- Germany

- /

- Diversified Financial

- /

- XTRA:HYQ

3 German Growth Stocks With Up To 35% Insider Ownership

Reviewed by Simply Wall St

As the European markets show strong gains, with Germany's DAX climbing 3.38%, investor interest in growth stocks remains robust. In this favorable environment, companies with high insider ownership often signal confidence from those who know the business best, making them attractive options for potential investors.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 70.6% |

| Stemmer Imaging (XTRA:S9I) | 25.9% | 23.2% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.4% | 63.5% |

| Exasol (XTRA:EXL) | 25.3% | 117.1% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| Stratec (XTRA:SBS) | 30.9% | 20.3% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 50.1% |

| elumeo (XTRA:ELB) | 25.8% | 120.2% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

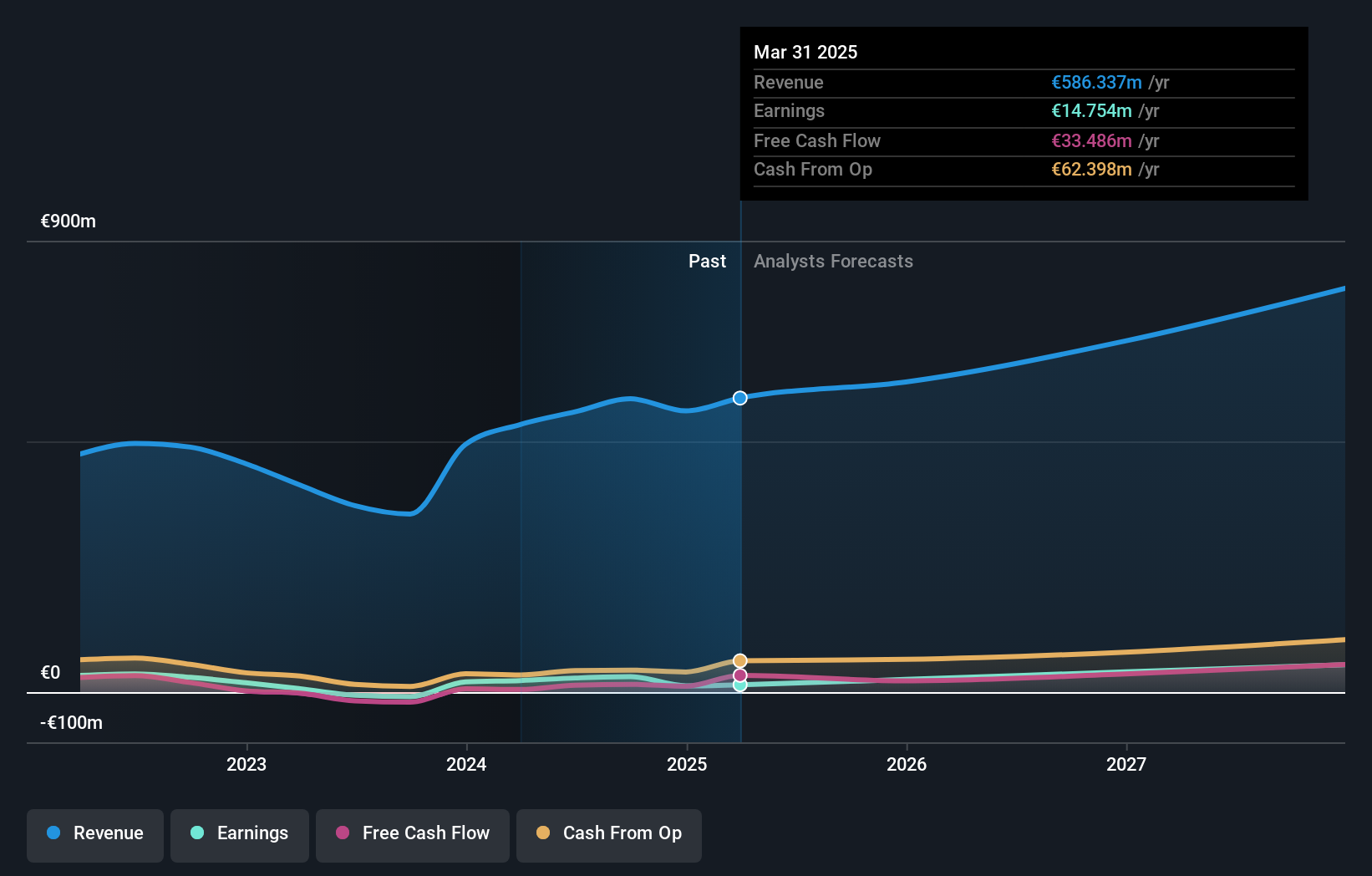

Overview: Hypoport SE develops and markets technology platforms for the financial services, property, and insurance industries in Germany, with a market cap of €1.71 billion.

Operations: The company's revenue segments include €157.97 million from the Credit Platform and €66.89 million from the Insurance Platform.

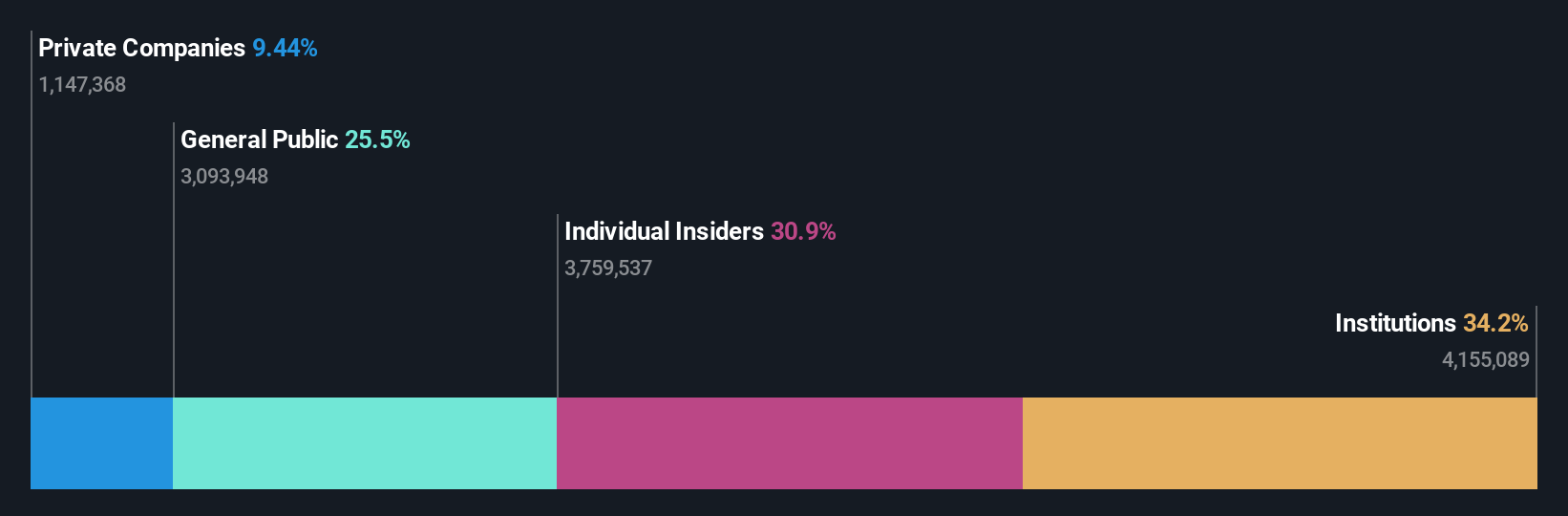

Insider Ownership: 35%

Hypoport SE, a growth company with high insider ownership, has shown robust performance. Earnings are forecast to grow significantly at 35% per year, outpacing the German market's 19.8%. Revenue is expected to increase by 12.5% annually, faster than the market's 5.7%. Despite recent volatility in share price and low forecasted return on equity (10.3%), Hypoport became profitable this year and reported strong Q2 results with sales of €110.62 million and net income of €2.4 million compared to a loss last year.

- Dive into the specifics of Hypoport here with our thorough growth forecast report.

- Our valuation report unveils the possibility Hypoport's shares may be trading at a premium.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €564.66 million.

Operations: Verve Group SE generates revenue from two primary segments: Demand Side Platforms (DSP) at €51.53 million and Supply Side Platforms (SSP) at €318.35 million.

Insider Ownership: 25.1%

Verve Group SE, trading at 76.4% below its estimated fair value, has seen substantial insider buying in the past three months and expects significant earnings growth of 20.52% per year. Despite recent volatility and a low forecasted return on equity (12.9%), Verve's revenue is projected to grow faster than the German market at 12.9% annually. Recent developments include raised revenue guidance for 2024 to €400 million - €420 million and strategic leadership changes enhancing its demand-side business capabilities following the Jun Group acquisition.

- Get an in-depth perspective on Verve Group's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Verve Group's shares may be trading at a discount.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE, with a market cap of €534.86 million, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences both in Germany and internationally.

Operations: The company's revenue segments include automation and instrumentation solutions for in-vitro diagnostics and life sciences across Germany, the European Union, and international markets.

Insider Ownership: 30.9%

Stratec SE, trading at 54.6% below its estimated fair value, is forecast to grow revenue by 7.9% annually, faster than the German market. Earnings are expected to increase significantly over the next three years at 20.34% per year. Recent earnings for Q2 2024 showed sales of €68.21 million and net income of €3.48 million, both higher than last year’s figures, indicating robust financial performance despite a slight dip in six-month sales compared to the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Stratec.

- Our expertly prepared valuation report Stratec implies its share price may be too high.

Summing It All Up

- Get an in-depth perspective on all 20 Fast Growing German Companies With High Insider Ownership by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hypoport might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HYQ

Hypoport

Develops and markets technology platforms for the financial services, property, and insurance industries in Germany.

Reasonable growth potential with adequate balance sheet.