- Germany

- /

- Aerospace & Defense

- /

- XTRA:RHM

Is Strong Q3 Growth Shifting the Investment Narrative for Rheinmetall (XTRA:RHM)?

Reviewed by Sasha Jovanovic

- Rheinmetall AG recently reported its third quarter and nine-month 2025 results, showing sales of €2.78 billion and net income of €152 million for the quarter, both higher than the year-ago period.

- This performance highlights steady gains across key financial metrics, including increases in both basic and diluted earnings per share compared to the previous year.

- With sales and earnings per share up year-over-year, we'll explore how sustained growth in core metrics may impact Rheinmetall’s investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Rheinmetall Investment Narrative Recap

To be a Rheinmetall shareholder, you need confidence in sustained European defense spending, the company’s expanding role across vehicle, ammunition, and electronic segments, and its ability to manage complex growth initiatives. The recent strong quarterly results reinforce expectations for robust top-line momentum, but they do not materially shift the short-term catalyst: the pipeline of large government contracts and ability to ramp up new capacity. Major risks still center on regulatory delays and exposure to procurement cycles, and that remains unchanged.

The company’s announcement in September to divest its civilian units and enter the shipbuilding sector is highly relevant, reflecting its sharpened focus as a pure-play defense supplier. This aligns closely with the expectation for defense budget tailwinds and underpins Rheinmetall’s ambitions to secure a leading share in future European procurement rounds.

On the other hand, investors should pay close attention to how regulatory or political delays could stall or defer new project execution and ultimately Earnings growth...

Read the full narrative on Rheinmetall (it's free!)

Rheinmetall's outlook anticipates €26.4 billion in revenue and €3.4 billion in earnings by 2028. Achieving this would require 35.3% annual revenue growth and a €2.6 billion increase in earnings from the current €845.0 million.

Uncover how Rheinmetall's forecasts yield a €2176 fair value, a 25% upside to its current price.

Exploring Other Perspectives

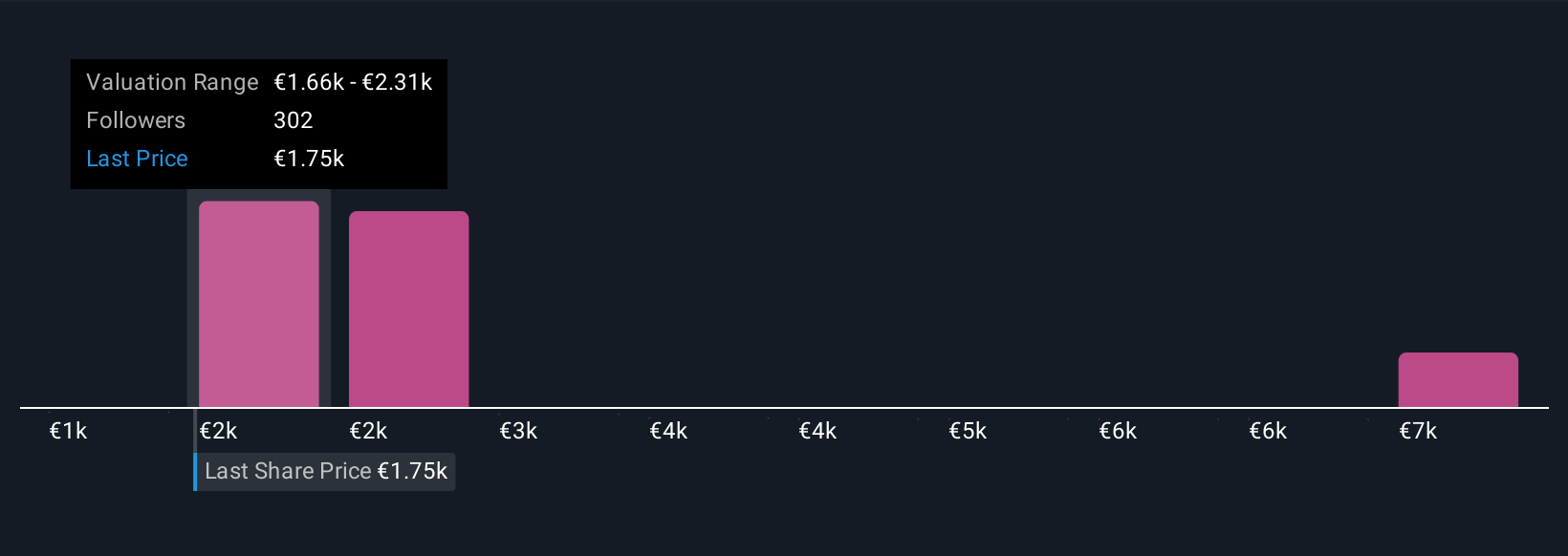

Thirty-one recent community estimates put Rheinmetall’s fair value anywhere from €1,737 to €7,569.50, with most falling below analyst consensus. While many see strong earnings momentum driving upside, views differ widely, highlighting the company’s ongoing exposure to government budget cycles and regulatory approvals. Check out several perspectives to see which view best aligns with your own.

Explore 31 other fair value estimates on Rheinmetall - why the stock might be worth just €1737!

Build Your Own Rheinmetall Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rheinmetall research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Rheinmetall research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rheinmetall's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHM

Rheinmetall

Provides mobility and security technologies in Germany, Rest of Europe, North, Middle, and South America, Asia and the Near East, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives