- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

Redcare Pharmacy (XTRA:RDC): Valuation in Focus After Reporting Strong Double-Digit Q3 Sales Growth

Reviewed by Kshitija Bhandaru

Redcare Pharmacy (XTRA:RDC) just released its preliminary third quarter sales numbers, reporting a 25% rise to EUR 719 million. Both the DACH and International divisions saw similar strong and fully organic growth.

See our latest analysis for Redcare Pharmacy.

Momentum has started building again for Redcare Pharmacy, with the share price jumping 20% in the past month as upbeat sales figures and management stability bolstered sentiment. However, the year-to-date share price return is still down 34%, reflecting a tougher stretch for the stock. The three-year total shareholder return of 126% shows that this has long been a compelling growth story.

If today’s surge in Redcare’s fortunes has you thinking about what else might be taking off, now’s your chance to discover fast growing stocks with high insider ownership

With shares rebounding and the company trading at a sizeable discount to analyst targets, investors are left to ask whether today’s price reflects an undervalued opportunity or if the market is already factoring in Redcare Pharmacy’s future growth potential.

Most Popular Narrative: 43.5% Undervalued

The most widely followed narrative currently sees Redcare Pharmacy as priced well below its fair value, using a discount rate of 5.09%. The fair value target set by this approach is nearly double the latest closing price, highlighting major catalysts that could bridge this gap.

Ongoing regulatory modernization in Germany and recent Supreme Court rulings are further opening the prescription drug (Rx) market to Redcare Pharmacy. These changes enable sustained market share gains and improve revenue visibility as Rx digital adoption accelerates post-2026 (impact: revenue growth).

Want to discover what’s powering this bold valuation? There’s a formula here that hinges on major top-line expansion and a sharp margin turnaround in the coming years. Which future-proof catalysts and striking financial leaps are behind the price target? Dive in to find out which projections could change everything.

Result: Fair Value of €153.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Redcare’s growth story still faces hurdles. Potential regulatory delays or slow digital prescription adoption could dampen long-term revenue momentum.

Find out about the key risks to this Redcare Pharmacy narrative.

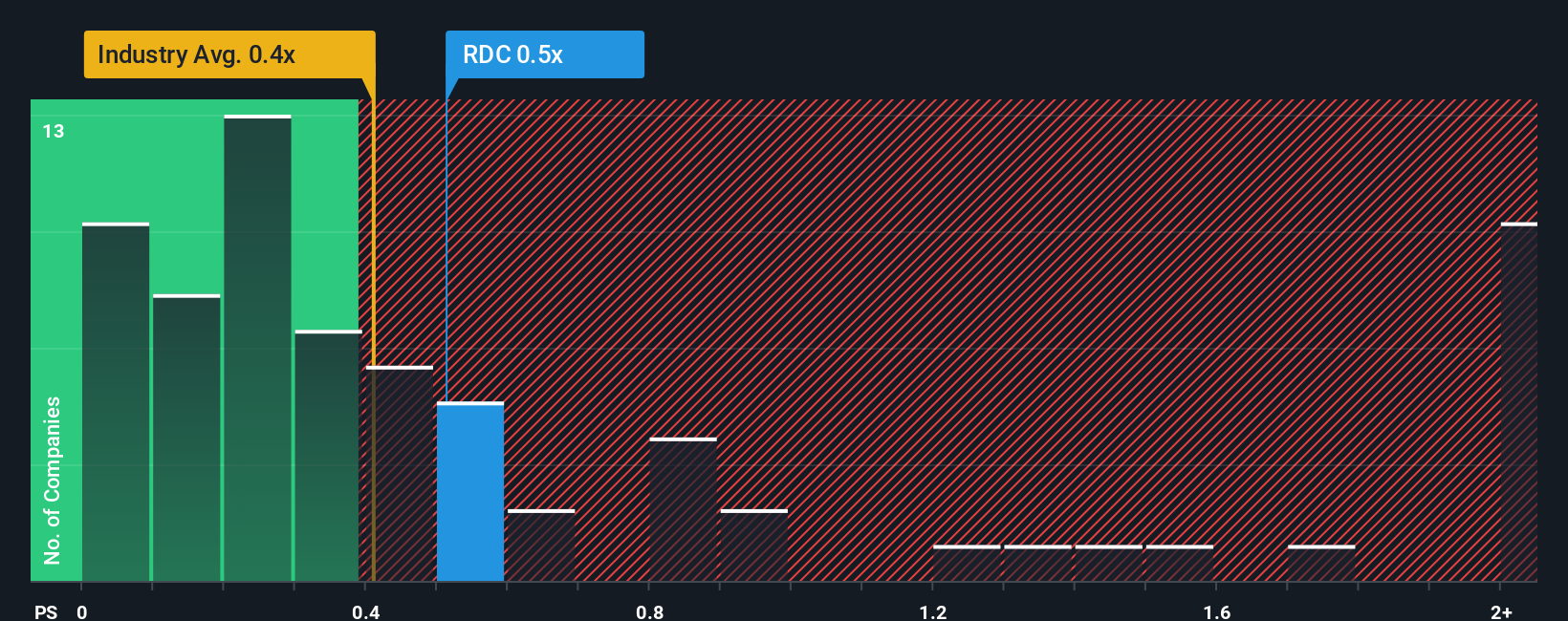

Another View: Price-To-Sales Comparison

Looking through the lens of the price-to-sales ratio, Redcare Pharmacy’s valuation appears high. At 0.7x, it stands well above the European Consumer Retailing industry average of 0.4x and even higher than its peer group’s 0.3x. The fair ratio is estimated at 0.4x, which is much lower than where the shares currently trade. This discrepancy means the market may be pricing in a lot of hope for future growth, but it also leaves less room for disappointment if targets slip. Could this premium be justified, or is there more downside risk ahead for patient investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redcare Pharmacy Narrative

Prefer to dig into the numbers yourself or want to build a personal perspective on Redcare Pharmacy? With just a few clicks, you can craft a narrative that matches your research approach: Do it your way.

A great starting point for your Redcare Pharmacy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Do not settle for just one opportunity. Put yourself in position to catch bigger winners by scanning what’s next in high-potential sectors using these hand-picked shortlists:

- Tap into unstoppable market momentum and uncover potential turnarounds by reviewing these 888 undervalued stocks based on cash flows, which features serious upside based on undervalued cash flows.

- Get ahead on breakthrough trends and see which leaders are achieving strong yields by checking these 19 dividend stocks with yields > 3%, with payouts exceeding 3%.

- Catch innovation at the intersection of healthcare and technology by surveying these 32 healthcare AI stocks to discover smarter, faster medical solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates the online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives