- Germany

- /

- Industrials

- /

- XTRA:SIE

Siemens’ Industrial Digitalization Push Might Change the Case for Investing In Siemens (XTRA:SIE)

Reviewed by Sasha Jovanovic

- Over the past week, HD Hyundai announced a Memorandum of Understanding with Siemens to jointly drive digital transformation and modernize the U.S. shipbuilding industry, while Siemens also expanded partnerships with Capgemini for AI-native solutions in manufacturing and implemented advanced hydrogen monitoring platforms with H2SITE across Europe.

- These collaborations highlight Siemens' pivotal role in advancing industrial digitalization, through smart automation, data-driven efficiency, and sustainable energy solutions, across multiple high-impact sectors.

- We'll examine how Siemens' expanded digitalization efforts in shipbuilding and manufacturing could shape its long-term growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Siemens Investment Narrative Recap

Being a Siemens shareholder today requires conviction in the company’s ability to deliver steady value from its digital transformation strategy, with catalysts rooted in industrial automation and energy solutions. Recent announcements, like the HD Hyundai partnership, reinforce Siemens’ focus on digital capabilities but do not fundamentally change short-term catalysts or reduce critical risks such as persistent weak demand for automation software and global macro uncertainty. In this context, the expanded collaboration with Capgemini to co-develop AI-native manufacturing solutions stands out, as it directly targets efficiency and recurring digital revenues, both of which are core to Siemens’ margin-improvement narrative. On the flip side, investors must not overlook the potential impact of cyclical slowdowns in key markets like China and Germany...

Read the full narrative on Siemens (it's free!)

Siemens' outlook points to €93.6 billion in revenue and €10.5 billion in earnings by 2028. This assumes a 6.1% annual revenue growth rate and a €2.6 billion increase in earnings from the current €7.9 billion.

Uncover how Siemens' forecasts yield a €252.03 fair value, a 3% upside to its current price.

Exploring Other Perspectives

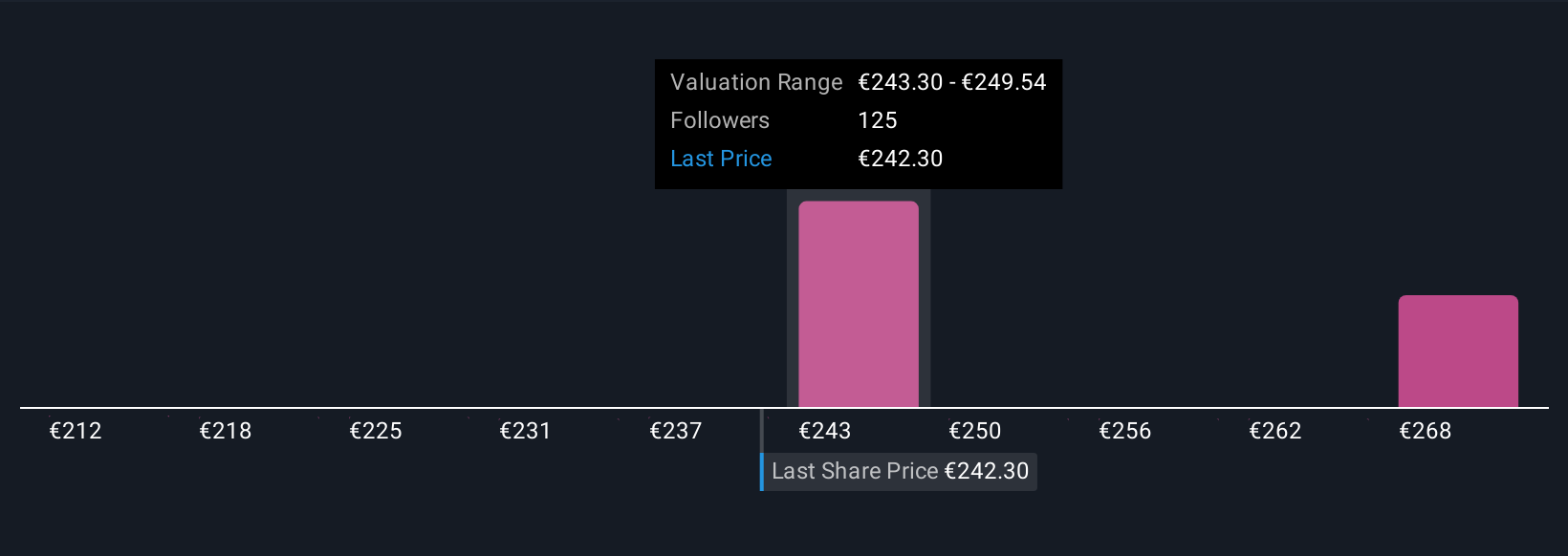

The Simply Wall St Community’s eight fair value estimates for Siemens span from €212.07 to €293.17 per share, showcasing sharply varied expectations. While some see upside, others flag risks from muted automation demand and slower profit growth, hinting at the broad range of outcomes investors should weigh.

Explore 8 other fair value estimates on Siemens - why the stock might be worth as much as 20% more than the current price!

Build Your Own Siemens Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Siemens research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Siemens research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Siemens' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SIE

Siemens

A technology company, focuses in the areas of automation and digitalization in Europe, Commonwealth of Independent States, Africa, the Middle East, the Americas, Asia, and Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives