- Switzerland

- /

- Insurance

- /

- SWX:SREN

European Dividend Stocks Featuring FinecoBank Banca Fineco And Two More

Reviewed by Simply Wall St

Amid cautious optimism in Europe, the pan-European STOXX Europe 600 Index has seen slight gains as investors navigate U.S. trade policy developments and geopolitical efforts to resolve the Russia-Ukraine conflict. In this environment of mixed market signals, dividend stocks like FinecoBank Banca Fineco offer potential stability and income, making them an attractive option for those seeking consistent returns amidst economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Mapfre (BME:MAP) | 5.86% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.34% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.48% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.41% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Thermador Groupe (ENXTPA:THEP) | 3.04% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.27% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

FinecoBank Banca Fineco (BIT:FBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinecoBank Banca Fineco S.p.A. offers a range of banking and investment products and services, with a market cap of approximately €11.12 billion.

Operations: FinecoBank Banca Fineco S.p.A. generates its revenue primarily from its banking segment, which accounts for €1.32 billion.

Dividend Yield: 4.1%

FinecoBank's dividend payments have been volatile over the past decade, but they are currently covered by earnings with a payout ratio of 67.9%. The dividend is forecast to remain sustainable in three years with a slightly higher payout ratio of 75.4%. Despite its lower yield compared to top Italian dividend payers, FinecoBank proposed a 7% year-on-year increase in dividends per share to €0.74, reflecting ongoing efforts to enhance shareholder returns amidst stable earnings growth.

- Navigate through the intricacies of FinecoBank Banca Fineco with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, FinecoBank Banca Fineco's share price might be too optimistic.

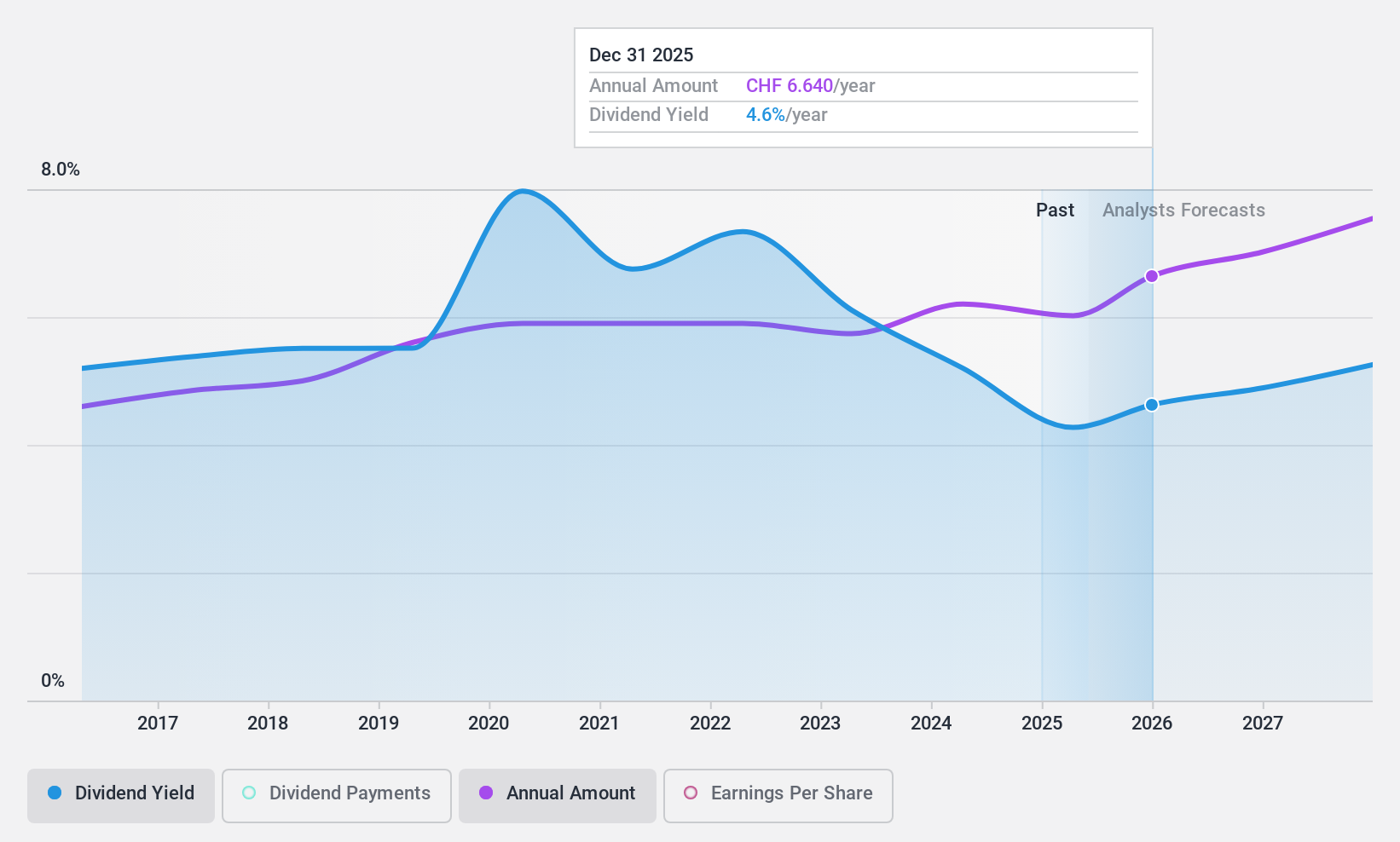

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF42.14 billion, operates globally through its subsidiaries to offer wholesale reinsurance, insurance, and other risk transfer and insurance-related services.

Operations: Swiss Re AG's revenue is primarily derived from its Property & Casualty Reinsurance segment, which generated $20.99 billion, followed by Life & Health Reinsurance at $17.47 billion and Corporate Solutions contributing $6.38 billion.

Dividend Yield: 4.2%

Swiss Re's dividends have been volatile over the past decade, with payments occasionally dropping by over 20%. Despite this instability, the dividend is covered by earnings and cash flows, with payout ratios of 67.4% and 50.3%, respectively. Trading at a significant discount to its estimated fair value, Swiss Re offers a dividend yield in the top quartile of the Swiss market. Recent executive changes may impact strategic direction but do not directly affect dividend policy.

- Dive into the specifics of Swiss Re here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Swiss Re shares in the market.

Wacker Neuson (XTRA:WAC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wacker Neuson SE manufactures and distributes light and compact equipment in Germany, Austria, the United States, and internationally, with a market cap of €1.20 billion.

Operations: Wacker Neuson SE generates revenue from three main segments: Services (€506.20 million), Light Equipment (€459.80 million), and Compact Equipment (€1.41 billion).

Dividend Yield: 6.5%

Wacker Neuson's dividend yield of 6.5% ranks in the top 25% of German payers, yet it's not sustainable due to a high payout ratio of 95.8%. Despite earnings forecasted to grow significantly, profit margins have declined from last year. While dividends have grown over the past decade, they remain volatile and unreliable with significant annual drops. Trading at a substantial discount to its fair value, Wacker Neuson is valued attractively compared to peers but faces financial challenges impacting dividend stability.

- Take a closer look at Wacker Neuson's potential here in our dividend report.

- The analysis detailed in our Wacker Neuson valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 205 Top European Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SREN

Swiss Re

Provides wholesale reinsurance, insurance, other insurance-based forms of risk transfer, and other insurance-related services worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives