Strong Q3 Results and Rising Profits Might Change The Case For Investing In adidas (XTRA:ADS)

Reviewed by Sasha Jovanovic

- adidas AG recently announced its third quarter 2025 results, reporting sales of €6.63 billion and net income of €461 million, both up from the previous year, alongside improved basic and diluted earnings per share.

- For the first nine months of 2025, the company's net income rose to €1.26 billion from €803 million, signaling increased profitability over the comparable period.

- We'll explore how these rising profits in the latest results may impact adidas' investment narrative and future earnings outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

adidas Investment Narrative Recap

To hold adidas stock, an investor needs to believe in the brand’s ability to convert global health, fitness, and athleisure trends into lasting sales and profit growth, while defending market share against sizeable competition. The latest earnings results show increased sales and net income, supporting adidas’ positive near-term outlook, but do not substantially allay concerns about ongoing U.S. tariff headwinds, which remain the most important short-term catalyst and risk to profitability.

Of the recent company announcements, adidas’ decision to raise its 2025 earnings guidance stands out as most relevant to the latest results. This upward revision follows improved revenue and earnings momentum, suggesting management sees continued demand and margin tailwinds, but it does not fully resolve uncertainties around cost pressures or the challenge of passing through higher prices in the U.S. market.

However, one thing investors should be watching for is if adidas’ success in emerging markets can offset ongoing U.S. tariff risks...

Read the full narrative on adidas (it's free!)

adidas' outlook anticipates €31.1 billion in revenue and €2.5 billion in earnings by 2028. This scenario calls for 8.2% annual revenue growth and a €1.3 billion increase in earnings from the current €1.2 billion.

Uncover how adidas' forecasts yield a €234.05 fair value, a 47% upside to its current price.

Exploring Other Perspectives

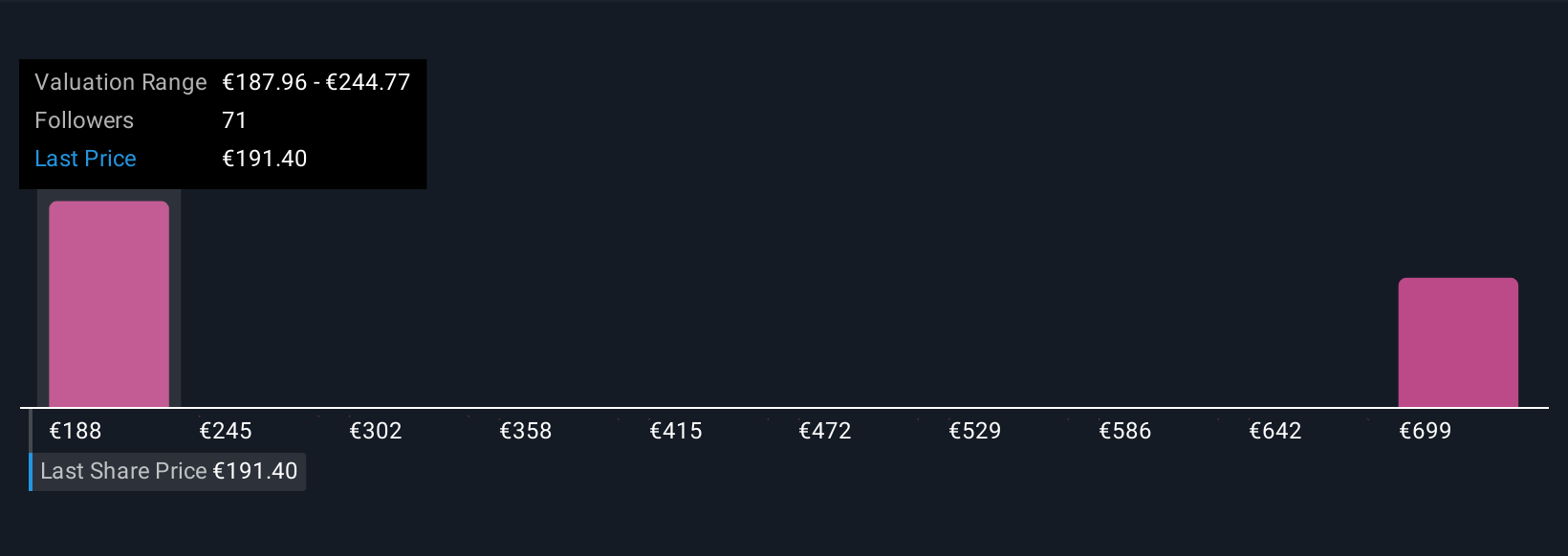

Simply Wall St Community members produced nine fair value estimates for adidas shares, ranging widely from €194.37 to €735.57. While some see extreme upside, others remain cautious given the persistent impact of U.S. import tariffs on profitability; your view may differ, so explore all the numbers for a fuller picture.

Explore 9 other fair value estimates on adidas - why the stock might be worth over 4x more than the current price!

Build Your Own adidas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your adidas research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free adidas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate adidas' overall financial health at a glance.

No Opportunity In adidas?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets a range of athletic and sports lifestyle products in Europe, Greater China, Japan, South Korea, Latin America, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives