Adidas (XTRA:ADS): Evaluating Valuation as Major World Cup Campaigns Boost Brand Visibility

Reviewed by Simply Wall St

Adidas (XTRA:ADS) is ramping up its marketing activity for the 2026 FIFA World Cup, rolling out striking campaigns and new kit launches with football stars like Lionel Messi and Lamine Yamal. These initiatives are boosting the brand's visibility as anticipation for the tournament grows.

See our latest analysis for adidas.

Adidas has kept the spotlight on itself with a cinematic World Cup ad and buzzy new sneaker launches, but recent momentum hasn’t been enough to offset a rocky year. After a sharp slide in the last month, adidas shares have fallen over 31% year-to-date, while the 1-year total shareholder return sits at -24.7%. However, looking back three years, the total return is still up 24.9%, which signals long-term investors have seen gains despite a challenging stretch. As excitement builds for the World Cup and new campaigns, investors are watching closely to see if this renewed energy will help re-invigorate adidas’s stock performance.

If all the high-profile action around World Cup brands has you curious about broader market movers, now’s a great moment to discover fast growing stocks with high insider ownership

Yet with shares trading far below their analyst price targets and new World Cup momentum building, the real question for investors is whether adidas is currently undervalued or if the market has already accounted for future growth prospects.

Most Popular Narrative: 30.7% Undervalued

adidas’s most widely-followed narrative assigns a fair value significantly above the recent share price. This suggests growth optimism outweighs current market caution. With the last close at €162.3 and the narrative fair value set at €234.05, expectations for future earnings strength are at the forefront.

The accelerating global health and fitness movement is driving strong demand for adidas' performance and athleisure product categories, as demonstrated by double-digit growth in key segments like Running (+25%), Training (+20%), and Basketball. This positions the company for sustained volume expansion and recurring sales growth (impacts revenue and earnings).

Want insight into how this premium is justified? This narrative builds its case around expansion in high-growth categories and margin gains that rival market leaders. Wonder what financial leaps are needed to support such a jump in valuation? Explore the full forecast for the bold assumptions behind this fair value.

Result: Fair Value of €234.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and intensifying competition in key markets could quickly undermine adidas’s growth and margin recovery prospects, which may temper investor optimism.

Find out about the key risks to this adidas narrative.

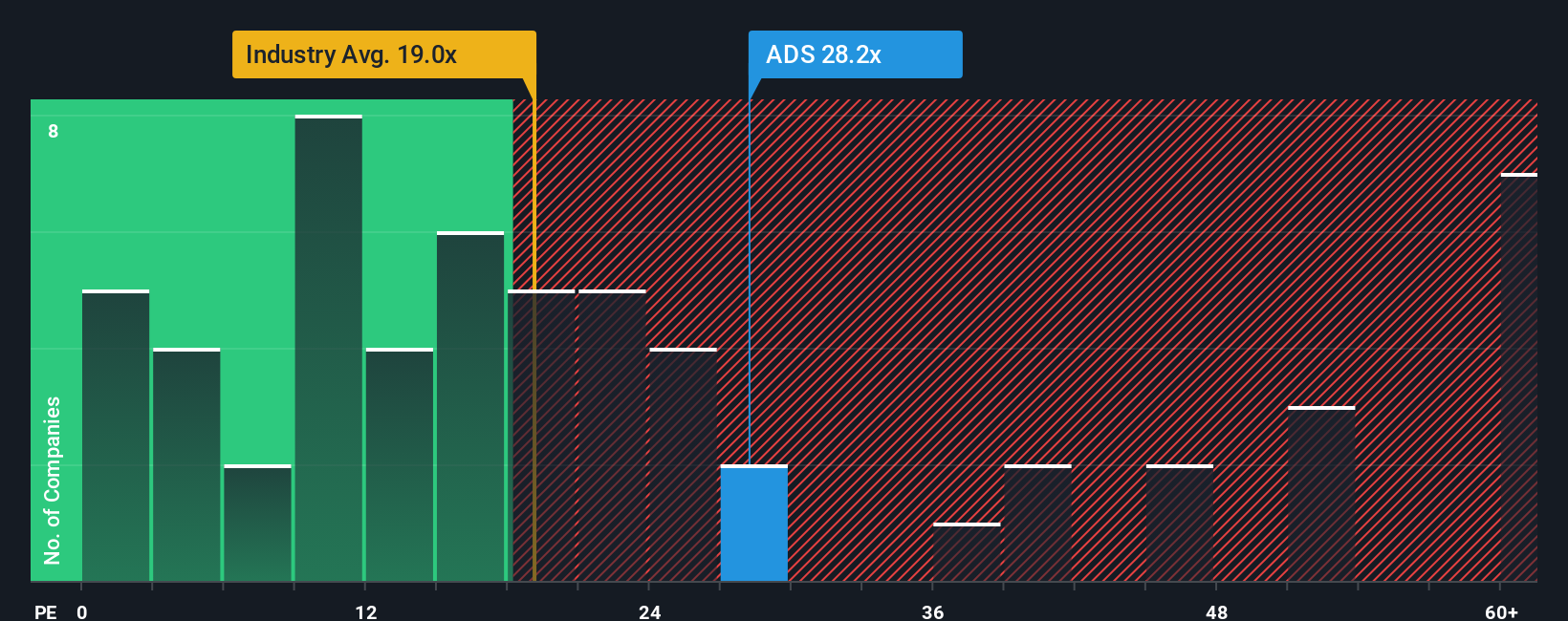

Another View: How Do Market Multiples Stack Up?

While narrative and analyst forecasts paint adidas as undervalued, the market’s actual price-to-earnings ratio tells a more complicated story. Shares are trading at 23.9 times earnings, which is higher than both the European Luxury industry average of 21 and the estimated fair ratio of 21.6. This premium could mean investors are betting on a notable rebound. It also raises questions about valuation risk if those rebound hopes do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own adidas Narrative

Prefer to dig into the numbers and form your own perspective? You can easily shape your own adidas story and analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding adidas.

Looking for More Investment Ideas?

Don't miss out on standout stock opportunities in other sectors. Tap into ideas that investors are acting on right now with these handpicked screens:

- Tap into major market potential by reviewing these 872 undervalued stocks based on cash flows, which are priced below their intrinsic value and primed for a turnaround.

- Lock in attractive yields and safeguard your portfolio by browsing these 15 dividend stocks with yields > 3%, offering consistent returns above 3%.

- Ride the AI wave and capture early growth by checking out these 26 AI penny stocks, gaining momentum in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets a range of athletic and sports lifestyle products in Europe, Greater China, Japan, South Korea, Latin America, North America, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives