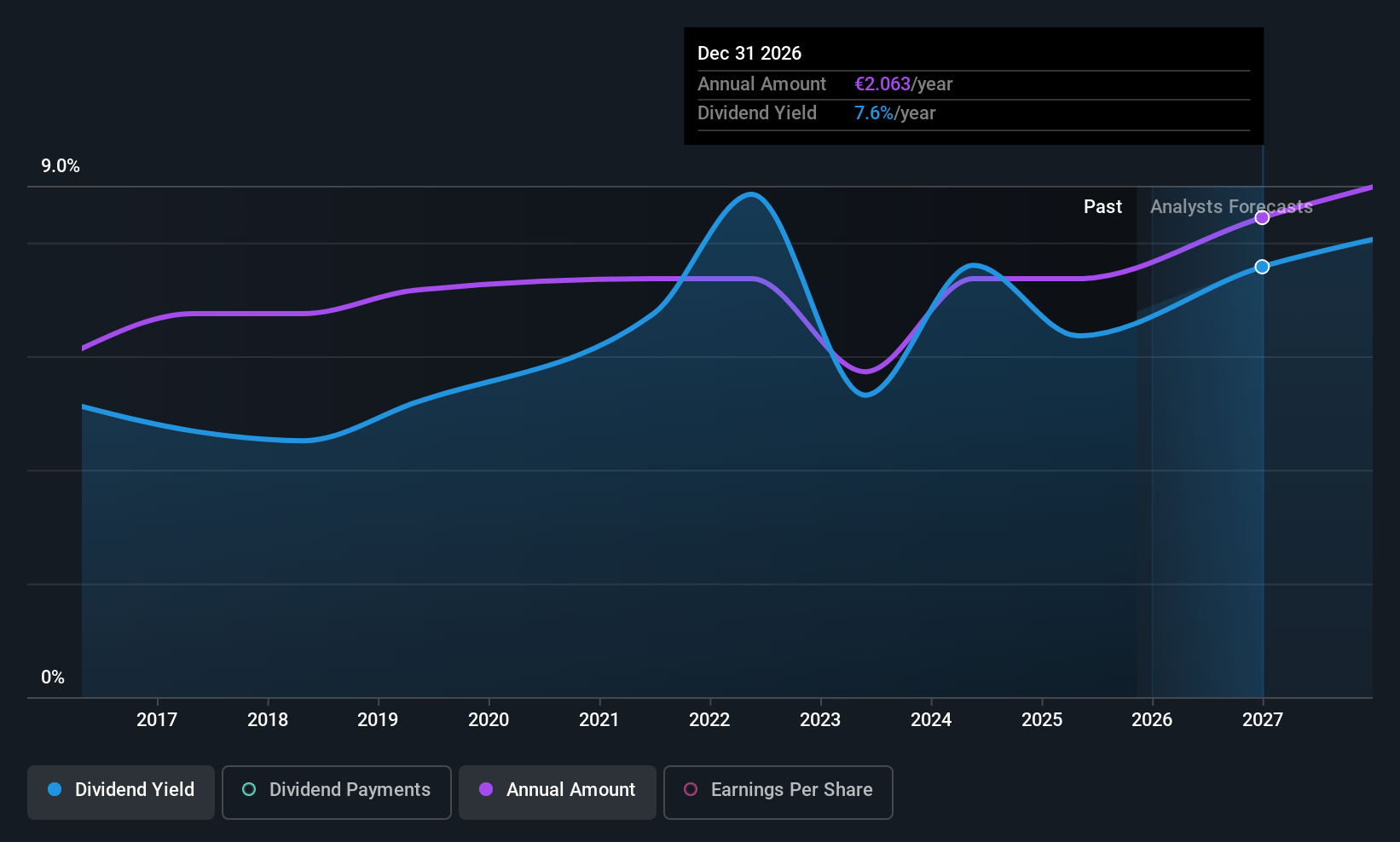

SCOR (ENXTPA:SCR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCOR SE, with a market cap of €4.82 billion, offers life and non-life reinsurance products across Europe, the Middle East, Africa, the Americas, Latin America, and the Asia Pacific through its subsidiaries.

Operations: SCOR SE generates revenue from its life reinsurance segment, SCOR L&H, amounting to €8.41 billion and from its non-life reinsurance segment, SCOR P&C, totaling €6.97 billion.

Dividend Yield: 6.6%

SCOR's dividend yield of 6.63% places it in the top 25% of French dividend payers, backed by a payout ratio of 59.6%, suggesting dividends are covered by earnings and cash flows (cash payout ratio: 27.6%). Despite recent profitability, SCOR's dividends have been volatile over the past decade, indicating an unstable track record. Recent debt restructuring efforts, including redeeming €63.6 million in notes and a tender offer for €317.1 million notes, may impact future financial flexibility.

- Get an in-depth perspective on SCOR's performance by reading our dividend report here.

- Our expertly prepared valuation report SCOR implies its share price may be lower than expected.

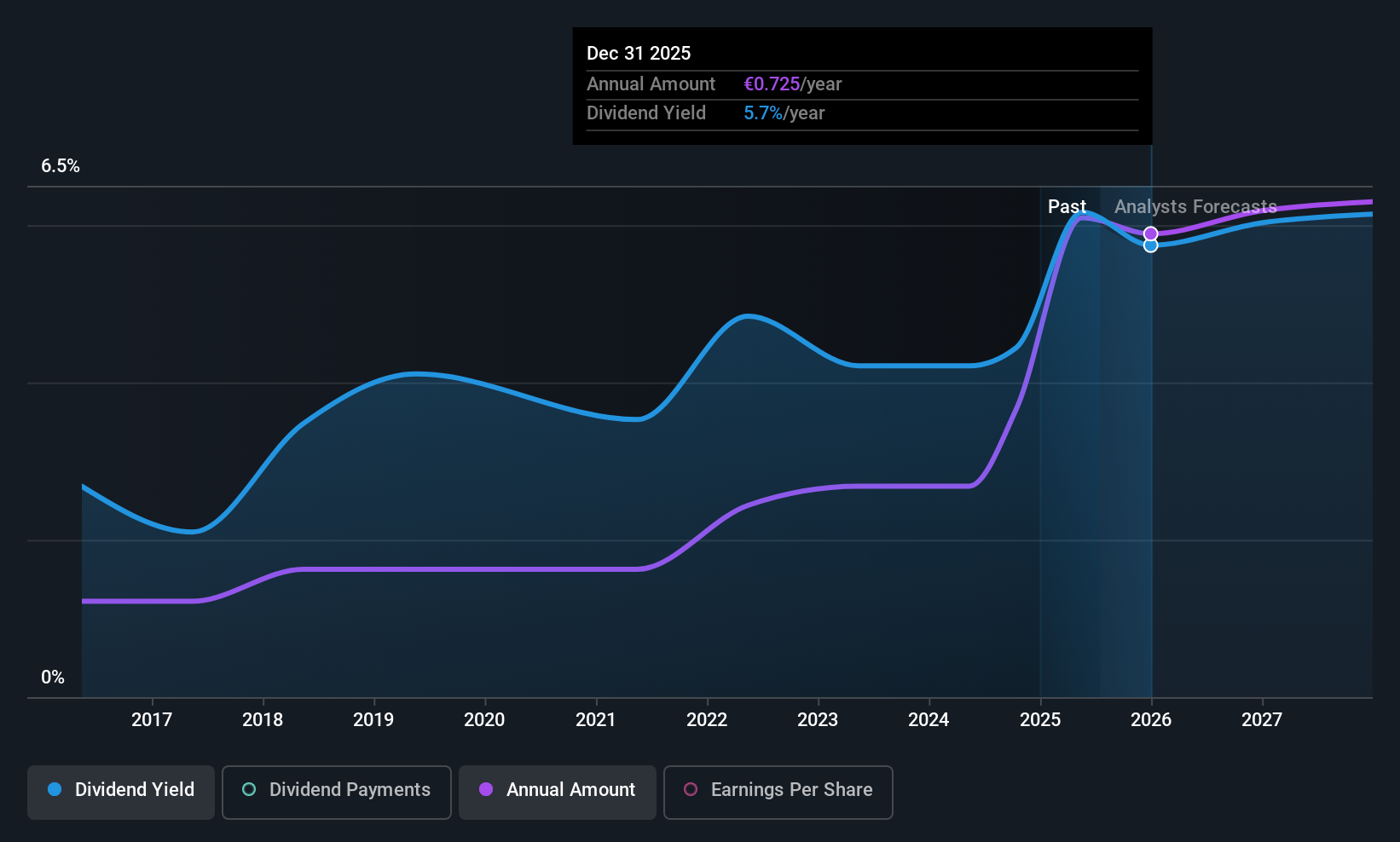

Deutsche Rohstoff (XTRA:DR0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Rohstoff AG, with a market cap of €236.57 million, is involved in the exploration and production of crude oil and natural gas across the United States, Australia, Western Europe, and South Korea.

Operations: Deutsche Rohstoff AG's revenue segments primarily consist of its activities in the exploration and production of crude oil and natural gas across several international regions.

Dividend Yield: 4.1%

Deutsche Rohstoff's dividend yield of 4.09% is below the top 25% of German dividend payers, with a payout ratio of 23.5%, indicating dividends are well covered by earnings and cash flows (cash payout ratio: 43.9%). Despite a decade-long increase in dividends, their volatility reflects an unstable track record. Recent financial performance shows declining sales and net income, while its removal from the S&P Global BMI Index could affect investor perception despite share buybacks totaling €7.52 million enhancing shareholder value.

- Take a closer look at Deutsche Rohstoff's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Deutsche Rohstoff is trading behind its estimated value.

Seize The Opportunity

- Dive into all 229 of the Top European Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DR0

Deutsche Rohstoff

Engages in the exploration and production of crude oil and natural gas primarily in the United States, Australia, Western Europe, and South Korea.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives